UPSC CURRENT AFFAIRS – 30th May 2025

Government approves continuation of interest subvention scheme for farmers

Why in News?

The Union Cabinet approved the continuation of the Modified Interest Subvention Scheme (MISS) for 2025–26.

Introduction

- On May 28, 2025, the Union Cabinet approved the continuation of the Modified Interest Subvention Scheme (MISS) for the financial year 2025–26.

- The decision aims to provide short-term agricultural credit to farmers at subsidised interest rates via the Kisan Credit Card (KCC) mechanism, thereby reinforcing the government’s commitment to doubling farmers’ income and ensuring financial inclusion in rural India.

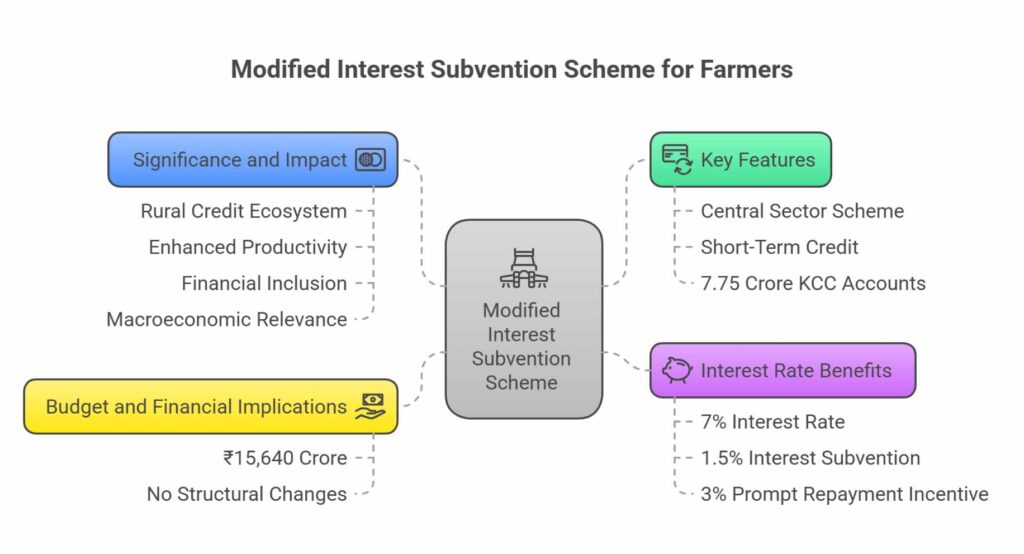

Key Features of MISS

- Type of Scheme: Central Sector Scheme

- Purpose: To ensure availability of short-term credit for farmers at affordable interest rates.

- Coverage: Over 7.75 crore KCC accounts across the country.

Interest Rate Benefits

- Short-term loans of up to ₹3 lakh are provided at 7% interest rate.

- A 1.5% interest subvention is given to lending institutions, reducing their lending cost.

- Farmers who repay promptly get an additional 3% Prompt Repayment Incentive (PRI), reducing the effective interest rate to 4%.

- For loans taken exclusively for animal husbandry or fisheries, benefits are available up to ₹2 lakh.

Budget and Financial Implications

- Total Cost to Exchequer: ₹15,640 crore for FY 2025-26.

- No changes have been proposed to the existing structure of the scheme.

Background and Trends

- Institutional Credit Flow via KCC:

- 2014: ₹4.26 lakh crore

- Dec 2024: ₹10.05 lakh crore

- Overall Agricultural Credit Flow:

- 2013–14: ₹7.3 lakh crore

- 2023–24: ₹25.49 lakh crore

This sharp increase highlights the growing dependence of farmers on institutional credit, supported by subvention policies like MISS.

Significance and Impact

- Strengthening Rural Credit Ecosystem: By keeping borrowing costs low, rural and cooperative banks can continue offering credit on favourable terms.

- Enhancing Productivity: Timely and affordable credit facilitates investment in quality seeds, fertilisers, machinery, and irrigation—improving agricultural output.

- Promoting Financial Inclusion: MISS targets small and marginal farmers, reducing their dependence on informal credit sources.

- Macroeconomic Relevance: As rural credit demand grows, MISS plays a vital role in aligning monetary policy instruments like repo rate and MCLR with inclusive agricultural financing.

Conclusion

- The continuation of the Modified Interest Subvention Scheme (MISS) for FY 2025-26 reflects the government’s strategic commitment to boosting agricultural growth, enhancing credit access, and supporting rural livelihoods.

- In the context of rising input costs and financial vulnerability in rural areas, such targeted interventions are essential for ensuring the sustainability of agriculture and achieving the broader goal of inclusive development.

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

For Indian Exporters

- These reforms reduce transaction costs and compliance hurdles

- Encourage a more competitive and efficient export environment

- Promote value addition in key sectors like leather

For Tamil Nadu

- The reforms particularly benefit the state’s leather industry, a major contributor to employment and exports

- Boost the marketability of GI-tagged E.I. leather, enhancing rural and traditional industries

For Trade Policy

- These decisions indicate a shift from regulatory controls to policy facilitation

Reinforce the goals of Make in India, Atmanirbhar Bharat, and India’s ambition to become a leading export power

Recently, BVR Subrahmanyam, CEO of NITI Aayog, claimed that India has overtaken Japan to become the fourth-largest economy in the world, citing data from the International Monetary Fund (IMF).

India’s rank as the world’s largest economy varies by measure—nominal GDP or purchasing power parity (PPP)—each with key implications for economic analysis.