UPSC CURRENT AFFAIRS – 25th July 2025

India–U.K. Comprehensive Economic and Trade Agreement (CETA), 2025

Why in News?

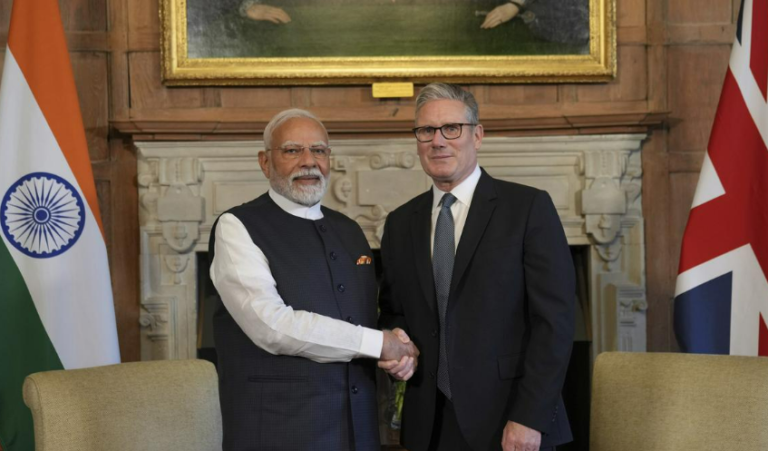

India and the U.K. signed a landmark Comprehensive Economic and Trade Agreement (CETA) on July 24, 2025.

Introduction

- India and the United Kingdom signed a landmark Comprehensive Economic and Trade Agreement (CETA) during Prime Minister Narendra Modi’s visit to the U.K.

- The agreement was signed by India’s Commerce Minister Piyush Goyal and U.K. Trade Secretary Jonathan Reynolds, marking the culmination of more than three years of negotiations after talks were re-launched post-Brexit

Key Features of the Agreement

- Trade in Goods and Tariff Reductions

- India to reduce tariffs on several British exports:

- Whiskey and gin: From 150% to 75% immediately, and down to 40% over 10 years.

- Medical devices and aerospace parts to become more affordable with tariff reductions.

- U.K. to lower tariffs on Indian exports, especially in:

- Footwear and jewellery

- Seafood and engineering goods

- Clothing, food, and shoes, making them more affordable in the U.K. market.

- India to reduce tariffs on several British exports:

- Agricultural Exports and MSMEs

- Indian agricultural exports expected to grow by 20% over the next 3 years.

- Boost for MSMEs through increased market access and reduced non-tariff barriers.

- Double Contributions Convention (DCC)

- A key social security coordination agreement:

- Ensures Indian employees working in the U.K. (and vice versa) need to pay social contributions in only one country for up to three years.

- Legally linked to the CETA – both must come into effect simultaneously.

- A key social security coordination agreement:

Strategic Framework: ‘India-U.K. Vision 2035’

Replaces the earlier ‘Roadmap 2030’, expanding into five pillars:

- Jobs and Growth

- Technology cooperation (builds on Technology Security Initiative of 2024)

- Climate change

- Defence and security

- Regular bilateral engagement: Annual reviews at the Foreign Minister level, with Prime Ministerial-level dialogue institutionalized.

Geopolitical and Security Discussions

- Terrorism: Joint condemnation of terror attacks like Pahalgam (April 2025) and commitment to counter-extremism.

- Khalistani threat: India raised concerns over extremist threats to diplomats, with U.K. promising cooperation.

- Extradition cooperation: Renewed efforts to bring back economic fugitives (e.g., Nirav Modi, Vijay Mallya).

- Indo-Pacific, Ukraine, and West Asia: Shared emphasis on peace, stability, and respect for sovereignty.

Industry Reactions

Positive:

- Confederation of Indian Industry (CII): “Strong foundation for market access and regulatory cooperation.”

- International Spirits and Wines Association of India: Welcomed phased tariff reduction on imports.

Concerns:

- Confederation of Indian Alcoholic Beverage Companies (CIABC): Criticized lack of safeguards like minimum import prices and delay in removing non-tariff barriers.

Significance of the Deal

For India:

- Increased market access in post-Brexit Britain.

- Enhanced Agri exports and support for small businesses.

- Strategic gains in terms of security and extradition cooperation.

For U.K.:

- Shows post-Brexit global engagement.

- Boosts key domestic sectors: distilleries, manufacturing, and services.

Strengthens defence and strategic partnership with a major Indo-Pacific power.

Challenges to the India–U.K. Free Trade Agreement (FTA)

- Tariff Imbalance: India offers tariff removal on 90% lines; may widen trade deficit.

- Limited liberalization in India’s key services (IT, pharma).

- Domestic Industry Concerns: Alcohol sector opposes whiskey duty cuts without safeguards.

- Sensitive agri sectors (dairy, apples) excluded, limiting rural gains.

- Implementation Gaps: Double Contributions Convention (DCC) not yet operational.

- Non-tariff barriers, regulatory delays persist.

- MSME Constraints: Lack of export preparedness, finance, and compliance capacity.

- Strategic and Political Risks

- Khalistani protests strain diplomatic ties.

- Post-Brexit U.K. trade policy remains uncertain.

- Social Security Disputes

- K. domestic opposition to long-term worker exemptions under DCC.

- Policy Coherence Issues

- India’s PLI and Atmanirbhar policies seen as protectionist.

- Custom facilitation and dispute redress mechanisms underdeveloped

Way Forward

- Swift ratification of CETA and DCC in both countries.

- Ensure fair treatment for vulnerable domestic sectors (e.g., Indian liquor companies).

- Institutionalize civil society and business-to-business dialogue.

- Monitor progress via Vision 2035 annual reviews.

Conclusion

- The India–U.K. CETA marks a strategic economic and diplomatic milestone, reflecting India’s growing global engagement and Britain’s post-Brexit outreach.

- With a comprehensive framework extending beyond trade into technology, security, and multilateral reform, the deal has the potential to be a template for future FTAs.

- However, its success hinges on timely implementation, mutual trust, and the political will to address sensitivities on both sides.

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

Introduction

Economic Implications

For Indian Exporters

- These reforms reduce transaction costs and compliance hurdles

- Encourage a more competitive and efficient export environment

- Promote value addition in key sectors like leather

For Tamil Nadu

- The reforms particularly benefit the state’s leather industry, a major contributor to employment and exports

- Boost the marketability of GI-tagged E.I. leather, enhancing rural and traditional industries

For Trade Policy

- These decisions indicate a shift from regulatory controls to policy facilitation

Reinforce the goals of Make in India, Atmanirbhar Bharat, and India’s ambition to become a leading export power

Recently, BVR Subrahmanyam, CEO of NITI Aayog, claimed that India has overtaken Japan to become the fourth-largest economy in the world, citing data from the International Monetary Fund (IMF).

India’s rank as the world’s largest economy varies by measure—nominal GDP or purchasing power parity (PPP)—each with key implications for economic analysis.