UPSC CURRENT AFFAIRS – 12th June 2025

SEBI mandates dedicated UPI address for registered intermediaries

Why in News?

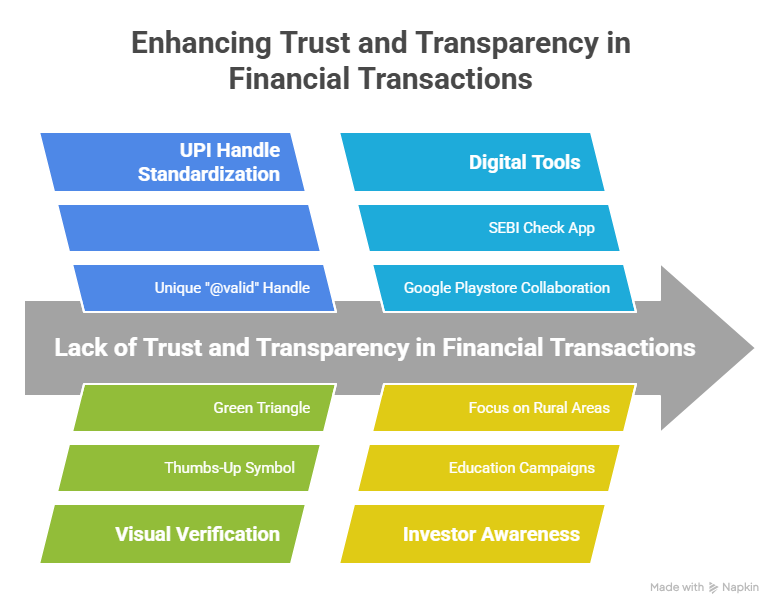

- SEBI will introduce a validated UPI handle “@valid” to ensure secure digital payments and prevent fraud in securities market transactions.

Introduction

- In an effort to enhance investor security and reduce the risk of digital payment fraud in India’s securities market, the Securities and Exchange Board of India (SEBI) is set to launch a new validated UPI handle – “@valid” – for all investor-facing intermediaries.

- This initiative, developed in consultation with the National Payments Corporation of India (NPCI), is scheduled to come into effect from October 1, 2025.

- It is designed to standardize digital payment mechanisms and prevent unauthorized or fraudulent UPI transactions within the securities ecosystem.

Key Features of the Initiative

- Creation of a Unique UPI Handle: “@valid”

- All registered intermediaries including brokers, investment advisors, research analysts, mutual fund distributors, and bankers to an issue will be required to use a standardized and verified UPI handle ending with “@valid”.

- For instance, if a broker is associated with HDFC Bank, the verified UPI handle may appear as: abc.bkr@validhdfc.

- These handles will be allocated and maintained by NPCI, ensuring each handle is authentic and traceable.

- Visual Verification Symbol

- To improve user trust, particularly among investors who may not be digitally literate or English-proficient, every valid payment request from such handles will display a thumbs-up symbol inside a green triangle.

- This visual marker serves to confirm the legitimacy of the handle and helps prevent phishing attacks, impersonation, and fraudulent payment demands.

Scope of Applicability

The reform is applicable to around 8,000 to 9,000 investor-facing intermediaries across the country, including but not limited to:

- Stock brokers

- Mutual fund distributors

- Investment advisors

- Research analysts

- Bankers to an issue

These stakeholders will need to migrate to the new handle format to continue receiving payments and fees.

Supporting Digital Tools: SEBI Check App

To complement this initiative, SEBI will introduce a dedicated application named “SEBI Check”, which will enable investors to:

- Verify the authenticity of UPI handles used by intermediaries

- Confirm SEBI registration of the intermediary

- Protect themselves against scams or impersonation attempts

Additionally, SEBI plans to work with Google Playstore to ensure that only legitimate, approved financial applications are available on public platforms, minimizing the risk of fake or fraudulent apps.

Investor Protection and Awareness Campaigns

A two-year investor awareness and education campaign will be undertaken starting from April 2025. The objectives of this initiative include:

- Spreading awareness about the use of the “@valid” UPI handle format

- Educating investors about recognizing legitimate payment requests

- Providing information on how to use the SEBI Check App

- Ensuring intermediaries actively display the validation symbols and guide investors accordingly

These campaigns will particularly focus on rural and semi-urban areas where awareness of digital safety may be low.

No Impact on Existing SIPs

SEBI has clarified that existing Systematic Investment Plans (SIPs) will not be impacted by the transition.

Ongoing mandates and payment arrangements will remain in force, and the shift to “@valid” handles will be implemented in a gradual and investor-friendly manner.

Significance of the Move

- Enhanced Trust and Transparency: The initiative fosters greater transparency and builds investor confidence by allowing them to identify verified payment recipients easily. It reduces ambiguity in financial transactions.

- Reduction in Cyber Fraud: Standardized handles and visual markers make it easier to distinguish genuine intermediaries from fraudsters, thereby minimizing digital payment-related fraud in capital markets.

- Standardization Across the Market: By enforcing a common handle format, the digital financial environment becomes simpler and more consistent for all users, improving operational efficiency and regulatory compliance.

- Promotion of Digital Inclusivity: The use of simple visual indicators ensures that individuals with limited technological literacy or language barriers can still transact safely, promoting broader inclusion in financial markets.

Way Forward

- SEBI should focus on extensive outreach in Tier 2 and Tier 3 cities and rural areas, where digital and financial literacy levels may be relatively lower.

- The initiative must be backed by periodic audits, updates to the SEBI Check app, and collection of stakeholder feedback to improve user experience.

- Integration with broader schemes such as Digital India and the Investor Protection Fund (IPF) would enhance the reach and effectiveness of this initiative.

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

Economic Implications

For Indian Exporters

- These reforms reduce transaction costs and compliance hurdles

- Encourage a more competitive and efficient export environment

- Promote value addition in key sectors like leather

For Tamil Nadu

- The reforms particularly benefit the state’s leather industry, a major contributor to employment and exports

- Boost the marketability of GI-tagged E.I. leather, enhancing rural and traditional industries

For Trade Policy

- These decisions indicate a shift from regulatory controls to policy facilitation

Reinforce the goals of Make in India, Atmanirbhar Bharat, and India’s ambition to become a leading export power

Recently, BVR Subrahmanyam, CEO of NITI Aayog, claimed that India has overtaken Japan to become the fourth-largest economy in the world, citing data from the International Monetary Fund (IMF).

India’s rank as the world’s largest economy varies by measure—nominal GDP or purchasing power parity (PPP)—each with key implications for economic analysis.