UPSC CURRENT AFFAIRS – 16th June 2025

The Cost of Rising Imports and India’s Agrarian Distress

Why in News?

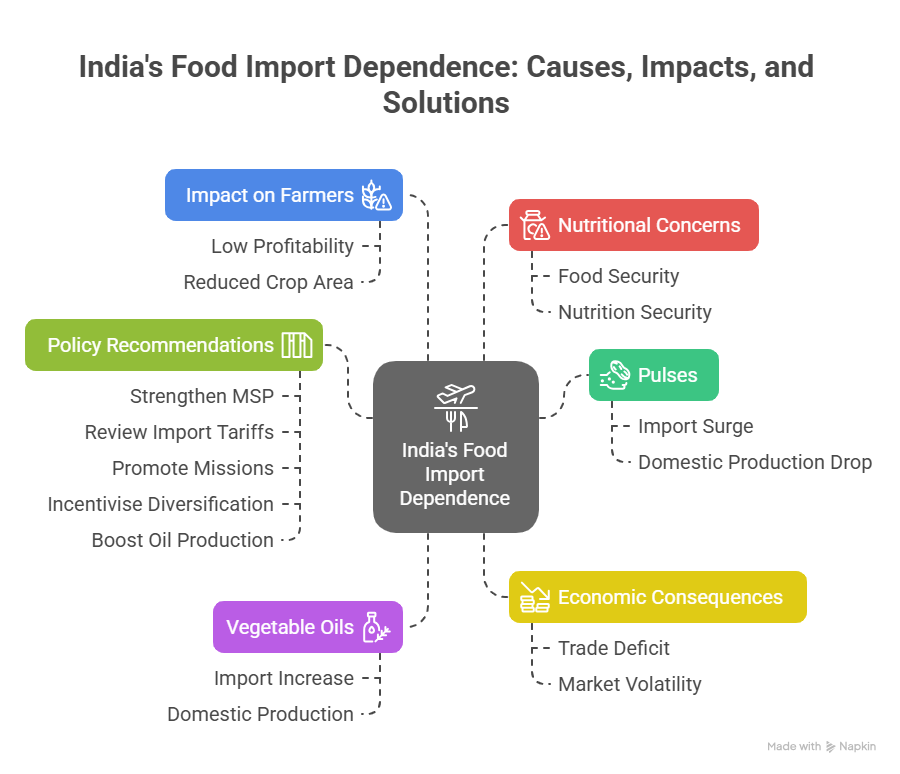

India is witnessing a surge in imports of pulses and edible oils, reflecting structural issues in domestic production and price support mechanisms for farmers.

Introduction

- India has recorded all-time-high imports of pulses and vegetable oils in the financial year 2024–25.

- This trend raises significant concerns about the future of domestic agriculture, particularly for farmers engaged in pulse and oilseed cultivation, who are facing low market prices and insufficient procurement support.

Ground Realities: The Case of Rao Gulab Singh Lodi

- Rao Gulab Singh Lodi, a farmer from Nanhegaon village in Madhya Pradesh’s Narsinghpur district, harvested approximately 90 quintals of summer moong (green gram) from his 16-acre land.

- However, he was forced to sell it in the open market at around ₹6,000 per quintal, far below the official Minimum Support Price (MSP) of ₹8,682 per quintal, due to the government’s lack of procurement.

Pulses: From Self-Sufficiency to Import Dependence

In 2024–25, India imported 7.3 million tonnes (mt) of pulses worth $5.5 billion, the highest ever, exceeding the previous 2016–17 record.

This surge reverses the progress made between 2017–2022, when improved domestic production had reduced annual imports to an average of 2.6 mt. The rise in imports was primarily driven by:

- An El Niño-induced drought in 2023–24

- A drop in domestic pulses production to 24.2 mt from a peak of 27.3 mt in 2021–22

- Inflationary pressure on pulse prices in retail markets

To control consumer price inflation, the government slashed import duties. As a result, consumer price index (CPI) inflation for pulses dropped from double digits in mid-2023 to negative territory by early 2025. However, this policy adversely impacted farmers, with market prices for key pulses like chana and arhar falling below MSP levels in mandis.

Breakdown of 2024–25 pulse imports:

- Yellow/white peas: 2.2 mt

- Chana: 1.6 mt

- Arhar (pigeon pea): 1.2 mt

- Masoor (red lentil): 1.2 mt

- Urad (black gram): 0.8 mt

Vegetable Oils: Increasing and Persistent Import Dependence

Over the past 11 years, India’s vegetable oil imports have more than doubled from 7.9 mt to 16.4 mt, and the import bill has nearly tripled from $7.2 billion in 2013–14 to $20.8 billion in 2022–23.

The 2024–25 imports comprised:

- Palm oil: 7.9 mt (Indonesia and Malaysia)

- Soyabean oil: 4.8 mt (Argentina and Brazil)

- Sunflower oil: 3.5 mt (Russia, Ukraine, Argentina)

Domestic production of edible oil from all sources is around 10 mt, leading to a heavy import dependency of over 60%.

To control high domestic inflation in edible oils (which stood at 17.9% in May 2025), the government reduced:

- Basic customs duty on crude edible oils from 20% to 10%

- Overall tariff (including cess and surcharges) from 27.5% to 16.5%

The US Department of Agriculture (USDA) expects this to further increase India’s soyabean oil imports, including from the United States.

Implications for Farmers and the Economy

Economic Consequences:

- Widening of the trade deficit due to expensive food imports

- High reliance on volatile global commodity markets

Impact on Farmers:

- Continued low profitability for pulses and oilseeds

- Discouragement from sowing these crops in future seasons

- Risk of reduced area under cultivation for essential protein and fat-rich crops

Nutritional Concerns:

- Pulses and oils are vital for India’s food and nutrition security

- Import-driven strategies may undercut long-term domestic availability and affordability

Policy Recommendations and Way Forward

- Strengthen MSP-based Procurement

- Institutionalise procurement of pulses and oilseeds on a par with rice and wheat

- Expand the role of the Price Support Scheme (PSS) under the Ministry of Agriculture

- Review Import Tariff Policies

- Use calibrated tariffs to balance inflation control and farmer incentives

- Consider seasonal restrictions or quotas to protect domestic harvests

- Promote Pulses and Oilseed Missions

- Expand the scope of the National Food Security Mission (NFSM)

- Support R&D and extension services for climate-resilient and short-duration varieties

- Incentivise Crop Diversification

- Encourage farmers to shift from water-intensive crops to pulses and oilseeds

- Provide insurance, minimum income support, and access to institutional credit

- Boost Domestic Oil Production

- Strengthen the National Mission on Edible Oils – Oil Palm

- Improve yields from existing oilseed crops like mustard, groundnut, and soyabean

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

Economic Implications

For Indian Exporters

- These reforms reduce transaction costs and compliance hurdles

- Encourage a more competitive and efficient export environment

- Promote value addition in key sectors like leather

For Tamil Nadu

- The reforms particularly benefit the state’s leather industry, a major contributor to employment and exports

- Boost the marketability of GI-tagged E.I. leather, enhancing rural and traditional industries

For Trade Policy

- These decisions indicate a shift from regulatory controls to policy facilitation

Reinforce the goals of Make in India, Atmanirbhar Bharat, and India’s ambition to become a leading export power

Recently, BVR Subrahmanyam, CEO of NITI Aayog, claimed that India has overtaken Japan to become the fourth-largest economy in the world, citing data from the International Monetary Fund (IMF).

India’s rank as the world’s largest economy varies by measure—nominal GDP or purchasing power parity (PPP)—each with key implications for economic analysis.