UPSC CURRENT AFFAIRS – 26th July 2025

Atal Pension Yojana Surpasses 8 Crore Enrolments

Why in News?

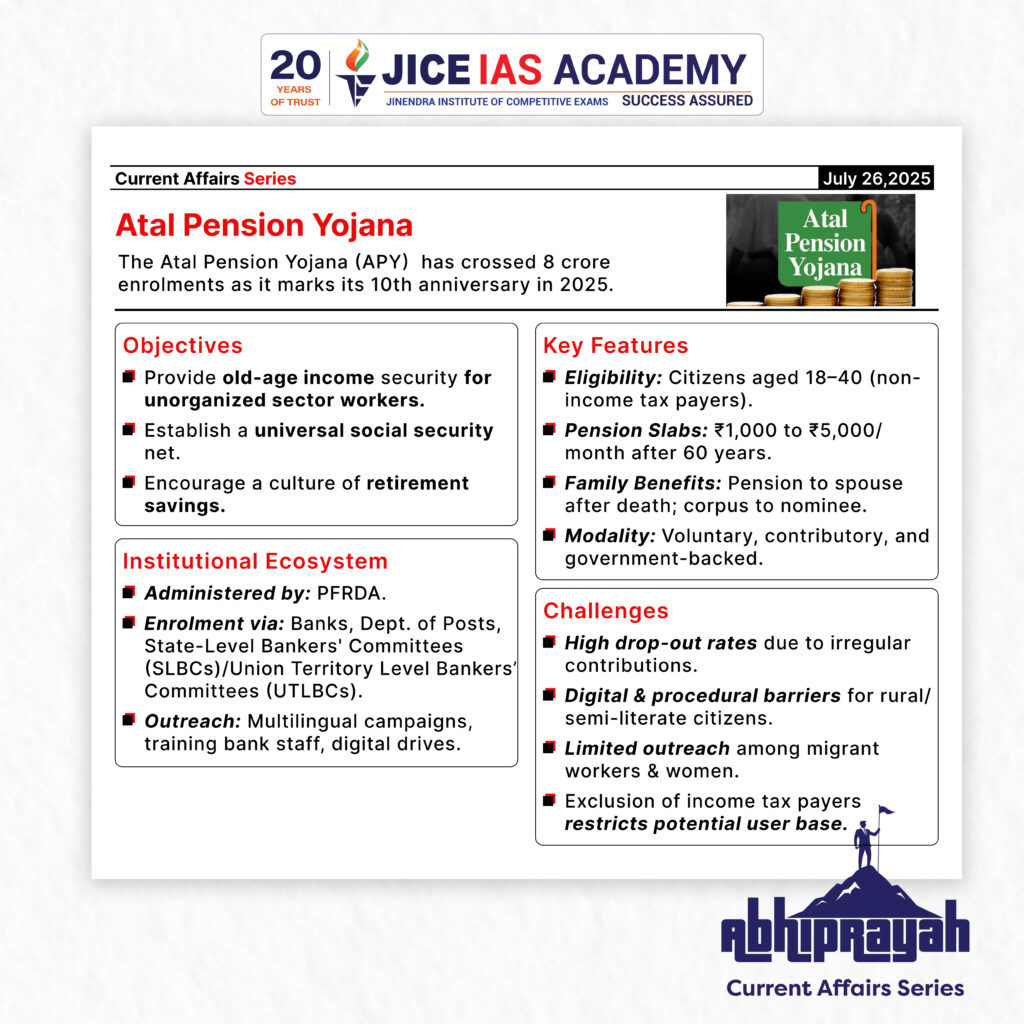

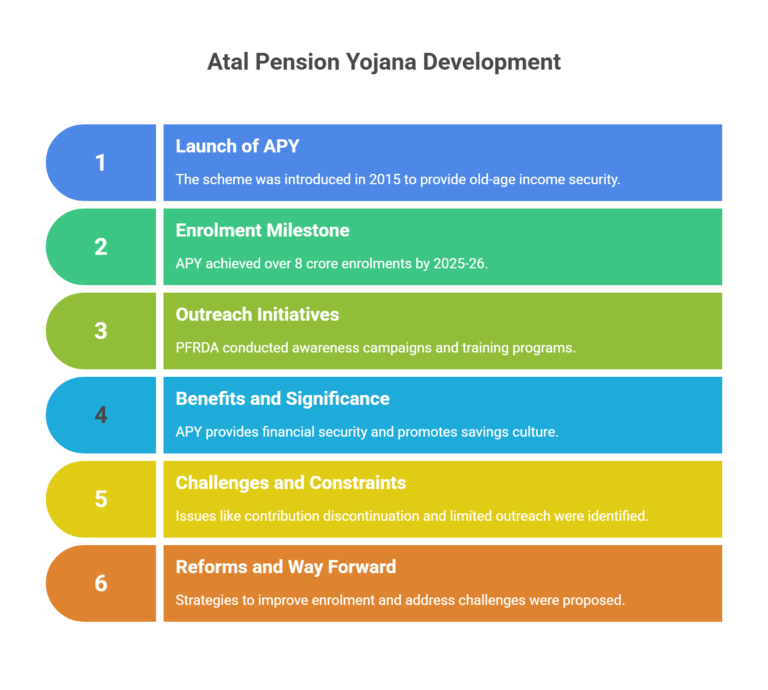

The Atal Pension Yojana (APY), launched in 2015 to provide old-age income security for unorganized sector workers, has crossed 8 crore enrolments as it marks its 10th anniversary in 2025.

Introduction

- The Atal Pension Yojana (APY), a flagship social security scheme of the Government of India, has crossed a major milestone by achieving over 8 crore gross enrolments as of the current Financial Year 2025–26, with 39 lakh new subscribers added this year alone.

- The announcement coincides with the scheme’s 10th anniversary, having been launched on May 9, 2015. Administered by the Pension Fund Regulatory and Development Authority (PFRDA), APY has evolved into one of the largest voluntary pension schemes in the world, aimed particularly at the unorganized sector.

Background and Objectives

Vision

- APY was launched with the objective of creating a universal social security system in India, particularly targeting the poor, underprivileged, and workers in the unorganized sector who lack access to formal retirement benefits.

Launch and Institutional Support

- Introduced in 2015 under the aegis of the then National Democratic Alliance (NDA) Government.

- Operated and regulated by the PFRDA.

- Enrolment facilitated by a broad network of Banks, Department of Posts (DoP), and State-Level Bankers’ Committees (SLBCs)/Union Territory Level Bankers’ Committees (UTLBCs).

Salient Features of the Atal Pension Yojana

Voluntary and Contributory

- Open to all Indian citizens aged 18 to 40 years, except those who are or have been income tax payers.

- Contributions vary depending on entry age and desired pension amount.

Guaranteed Monthly Pension

- Offers a guaranteed monthly pension of ₹1,000, ₹2,000, ₹3,000, ₹4,000, or ₹5,000 after the subscriber turns 60 years of age.

- The government guarantees the pension payout, which adds to the scheme’s credibility.

Family Benefits Structure

- Upon the death of the subscriber:

- The spouse receives the same pension for life.

- After the death of both subscriber and spouse, the accumulated corpus is returned to the nominee.

- The scheme thereby ensures a “Sampurna Suraksha Kavach” (Complete Security Shield) for the family.

Benefits and Significance

Financial Security for the Elderly

APY provides a predictable and reliable income to individuals during old age, particularly for those employed in informal sectors without access to EPF or corporate pension systems.

Inclusion of the Unorganized Sector

- A large portion of India’s workforce (over 80 percent) is employed in the unorganized sector.

- APY bridges the gap by offering an accessible and affordable pension product.

Long-Term National Impact

- Encourages a culture of savings for retirement.

- Strengthens India’s efforts towards financial inclusion and social justice.

- Complements other schemes like the Pradhan Mantri Jan Dhan Yojana and Pradhan Mantri Jeevan Jyoti Bima Yojana.

Challenges and Constraints

- Despite massive enrolment, contribution discontinuation remains a concern. Many subscribers fail to continue regular payments.

- Need for further simplification of procedures, especially for rural and semi-literate populations.

- Limited outreach in remote regions and among migrant laborers.

- Exclusion of income tax payers restricts the upper-middle segment from availing the scheme despite their possible need for old-age financial planning.

Reforms and Way Forward

- Development of a digital contribution tracking and reminder system to prevent drop-outs.

- Integration of APY awareness with other government welfare schemes to increase reach.

- Periodic review of pension amounts to match inflation and changing economic conditions.

- Continued collaboration between PFRDA, banks, post offices, and local governance bodies to drive enrolment, especially among women and younger citizens.

Conclusion

- The Atal Pension Yojana has emerged as a cornerstone of India’s social security architecture, especially for the vulnerable and underserved segments of society. Surpassing 8 crore enrolments within a decade underscores its wide acceptance and critical role in enhancing retirement security. Going forward, with appropriate policy interventions and stakeholder coordination, APY has the potential to ensure universal pension coverage and play a crucial role in achieving inclusive development goals.

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

Introduction

Economic Implications

For Indian Exporters

- These reforms reduce transaction costs and compliance hurdles

- Encourage a more competitive and efficient export environment

- Promote value addition in key sectors like leather

For Tamil Nadu

- The reforms particularly benefit the state’s leather industry, a major contributor to employment and exports

- Boost the marketability of GI-tagged E.I. leather, enhancing rural and traditional industries

For Trade Policy

- These decisions indicate a shift from regulatory controls to policy facilitation

Reinforce the goals of Make in India, Atmanirbhar Bharat, and India’s ambition to become a leading export power

Recently, BVR Subrahmanyam, CEO of NITI Aayog, claimed that India has overtaken Japan to become the fourth-largest economy in the world, citing data from the International Monetary Fund (IMF).

India’s rank as the world’s largest economy varies by measure—nominal GDP or purchasing power parity (PPP)—each with key implications for economic analysis.