UPSC CURRENT AFFAIRS – 16th July 2025

Concerns with Corporate Investment in India

Why in News?

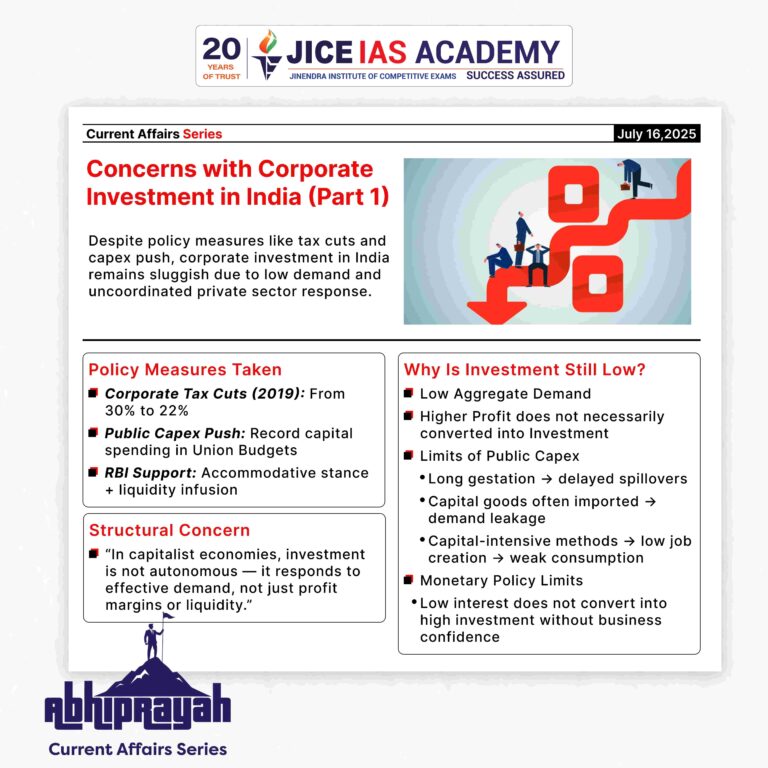

- Despite policy measures like tax cuts and capex push, corporate investment in India remains sluggish due to low demand and uncoordinated private sector response.

Introduction

- Despite favourable policy moves such as corporate tax cuts, increased government capital expenditure, and accommodative monetary policy, corporate investment in India continues to lag.

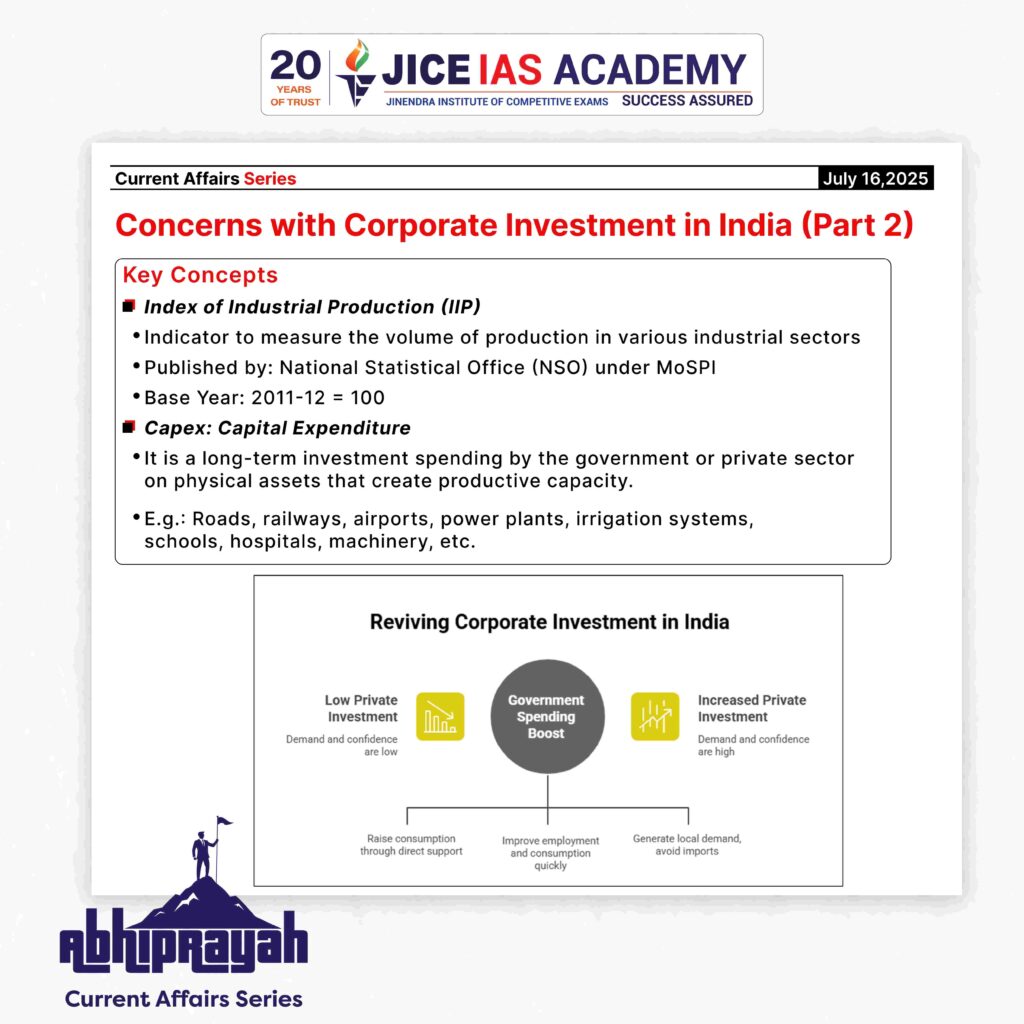

- The Index of Industrial Production (IIP) growth slowed to a nine-month low of 1.2% in June 2025, raising concerns about industrial recovery and job creation in the post-pandemic era.

Understanding Investment in a Capitalist Economy

- Investment is not an autonomous activity; it is fundamentally driven by the demand for goods and services. This classical observation has deep theoretical underpinnings, particularly in Marxist economics.

- To understand the sluggishness in corporate investment, one must revisit the structural dynamics of how investment decisions are made under capitalism.

Theoretical Background: Luxemburg vs. Baranovsky

- Tugan Baranovsky argued that investment could sustain itself if capitalists maintain a balance between production of consumption and capital goods. For him, investment creates its own market; machines can be made to produce more machines in a closed loop of capital accumulation.

- Rosa Luxemburg, on the other hand, emphasized that individual capitalists’ base investment decisions on expected demand. While theoretically investment can drive profit, in real-world capitalism, investment decisions are uncoordinated. No individual firm will invest in the absence of perceived market demand, especially if existing capacity remains underutilized.

Thus, investment requires an exogenous stimulus — it cannot initiate growth cycles on its own in times of economic slowdown.

India’s Current Scenario:

Policy Measures Taken

- Corporate Tax Cuts (2019): Reduction from 30% to 22% intended to boost post-tax profitability and incentivize private investment.

- Public Capital Expenditure: Massive infrastructure push over successive Union Budgets.

- Monetary Easing by RBI: Repo rate cuts and liquidity support through various instruments to lower the cost of borrowing.

Despite these measures, Gross Fixed Capital Formation (GFCF) by the private sector in machinery, equipment, and intellectual property has grown only 35% cumulatively between FY20 and FY23.

Why Investment Remains Low

1. Lack of Aggregate Demand

- Investment decisions are primarily governed by the expected demand for final goods.

- With private consumption demand still recovering, especially post-COVID, businesses see no reason to expand production capacity.

- The economy suffers from underutilization of existing infrastructure, further deterring new investment.

2. Misreading of the Investment-Profit Relationship

- The government assumed that higher profits would lead to higher investment, but the causality runs the other way — investment leads to profits, not vice versa.

- Investment needs the confidence of a revival, not just financial capacity.

3. Limitations of Public Capital Expenditure

While public capex is expected to crowd-in private investment, the following factors reduce its effectiveness:

- Long Gestation Periods: Infrastructure projects like roads and ports take time to generate spillover effects.

- High Import Content: If capital goods are imported, the demand stimulus leaks out of the domestic economy.

- Low Labour Intensity: Use of capital-intensive methods reduces employment generation and hence curtails consumption demand.

4. Ineffectiveness of Monetary Policy Alone

- Low interest rates or surplus liquidity cannot drive investment unless speculative confidence returns.

- As Keynes noted, both credit availability and business confidence must revive to trigger a turnaround.

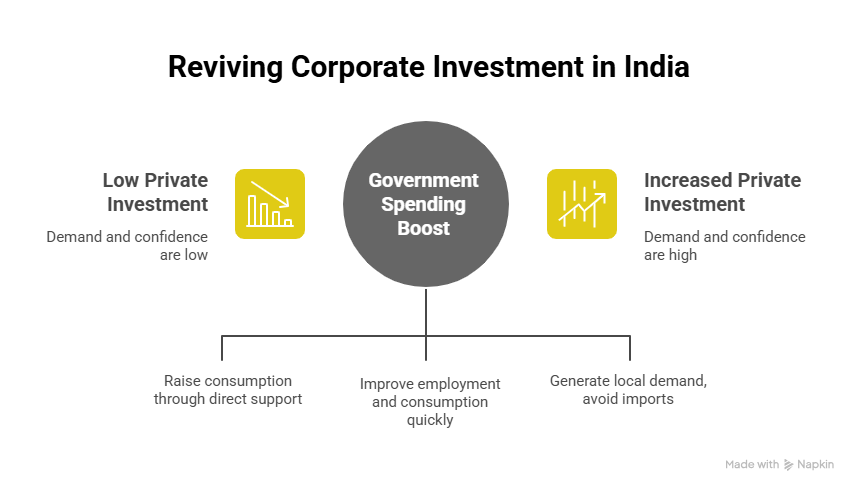

Way Forward:

Given that private investment is unlikely to pick up on its own in a slowing economy, government spending remains the most potent tool to jumpstart the investment cycle. This includes:

- Boosting direct income support and employment schemes to raise consumption.

- Enhancing labour-intensive infrastructure projects to improve immediate employment and consumption.

- Targeted fiscal spending that generates local demand and avoids high import dependence.

With global demand slowing and export markets weakening due to geopolitical tensions and trade protectionism, domestic demand revival must be the central strategy.

Conclusion

- Corporate investment in India remains subdued not due to lack of profitability or financing options, but due to structural constraints in demand revival. Policymakers must recognize that investment is not a self-sustaining engine in capitalist economies.

- Without exogenous interventions — especially government expenditure that raises effective demand — India’s industrial revival will remain elusive.

- A coordinated fiscal-monetary approach rooted in realistic expectations of capitalist behaviour is essential for sustained growth and employment generation.

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

Economic Implications

For Indian Exporters

- These reforms reduce transaction costs and compliance hurdles

- Encourage a more competitive and efficient export environment

- Promote value addition in key sectors like leather

For Tamil Nadu

- The reforms particularly benefit the state’s leather industry, a major contributor to employment and exports

- Boost the marketability of GI-tagged E.I. leather, enhancing rural and traditional industries

For Trade Policy

- These decisions indicate a shift from regulatory controls to policy facilitation

Reinforce the goals of Make in India, Atmanirbhar Bharat, and India’s ambition to become a leading export power

Recently, BVR Subrahmanyam, CEO of NITI Aayog, claimed that India has overtaken Japan to become the fourth-largest economy in the world, citing data from the International Monetary Fund (IMF).

India’s rank as the world’s largest economy varies by measure—nominal GDP or purchasing power parity (PPP)—each with key implications for economic analysis.