UPSC CURRENT AFFAIRS – 20th July 2025

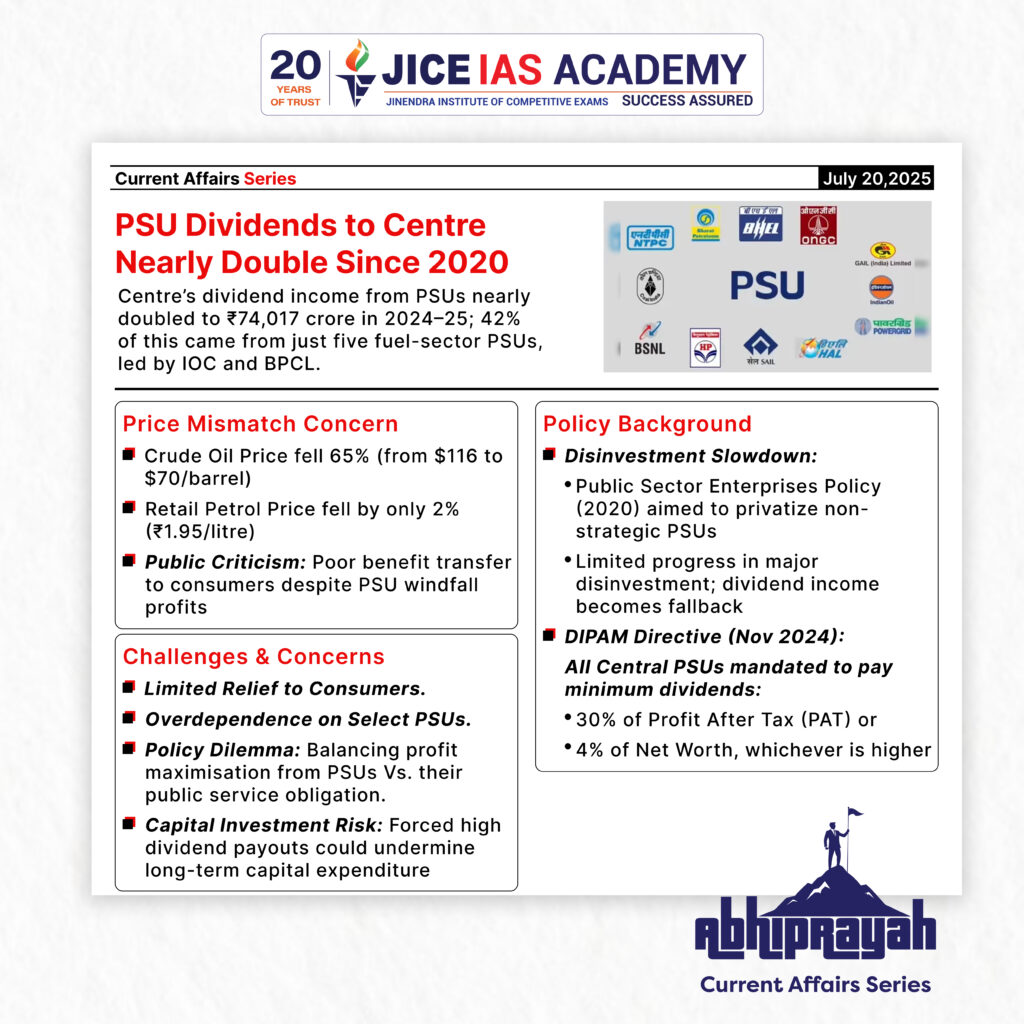

PSU Dividends to Centre Nearly Double Since 2020; 40% from Fuel PSUs

Why in News?

- The Union government has nearly doubled its dividend income from Public Sector Undertakings (PSUs) over the last five years, touching ₹74,017 crore in 2024–25.

- A significant 42% share of these dividends came from just five fuel-sector PSUs, with Indian Oil Corporation (IOC) and Bharat Petroleum Corporation Limited (BPCL) alone recording a 255% increase in dividend payouts — even as crude oil prices fell 65% and retail petrol prices barely declined.

Key Highlights

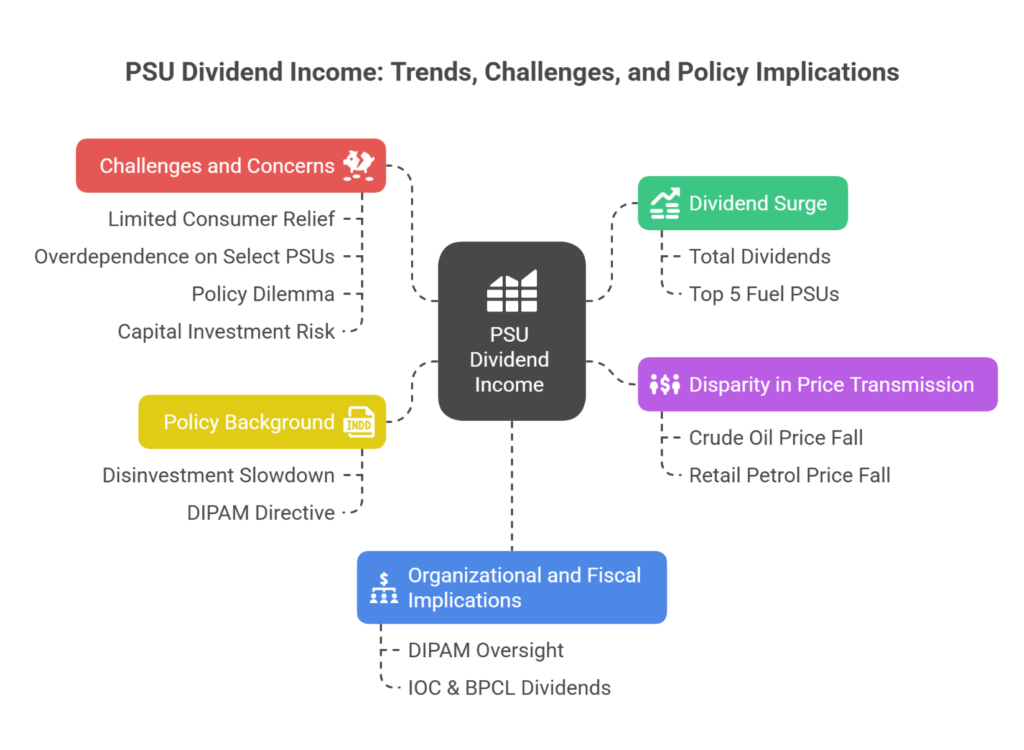

- Dividend Surge:

- Total dividends from non-banking PSUs (2020–25): ₹3 lakh crore.

- From 2020–21 (₹39,558 crore) to 2024–25 (₹74,017 crore), dividend income nearly doubled.

- Top 5 fuel-related PSUs (Coal India, ONGC, IOC, BPCL, GAIL) contributed ₹1.27 lakh crore, i.e., 42.3% of total.

- Disparity in Price Transmission:

- Crude oil price fell 65% (from $116 to $70/barrel).

- Retail petrol price fell by only 2% (₹1.95/litre).

- Despite massive input cost reduction, OMCs passed minimal benefits to consumers.

Policy Background

- Disinvestment Slowdown:

- The Public Sector Enterprises Policy (2020) aimed to privatize non-strategic PSUs and maintain minimal presence in strategic sectors.

- Limited progress in major disinvestment deals forced the government to rely more on dividend income from profitable PSUs.

- DIPAM Directive (Nov 2024):

- All Central PSUs mandated to pay minimum dividends:

- 30% of Profit After Tax (PAT) or

- 4% of Net Worth, whichever is higher.

- Encouraged to exceed the minimum benchmark based on profitability, capex, reserves, etc.

- All Central PSUs mandated to pay minimum dividends:

Organizational and Fiscal Implications

- DIPAM (Department of Investment and Public Asset Management):

- Oversees disinvestment and dividend policy for CPSEs.

- Shifted focus toward sustainable dividend strategy in light of slower privatisation outcomes.

- IOC & BPCL:

- Combined dividend to Centre rose from ₹2,435 crore (2022–23) to ₹8,653 crore (2024–25).

- Despite this, consumer benefit remains marginal — raising questions about pricing transparency and public accountability.

Challenges and Concerns

- Limited Relief to Consumers:

- Inadequate pass-through of reduced crude costs raises concerns over pricing ethics in state-owned fuel firms.

- Overdependence on Select PSUs:

- Fiscal reliance on a few commodity-based enterprises makes dividend revenues vulnerable to global price volatility.

- Policy Dilemma:

- Balancing profit maximisation from PSUs vs their public service obligation (especially in fuel pricing) is increasingly complex.

- Capital Investment Risk:

- Forced high dividend payouts could undermine long-term capex, especially in energy transition and infrastructure.

Conclusion

With sluggish disinvestment and higher fiscal needs, the government has turned to enhanced PSU dividends as a revenue source. However, this raises critical questions on the function of PSUs — whether they should serve primarily as revenue generators or continue fulfilling their public welfare objectives, especially in key sectors like fuel and energy. A balanced, transparent, and consumer-sensitive approach will be essential going forward.

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

Economic Implications

For Indian Exporters

- These reforms reduce transaction costs and compliance hurdles

- Encourage a more competitive and efficient export environment

- Promote value addition in key sectors like leather

For Tamil Nadu

- The reforms particularly benefit the state’s leather industry, a major contributor to employment and exports

- Boost the marketability of GI-tagged E.I. leather, enhancing rural and traditional industries

For Trade Policy

- These decisions indicate a shift from regulatory controls to policy facilitation

Reinforce the goals of Make in India, Atmanirbhar Bharat, and India’s ambition to become a leading export power

Recently, BVR Subrahmanyam, CEO of NITI Aayog, claimed that India has overtaken Japan to become the fourth-largest economy in the world, citing data from the International Monetary Fund (IMF).

India’s rank as the world’s largest economy varies by measure—nominal GDP or purchasing power parity (PPP)—each with key implications for economic analysis.