UPSC CURRENT AFFAIRS – 20th July 2025

RBI’s Record Banking System Fund Infusion Not Boosting Loan Growth

Why in News?

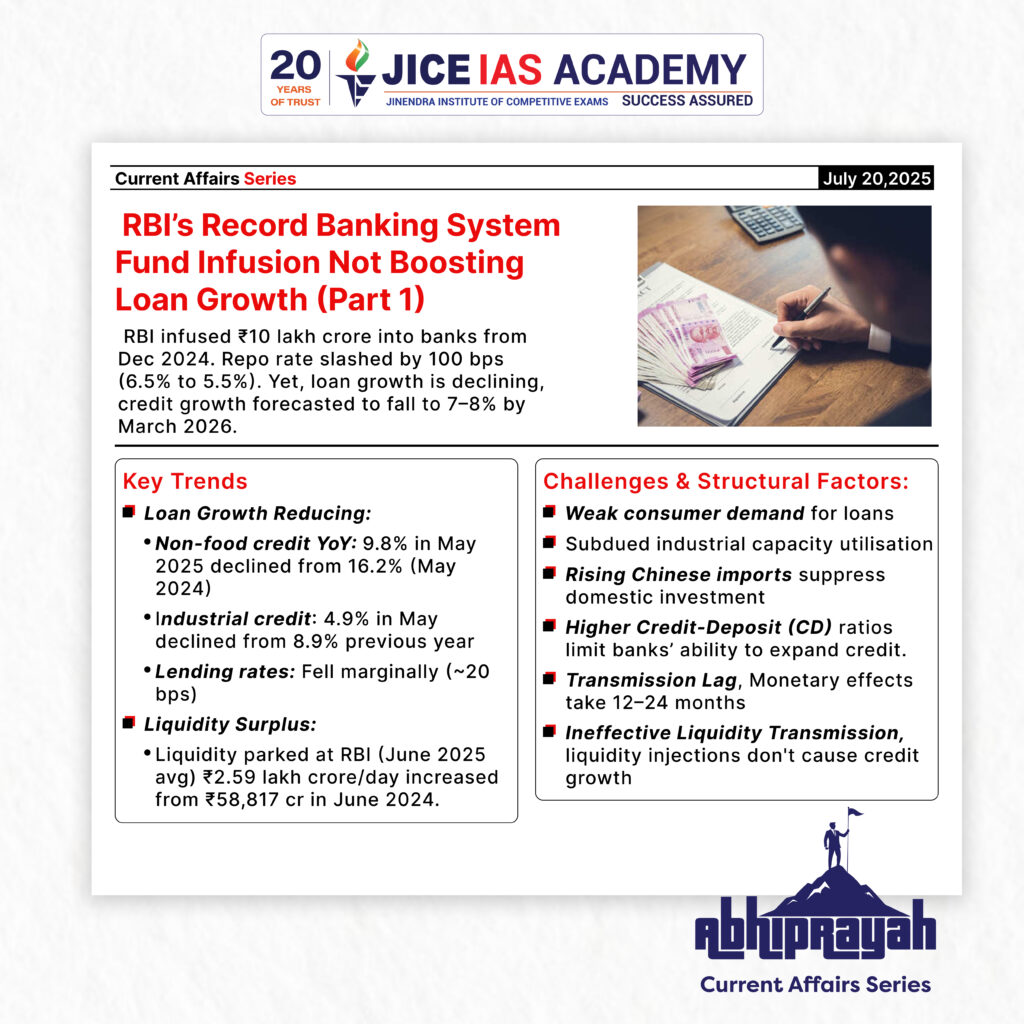

- Despite the Reserve Bank of India’s (RBI) substantial liquidity injections and policy rate cuts totaling 100 basis points (bps) since December 2024, loan growth in India continues to decline, with Nomura forecasting credit growth to fall to 7–8% by March 2026.

Background

- Liquidity Measures:

- RBI infused nearly ₹10 lakh crore into the banking system since Dec 2024 through tools like CRR cuts and government bond purchases.

- The policy repo rate was cut from 6.5% to 5.5% (June 6, 2025) by the Monetary Policy Committee (MPC).

- Objective:

- Lower borrowing costs.

- Spur bank lending to support economic activity.

Key Findings

- Loan Growth Trends:

- Non-food credit grew 9.8% YoY as of May 2025 (down from 16.2% a year ago).

- Industrial credit growth dropped to 4.9% in May (from 8.9% a year ago).

- Lending rates declined marginally — just 20 bps cheaper over the year.

- Liquidity Surplus:

- Banks deposited ₹2.59 lakh crore daily on average in June 2025 at the Standing Deposit Facility, up from ₹58,817 crore in June 2024 — indicating lack of credit demand.

Challenges & Structural Factors

- Weak Credit Demand:

- Low retail and personal loan appetite.

- Subdued industrial capacity utilisation.

- Global uncertainty and rising Chinese imports slowing investment.

- Credit-Deposit (CD) Ratio:

- Presently close to 80%, compared to 70-74% during periods of stronger rate transmission.

- Higher CD ratios limit banks’ ability to expand credit.

- Transmission Lag:

- Monetary policy transmission takes 12–24 months.

- RBI’s rate cuts may not stimulate credit growth immediately.

- Ineffective Liquidity Transmission:

- According to J.P. Morgan, liquidity injections don’t cause credit growth; the causality may be reverse.

- Lending rates react mainly to the call money rate, not just excess funds.

Policy Implications

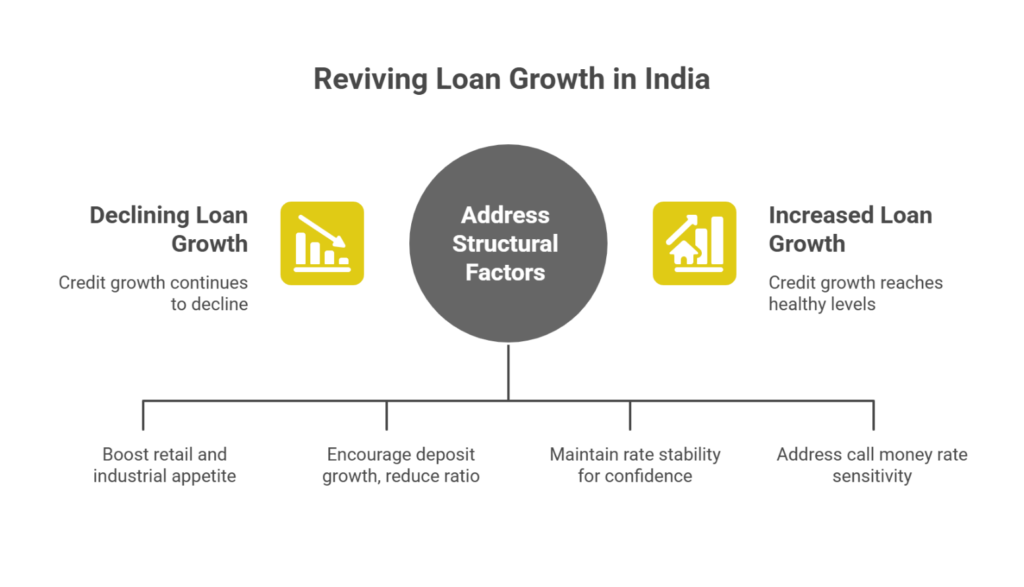

- Monetary Policy Limitations:

- Merely lowering rates or adding liquidity is insufficient without loan demand.

- Need for stability in rates over 18–24 months to revive confidence, per Boston Consulting Group.

- Macro Signals:

- Weak credit demand despite policy support suggests underlying macroeconomic sluggishness, even if GDP growth is ~6.5%.

- Future Outlook:

- Nomura expects credit growth to dip further to 7–8% by FY 2025–26 end.

Conclusion

The RBI’s aggressive liquidity measures and interest rate cuts have failed to boost bank lending, highlighting the need to focus on macroeconomic demand revival, investment incentives, and credit appetite. Going forward, policy coordination between fiscal and monetary arms is essential to ensure that the liquidity reaches the real economy, not just the banking vaults.

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

Economic Implications

For Indian Exporters

- These reforms reduce transaction costs and compliance hurdles

- Encourage a more competitive and efficient export environment

- Promote value addition in key sectors like leather

For Tamil Nadu

- The reforms particularly benefit the state’s leather industry, a major contributor to employment and exports

- Boost the marketability of GI-tagged E.I. leather, enhancing rural and traditional industries

For Trade Policy

- These decisions indicate a shift from regulatory controls to policy facilitation

Reinforce the goals of Make in India, Atmanirbhar Bharat, and India’s ambition to become a leading export power

Recently, BVR Subrahmanyam, CEO of NITI Aayog, claimed that India has overtaken Japan to become the fourth-largest economy in the world, citing data from the International Monetary Fund (IMF).

India’s rank as the world’s largest economy varies by measure—nominal GDP or purchasing power parity (PPP)—each with key implications for economic analysis.