UPSC CURRENT AFFAIRS – 16th June 2025

Iran-Israel Conflict: Implications for India’s Economy and Trade

Why in News?

The Iran-Israel conflict poses economic risks for India through higher oil prices, disrupted trade routes, inflationary pressure, and strategic energy security challenges.

Introduction

- As the Iran-Israel conflict escalates into a direct confrontation, the global economy faces renewed uncertainty.

- India, as a major energy-importing and trade-driven economy, is particularly exposed to the fallout.

- The crisis has revived fears of surging oil prices, supply chain disruptions, and inflationary pressures, threatening the country’s recent gains in economic stability.

Global Trade Disruption and the Red Sea Crisis

- The Red Sea route, crucial for global shipping, had only recently begun to stabilize after prolonged Houthi attacks.

- With the outbreak of direct hostilities between Iran and Israel, ships are being rerouted via the Cape of Good Hope, adding:

- 10–14 days to voyage times

- Higher freight and insurance costs

- According to Kpler data, LNG flows through the Suez Canal dropped sharply from 32.36 million tonnes in 2023 to just 4.15 million tonnes in 2024, indicating severe disruption.

Strait of Hormuz: A Strategic Energy Chokepoint

- The Strait of Hormuz handles 20–25% of global oil supply and a significant portion of LNG exports from Qatar and the UAE—with Qatar being a major LNG supplier to India.

- Experts warn that Iran could retaliate by blocking the Strait, which would:

- Severely impact global crude and gas flows

- Push up Brent crude prices, possibly crossing $90 per barrel (Goldman Sachs projection)

- Disrupt LNG shipments to India, increasing energy insecurity

Inflationary Pressures and Monetary Policy Constraints

- India’s headline retail inflation fell to a 75-month low of 2.82% in May 2025, largely due to falling prices of fruits, pulses, and cereals.

- This allowed the RBI’s MPC to cut the repo rate by 50 basis points, aiming to support economic growth.

- However, the RBI has cautioned that “monetary policy has very limited space to support growth” if inflation resurges due to:

- Rising oil prices

- Imported inflation from freight and insurance costs

- LNG shortages driving industrial input prices up

Impact on Energy Infrastructure and Supply

- So far, no direct attacks have targeted energy infrastructure, but precautionary steps have begun:

- Israel shut its Leviathan gas field, a vital supplier to Jordan and Egypt.

- Iran’s oil refineries and storage reported no damage yet, but a significant drop in exports is expected.

- S&P Global forecasts that Iran’s crude exports could fall below 1.5 million b/d in June 2025, from 4 million b/d in May.

Trade and Export Risks for India

- Exporters, represented by FIEO, had hoped conflict escalation would be avoided. Now, with fears materialising:

- Freight rates are rising again

- Vessel availability is tightening

- Export competitiveness may be affected, particularly for low-margin goods

- Prolonged instability will hurt India’s non-oil imports (chemicals, fertilizers) and exports to West Asia, increasing trade imbalance.

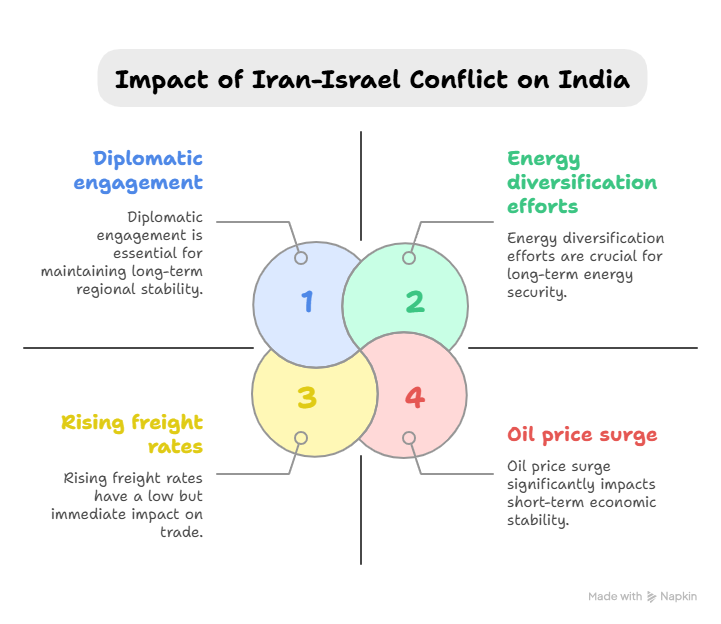

Strategic and Diplomatic Considerations

- India faces the challenge of maintaining balanced relations with both Iran and Israel amid deepening polarisation.

- Rising instability may jeopardise:

- Chabahar Port connectivity project in Iran

- India’s broader energy diversification efforts

- Diplomatic engagement and crisis management in West Asia will be crucial to safeguarding long-term interests.

Conclusion

The Iran-Israel conflict poses serious macroeconomic and strategic risks for India, particularly through higher energy prices, inflationary pressures, disrupted trade routes, and reduced monetary policy flexibility. While short-term volatility appears inevitable, India must focus on:

- Diversifying energy sources

- Boosting strategic reserves

- Enhancing shipping and logistics resilience

- Proactive diplomatic outreach to maintain regional stability

India’s economic planners must remain vigilant to ensure that geopolitical tensions do not derail the fragile post-pandemic recovery.

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

Economic Implications

For Indian Exporters

- These reforms reduce transaction costs and compliance hurdles

- Encourage a more competitive and efficient export environment

- Promote value addition in key sectors like leather

For Tamil Nadu

- The reforms particularly benefit the state’s leather industry, a major contributor to employment and exports

- Boost the marketability of GI-tagged E.I. leather, enhancing rural and traditional industries

For Trade Policy

- These decisions indicate a shift from regulatory controls to policy facilitation

Reinforce the goals of Make in India, Atmanirbhar Bharat, and India’s ambition to become a leading export power

Recently, BVR Subrahmanyam, CEO of NITI Aayog, claimed that India has overtaken Japan to become the fourth-largest economy in the world, citing data from the International Monetary Fund (IMF).

India’s rank as the world’s largest economy varies by measure—nominal GDP or purchasing power parity (PPP)—each with key implications for economic analysis.