UPSC CURRENT AFFAIRS – 04th July 2025

Seville FfD4 Conference and the Borrowers’ Forum

Why in News?

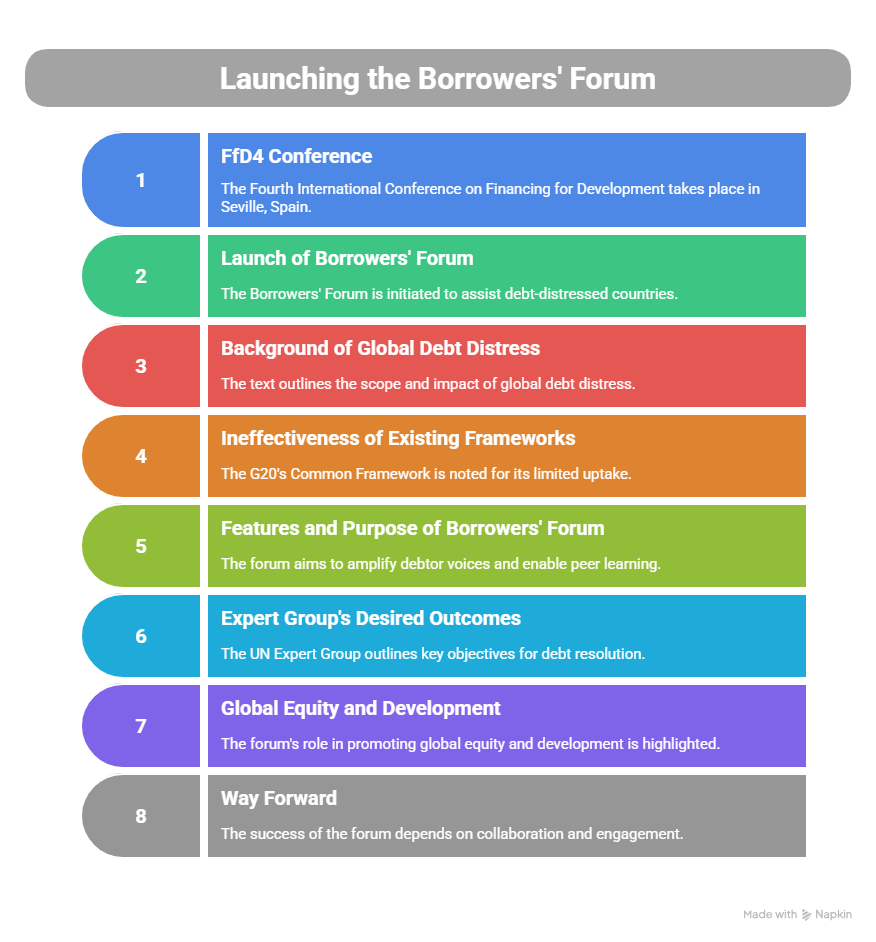

The Fourth International Conference on Financing for Development (FfD4) launched a Borrowers’ Forum.

Introduction

- The Fourth International Conference on Financing for Development (FfD4), currently underway in Seville, Spain, has marked a major initiative in global debt governance.

- A significant highlight of the conference is the launch of a Borrowers’ Forum aimed at assisting debt-distressed countries, particularly in the Global South.

- The forum is one of 11 actions recommended by the UN Secretary-General’s Expert Group on Debt, formed in December 2024.

Background: Global Debt Distress

- Debt Crisis Scope:

- As of 2024, 3.4 billion people live in countries where interest payments surpass spending on health and education.

- 21 countries allocate over 10% of GDP to interest payments, reflecting an unsustainable burden.

- 35 countries are in or at risk of debt distress, with 74% of them stuck in this status since at least 2018.

- Ineffectiveness of Existing Frameworks:

- The G20’s Common Framework for Debt Treatments, launched in 2020 to aid low-income countries post-COVID, has seen minimal uptake.

- Only four countries — Chad, Ethiopia, Ghana, and Zambia — have used it.

- This reflects the lack of trust, delays, and complexity involved in multilateral restructuring mechanisms.

Borrowers’ Forum: Features and Purpose

The Borrowers’ Forum is a new international initiative designed to:

1. Amplify the Voice of Debtor Countries

- Historically, debtor nations have had limited voice in international financial decision-making.

- The forum will re-balance global debt governance by strengthening collective advocacy.

2. Enable Peer-to-Peer Learning

- It offers a platform for knowledge sharing, including:

- Best practices in debt swaps (e.g., Egypt’s agreements with Germany and Italy).

- Negotiation strategies with creditors.

- Technical modalities of restructuring agreements.

3. Enhance Capacity Building

- The forum emphasizes:

- Technical assistance for managing debt portfolios.

- Capacity building to implement sustainable financing policies.

- This could translate into financial and developmental gains.

4. Support Coordinated Approaches

- Encourages regional cooperation and collective bargaining among debtor nations.

- Could lead to more equitable restructuring terms and greater creditor accountability.

Expert Group's Four Desired Outcomes

The UN Expert Group outlined four key objectives to resolve the debt morass and foster sustainable development:

- Lowering the Cost of New Financing

- Ensure developing countries have access to affordable credit, including concessional loans.

- Increasing Volume and Access to Long-term Financing

- Develop new instruments and partnerships to finance SDGs and climate transitions.

- Reducing the Cost of Servicing Existing Debt

- Implement measures like interest rate reductions, longer grace periods, and debt service relief.

- Reducing the Stock of Existing Debt

- Advocate for comprehensive restructuring, debt forgiveness, and debt-for-development swaps.

Why This Matters: Global Equity and Development

- Unsustainable debt in developing countries is a barrier to poverty reduction, education, health, and climate action.

- The Borrowers’ Forum can democratize global financial governance and address structural inequalities in the global financial system.

- It also aligns with broader efforts, including the UN SDGs and upcoming COP30 climate negotiations in Belem, by linking debt relief to climate resilience.

Way Forward

- The success of the Borrowers’ Forum depends on:

- Political will among debtor countries to collaborate.

- Constructive engagement by creditors, including multilateral and private lenders.

- Integration into global institutions like the G20, IMF, and UN bodies.

UN Secretary-General António Guterres expressed hope that the forum would empower borrower nations and help shape a fairer international financial architecture.

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

Economic Implications

For Indian Exporters

- These reforms reduce transaction costs and compliance hurdles

- Encourage a more competitive and efficient export environment

- Promote value addition in key sectors like leather

For Tamil Nadu

- The reforms particularly benefit the state’s leather industry, a major contributor to employment and exports

- Boost the marketability of GI-tagged E.I. leather, enhancing rural and traditional industries

For Trade Policy

- These decisions indicate a shift from regulatory controls to policy facilitation

Reinforce the goals of Make in India, Atmanirbhar Bharat, and India’s ambition to become a leading export power

Recently, BVR Subrahmanyam, CEO of NITI Aayog, claimed that India has overtaken Japan to become the fourth-largest economy in the world, citing data from the International Monetary Fund (IMF).

India’s rank as the world’s largest economy varies by measure—nominal GDP or purchasing power parity (PPP)—each with key implications for economic analysis.