UPSC CURRENT AFFAIRS – 23rd March 2025

Reclaiming the Power of the Purse — Restoring Parliament’s Role in India’s Budget Process

Why in News?

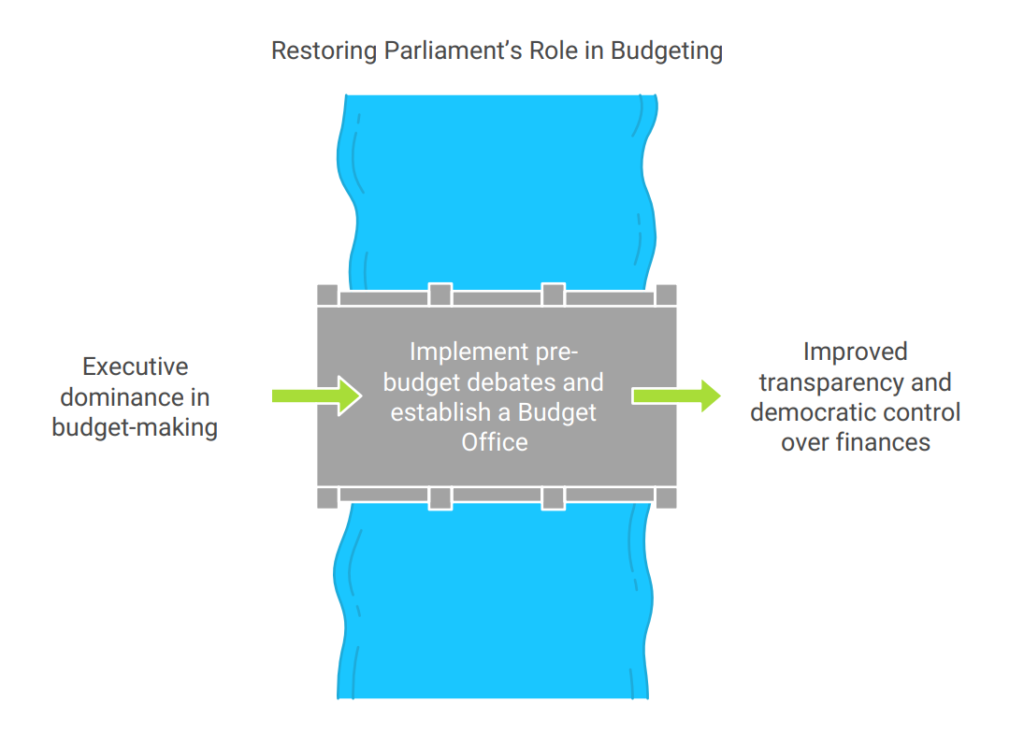

Concerns have been raised over the limited role of Parliament in India’s budget-making process, which is largely dominated by the executive. There are growing calls for institutional reforms, including pre-Budget discussions and the creation of a Parliamentary Budget Office (PBO), to enhance legislative oversight and democratic accountability.

Key Issues with India’s Budget Process

- Executive Monopoly:

- The Ministry of Finance prepares the entire Budget in secrecy.

- Even Cabinet Ministers are often unaware of allocations until presentation day.

- Ceremonial Role of Parliament:

- Budget is introduced without pre-legislative consultation.

- MPs cannot amend budgetary provisions — they can only discuss and vote.

- Rajya Sabha’s Exclusion:

- Money Bills (Article 110) are not subject to voting in the Upper House.

- Ironically, the Finance Minister may belong to the Rajya Sabha, yet cannot vote on their own Budget.

- Guillotining of Demands for Grants:

- A large number of budgetary allocations are passed without any debate.

- Average time spent on Budget debates in Parliament is just 12 hours (PRS Legislative Research, 2023).

Consequences of Legislative Marginalisation

- Weak Accountability: Erodes the foundational democratic principle of “power of the purse.”

- Poor Quality of Debate: Limited access to data and research reduces effectiveness of scrutiny.

- Reduced Transparency: Decisions about taxation and spending become opaque and top-down.

Global Best Practices

- USA:

- The Congressional Budget Office (CBO) offers non-partisan analysis of fiscal policy and legislative proposals.

- UK, Canada, Australia:

- Operate Parliamentary Budget Offices (PBOs) to empower MPs with independent economic analysis and fiscal projections.

- Open Budget Index (2021):

- India ranked 53rd out of 120 countries, lagging behind nations with institutional legislative support systems.

Constitutional Provisions in India

- Article 112: Union Budget is presented as the Annual Financial Statement.

- Article 110: Budget is classified as a Money Bill — exclusive to Lok Sabha.

- Article 75(3): The executive is collectively responsible to the Lok Sabha, implying budgetary accountability.

Proposed Reforms

- Institutionalise Pre-Budget Discussions:

- Conduct structured debates during the Monsoon Session (5–7 days).

- Facilitate broader consultation on economic priorities, fiscal trends, and public needs.

- Establish a Parliamentary Budget Office (PBO):

- Provide MPs with independent, non-partisan fiscal research.

- Analyse tax policies, public expenditure, debt sustainability, and policy impacts.

- Examples: US CBO, Canada’s PBO, and UK Office for Budget Responsibility.

- Strengthen Standing Committees:

- Allocate technical and research staff to Departmentally Related Standing Committees (DRSCs).

- Enhance scrutiny of Demands for Grants and ministry-wise expenditure.

Addressing Concerns Over Populism

- Critics fear greater legislative involvement may lead to populist fiscal policies.

- However, OECD studies show that countries with transparent and participatory budgeting enjoy:

- More equitable resource allocation.

- Better fiscal discipline.

- Higher public trust in institutions.

Conclusion

- The current budgetary framework in India dilutes legislative sovereignty, undermining the essence of representative democracy.

- Reforms such as pre-Budget deliberations and the creation of a PBO are not just procedural; they are essential to transparency, accountability, and evidence-based policymaking.

- A stronger, research-backed, and participatory Parliament will ensure that budget decisions reflect the will and welfare of the people, not just the priorities of the executive.

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.