UPSC CURRENT AFFAIRS – 13th June 2025

Trump’s tariffs and a U.S.-India trade agreement

Why in News?

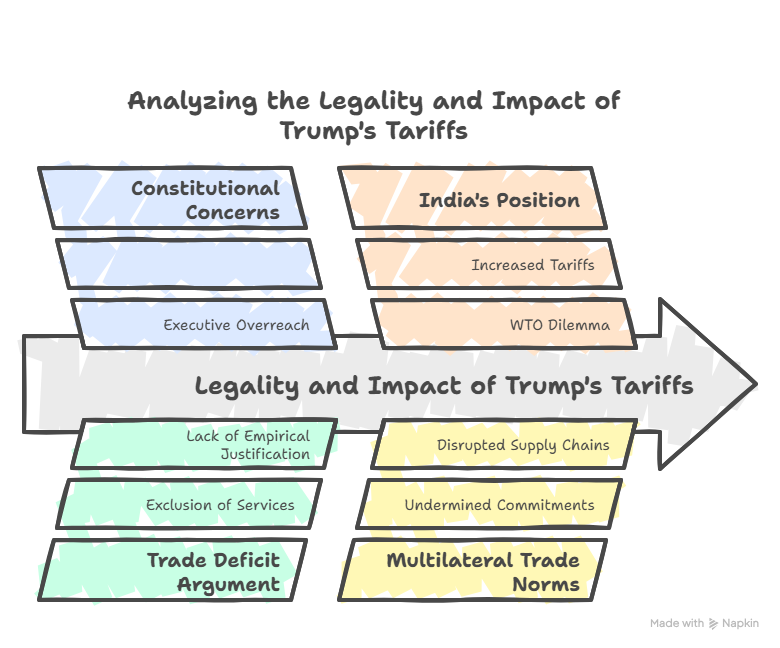

The U.S. Court of International Trade (CIT) challenged President Trump’s sweeping global tariffs as unconstitutional and unlawful.

Background:

- On May 28, 2025, the U.S. Court of International Trade (CIT) delivered a landmark ruling that challenged the legality of sweeping tariffs imposed by U.S. President Donald Trump.

- The case was brought not by rival nations, but by five small U.S. businesses, which argued that these tariffs were unlawful and harmful to their operations.

- This development holds significant implications for India, which faces increased tariffs despite a supposed mutual settlement at the WTO.

- It also raises broader questions about the legality of executive overreach in the U.S., the role of trade deficits, and the state of multilateral trade norms.

Understanding Trump’s Tariff Regime

- Between 2017 and 2025, President Trump imposed broad-based tariffs ranging from 10% to 135%, impacting over 100 countries, including allies and trade partners like India, Japan, and the EU.

- The justification was a supposed “national emergency” created by persistent trade deficits.

- Tariffs were even extended to remote, uninhabited places like the Heard and McDonald Islands, highlighting the absurdity and scale of the executive order.

- These actions undermined multilateral trade commitments, particularly WTO-bound tariff commitments, and disrupted global supply chains.

Constitutional Concerns in the U.S.

- The U.S. Constitution follows a separation of powers between the executive, legislature, and judiciary.

- By unilaterally imposing tariffs, the executive bypassed Congressional oversight and undermined the rule of law.

- The U.S. Court of International Trade (CIT) noted that:

- A mere invocation of “national emergency” cannot override constitutional checks.

- The President cannot re-write binding international commitments on tariffs.

This ruling reasserted judicial oversight over executive action and upheld the sanctity of international trade law.

The Trade Deficit Argument

- A trade deficit means that a country’s imports exceed exports. But it’s not inherently negative.

- The Trump administration’s calculations excluded services — a major strength of the U.S. economy.

- Example:

- The U.S. cited a $44.4 billion goods trade deficit with India.

- But after accounting for services and arms trade, the U.S. actually has a $35–40 billion surplus with India (Global Trade Research Initiative).

The rationale behind the tariffs lacked empirical and legal justification.

India’s Position: Between Cooperation and Coercion

- India was hit with increased tariffs (from 25% to 50%) on steel and aluminium, despite previously reaching a “mutually agreed solution” at the WTO in 2023.

- India had withdrawn its WTO case against U.S. tariffs under Trump’s first term, expecting reprieve.

- Now, with further tariff escalation, India faces a dilemma:

- Retaliate and escalate the dispute at the WTO again?

- Or engage in bilateral negotiations under pressure?

The U.S.’s disregard for WTO rulings puts India’s strategic trade calculus at risk.

The WTO and Multilateralism

- WTO panels in 2022 ruled that the Trump-era tariffs did not meet national security justification.

- Yet, the U.S. continues to ignore WTO rulings.

- India’s G-20 presidency emphasized the importance of multilateralism and WTO-based trade.

India must proactively defend multilateral institutions while safeguarding national trade interests.

Strategic Implications for India

Despite assumptions that U.S.-China tensions would benefit India:

- The U.S.-China truce has paused their trade war.

- Trump’s threat to impose tariffs on Apple products if manufactured in India sends a chilling message.

- There is no guarantee of U.S. support for India in broader strategic or military conflicts.

India should not rely solely on strategic alignment but focus on independent, well-balanced trade policy.

Key Issues for India in a Future U.S. Trade Deal

To safeguard its national interest, India must:

a. Tariff Removal

- Ensure complete rollback of enhanced tariffs on Indian goods (steel, aluminium, etc.).

b. Protection of Services and Digital Trade

- Prevent retaliatory action against India’s digital services tax.

- Secure visa access (H-1B, L1) for Indian professionals under Mode 4 of trade in services.

c. Remittances

- Demand exemption from proposed 3.5% U.S. tax on remittances under the “Trump One Big Beautiful Bill (OBBB).”

d. Legal Predictability

- Seek legal assurance against arbitrary executive action.

- Ensure that U.S. laws do not override WTO commitments.

The Bigger Picture: Rule of Law vs Executive Overreach

The May 2025 CIT judgment, though temporarily stayed by a higher court, is a landmark:

- It challenges the unchecked power of the executive in trade policy.

- Reinforces constitutionalism in trade law.

- Affirms the role of domestic courts in upholding international commitments.

Conclusion

- In a rapidly shifting global order, India must pursue strategic autonomy in trade policy. A deal with the U.S. should not come at the cost of sovereignty, multilateralism, or economic fairness.

- The WTO remains a crucial shield for developing economies like India against arbitrary power plays.

- While President Trump’s tariffs may be legally unsustainable in the long run, India should not rush into any sub-optimal agreement.

- The challenge to these tariffs from within the U.S. legal system offers hope — but only if India continues to negotiate with prudence, assertiveness, and alignment to global trade norms.

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

Economic Implications

For Indian Exporters

- These reforms reduce transaction costs and compliance hurdles

- Encourage a more competitive and efficient export environment

- Promote value addition in key sectors like leather

For Tamil Nadu

- The reforms particularly benefit the state’s leather industry, a major contributor to employment and exports

- Boost the marketability of GI-tagged E.I. leather, enhancing rural and traditional industries

For Trade Policy

- These decisions indicate a shift from regulatory controls to policy facilitation

Reinforce the goals of Make in India, Atmanirbhar Bharat, and India’s ambition to become a leading export power

Recently, BVR Subrahmanyam, CEO of NITI Aayog, claimed that India has overtaken Japan to become the fourth-largest economy in the world, citing data from the International Monetary Fund (IMF).

India’s rank as the world’s largest economy varies by measure—nominal GDP or purchasing power parity (PPP)—each with key implications for economic analysis.