UPSC CURRENT AFFAIRS – 16th July 2025

Headline Inflation Falls, But Household Costs Continue to Rise

Why in News?

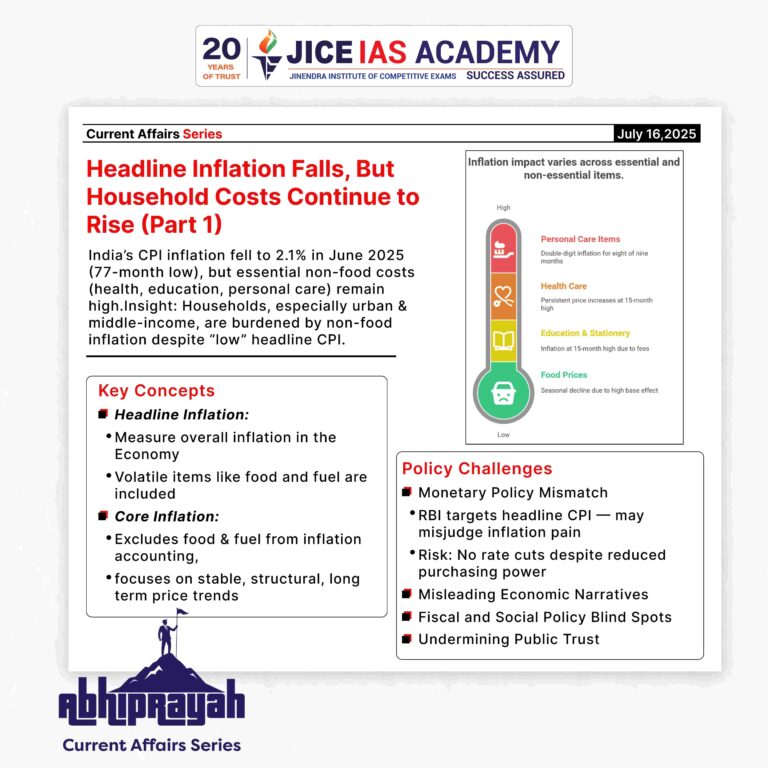

Despite headline CPI inflation falling to a 77-month low of 2.1% in June 2025, essential non-food items continue to experience high inflation.

Introduction

- The decline of headline retail inflation to a 77-month low of 2.1% in June 2025 may appear to be a major victory for economic policymakers.

- At first glance, it suggests price stability, macroeconomic control, and a supportive environment for economic recovery.

- However, this statistical milestone conceals a more nuanced and sobering reality. For the average Indian consumer, particularly in urban and lower-income households, inflation is far from over.

- A closer look at the sectoral components of inflation reveals disparities in price pressures, raising questions about how well headline inflation metrics represent the real cost of living.

Headline vs. Core Reality: Dissecting the Inflation Figures

- While food prices — traditionally the most volatile component of the Consumer Price Index (CPI) — saw a welcome easing, the trend is seasonal, not structural.

- In June 2025, food and beverage prices contracted by 0.2% on a high base effect of 8.4% from the previous year. Prices of essential food items such as vegetables, pulses, spices, and meat declined year-on-year.

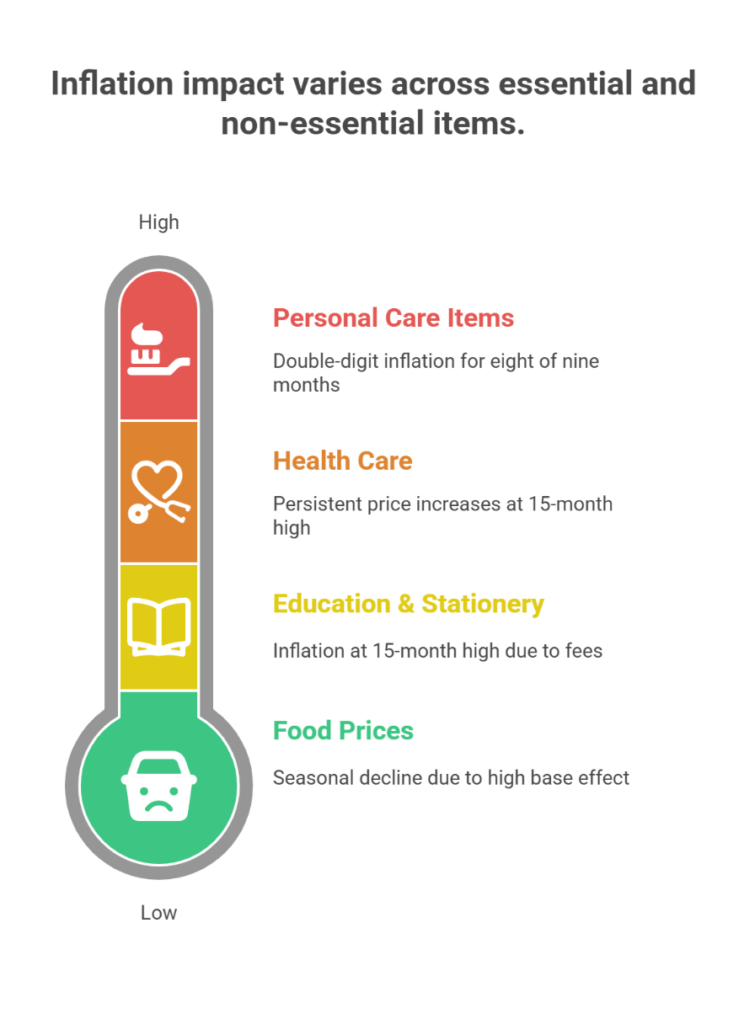

However, other categories crucial to daily life witnessed sharp inflationary pressures:

- Education and stationery: Inflation rose to 4.4%, a 15-month high, driven by rising costs in school and private tuition fees.

- Health care: Prices saw persistent increases, also touching a 15-month high, indicating rising out-of-pocket health expenditures.

- Personal care items: Inflation soared to 14.8%, the eighth month in nine that this category saw double-digit inflation. Everyday products like soap, shampoo, toothpaste, and sanitary napkins have become increasingly expensive.

This uneven inflation landscape means that while overall CPI inflation looks subdued, non-food essentials — which account for a growing share of household expenditure — are burdening consumers, especially those outside the rural poor demographic that traditionally spends more on food.

Structural Problems in CPI Weightage

- A central issue is the disproportionate weight of food in the CPI. Presently, food and beverages account for 46% of the overall CPI basket, making the index highly sensitive to food price movements.

- In contrast, the recent Household Consumption Expenditure Survey (HCES) data suggest that food comprises only around 30% of actual household spending, especially in urban and middle-income households.

- The Ministry of Statistics and Programme Implementation (MoSPI) is currently in the process of updating the base year of the CPI from 2011–12 to a more recent period.

- This revision will also include an update of the category-wise weights to better reflect evolving consumption patterns.

- However, until this revision is completed and implemented, monetary policy, inflation targeting, and welfare measures continue to be guided by an outdated index.

Policy Implications and the Need for Nuanced Inflation Management

The implications of relying on an outdated inflation metric are considerable:

- Monetary Policy Mismatch: The RBI’s inflation targeting framework, which hinges on headline CPI, may misjudge actual demand-side pressures and the inflation pain experienced by households. A low headline figure may discourage rate cuts even as real purchasing power declines for essential non-food goods.

- Misleading Economic Narratives: A headline inflation figure of 2.1% suggests economic relief, but it masks the real burden on the poor and middle class, who are paying more for health care, education, and personal care.

- Fiscal and Social Policy Blind Spots: Welfare schemes, subsidies, and tax relief policies designed to offset inflation must be informed by disaggregated inflation data, not just the headline number.

- Undermining Public Trust: When the public’s lived experience of inflation diverges from official data, it erodes trust in institutions, particularly in the credibility of government statistics and central bank actions.

The Way Forward

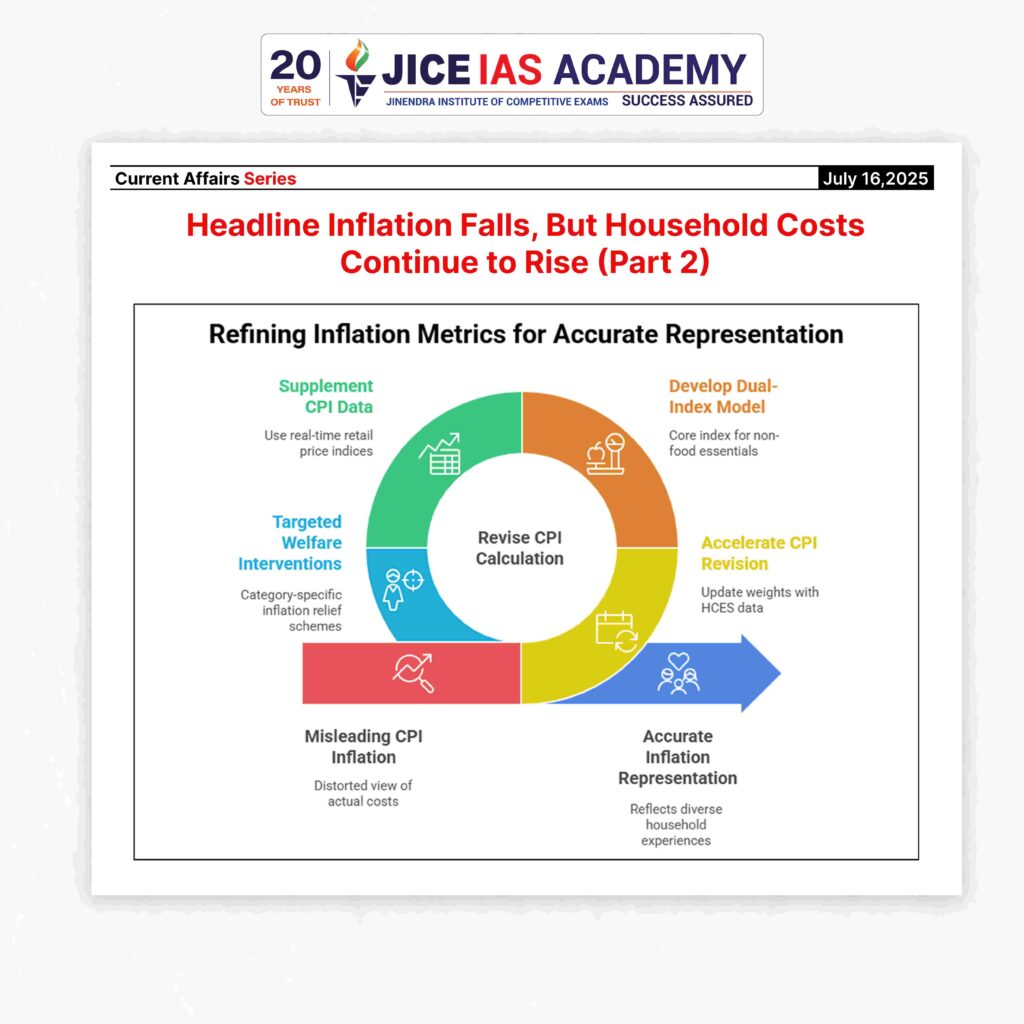

To make inflation metrics more relevant, representative, and useful, the following steps are essential:

- Accelerate the CPI revision process: MoSPI must urgently complete the base year update, incorporating new weights based on recent HCES data to reflect current spending habits more accurately.

- Develop a dual-index model: Consider the development of a core inflation index that strips away food and fuel volatility but adds weight to health, education, housing, and personal care, especially in urban CPI.

- Supplement CPI with alternate data: Use tools like the Consumer Confidence Survey, real-time retail price indices, and region-specific price indicators to supplement the CPI and get a finer picture of inflation dynamics.

- Targeted welfare interventions: Government schemes aimed at inflation relief must take into account category-specific inflation (e.g., sanitary products, tuition fees), ensuring that assistance is targeted, not generalised.

Conclusion

- The fall in headline inflation to 2.1% may look impressive in macroeconomic terms, but it does not adequately reflect the pain experienced by Indian households. Policymaking based solely on this headline number risks becoming disconnected from ground realities.

- As India moves toward becoming a more consumption-driven economy, it is imperative that inflation metrics evolve to capture the diversity of household experiences, especially in urban and semi-urban India.

- A more dynamic, updated CPI is not just a statistical necessity — it is an economic and social imperative.

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

Economic Implications

For Indian Exporters

- These reforms reduce transaction costs and compliance hurdles

- Encourage a more competitive and efficient export environment

- Promote value addition in key sectors like leather

For Tamil Nadu

- The reforms particularly benefit the state’s leather industry, a major contributor to employment and exports

- Boost the marketability of GI-tagged E.I. leather, enhancing rural and traditional industries

For Trade Policy

- These decisions indicate a shift from regulatory controls to policy facilitation

Reinforce the goals of Make in India, Atmanirbhar Bharat, and India’s ambition to become a leading export power

Recently, BVR Subrahmanyam, CEO of NITI Aayog, claimed that India has overtaken Japan to become the fourth-largest economy in the world, citing data from the International Monetary Fund (IMF).

India’s rank as the world’s largest economy varies by measure—nominal GDP or purchasing power parity (PPP)—each with key implications for economic analysis.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?