UPSC CURRENT AFFAIRS – 19th May 2025

IMF Sets 11 New Conditions for Pakistan

Why in News?

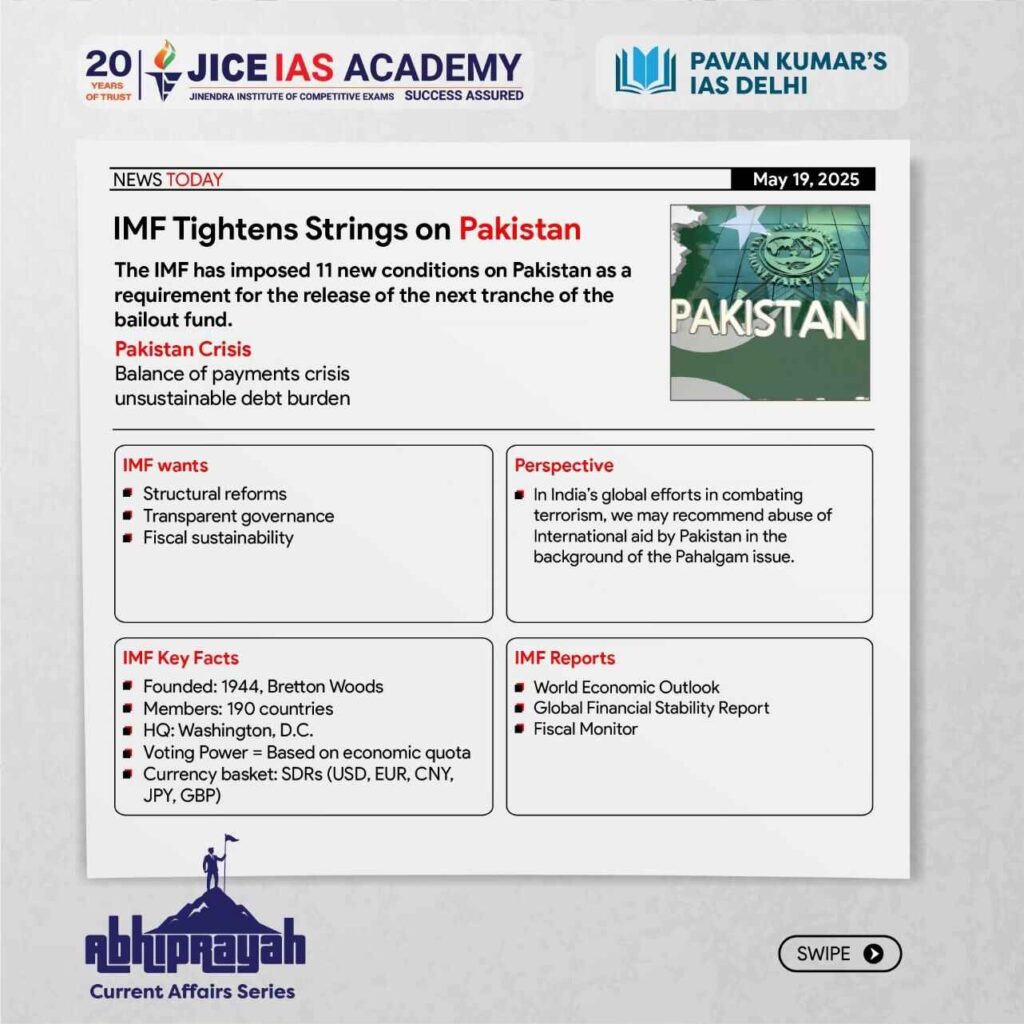

The IMF has imposed 11 new conditions on Pakistan, raising the total to 50, linking further bailout disbursal to fiscal reforms, energy tariff hikes, and governance improvements amidst rising India-Pakistan tensions.

Background

- Pakistan is currently under an IMF bailout programme due to its severe balance of payments crisis, low foreign exchange reserves, and unsustainable debt burden.

- The IMF provides financial support in tranches, but in return, it imposes strict conditions to ensure reforms that stabilize the economy and ensure debt repayment capacity.

- Recently, the IMF has imposed 11 new conditions, increasing the total to 50 conditions, as a requirement for the release of the next tranche of the bailout fund.

IMF – Key Facts

- The International Monetary Fund (IMF) was established in 1944 at the Bretton Woods Conference to promote global monetary cooperation and financial stability.

- The IMF is headquartered in Washington, D.C., USA, and currently has 190 member countries (as of 2024), including India.

- India is a founding member of the IMF, having joined it in 1945.

- IMF provides short- to medium-term financial assistance to countries facing balance of payments crises, with conditional policy reform measures.

- IMF voting power is quota-based, and a country’s quota is determined using a formula that includes GDP, openness, economic variability, and foreign exchange reserves.

- Quotas determine three things: a country’s voting power, access to IMF resources, and allocation of Special Drawing Rights (SDRs).

- Special Drawing Rights (SDRs) are the IMF’s international reserve asset and unit of account, valued based on a basket of five major currencies (USD, EUR, CNY, JPY, GBP).

- India holds about 2.75% of total IMF voting power, ranking among the top 10 countries.

- The IMF conducts regular economic surveillance and publishes reports like the World Economic Outlook (WEO) and Global Financial Stability Report (GFSR).

- In India, the Department of Economic Affairs (Ministry of Finance) handles IMF relations.

- IMF reforms and quota realignment are ongoing demands from emerging economies like India to reflect current global economic realities.

- Unlike the World Bank, the IMF does not fund infrastructure projects; it focuses on macroeconomic stability and liquidity support.

Key IMF Conditions Imposed on Pakistan

Here is a breakdown of the 11 new IMF conditions:

- Parliamentary Approval of Budget (FY 2026)

- Pakistan must pass a ₹17.6 trillion federal budget in parliament.

- This includes ₹1.07 trillion for development spending.

- The budget must align with IMF programme targets by the end of June 2025.

- Increase in Electricity Surcharge

- The government must remove the cap of ₹3.21 per unit on the debt servicing surcharge on electricity bills.

- This means consumers may face higher electricity bills to compensate for inefficiencies in the power sector.

- The legislation for this must be passed by the end of June 2025.

- Import Policy Change – Used Cars

- The IMF wants Pakistan to lift the restriction on the import of used cars that are more than three years old.

- The government must allow commercial import of used vehicles up to five years old.

- All relevant legislation must be submitted to Parliament by the end of July 2025.

- Agriculture Income Tax by Provinces

- The four provinces must implement new Agriculture Income Tax laws through:

- An operational platform for processing returns

- Taxpayer identification and registration systems

- Public awareness campaign

- Compliance improvement measures

- Deadline: June 2025.

- Governance Action Plan

- The government must publish a governance reform plan based on the IMF’s Governance Diagnostic Assessment.

- The objective is to address weaknesses in public financial management and accountability.

- Financial Sector Strategy Post-2027

- A new plan must be developed and published outlining the financial sector framework from 2028 onward, including:

- Regulatory environment

- Institutional arrangements

- Long-term reform goals

- Electricity Tariff Rebasing

- Government must issue notifications for annual rebasing of electricity tariffs by July 1, 2025.

- This ensures that energy prices reflect actual costs, discouraging losses in the sector.

- Gas Tariff Adjustment

- A semi-annual gas tariff adjustment must be implemented by February 15, 2026 to align tariffs with cost recovery.

- Captive Power Levy Legislation

- Parliament must pass legislation to make the captive power levy (currently imposed through ordinance) permanent by the end of May 2025.

- This measure pushes industries to shift from private generation to the national electricity grid.

- Removal of Industrial Zone Incentives

- The IMF has required Pakistan to phase out all tax and policy incentives for Special Technology Zones and Industrial Parks by 2035.

- A detailed plan for this must be prepared by the end of 2025.

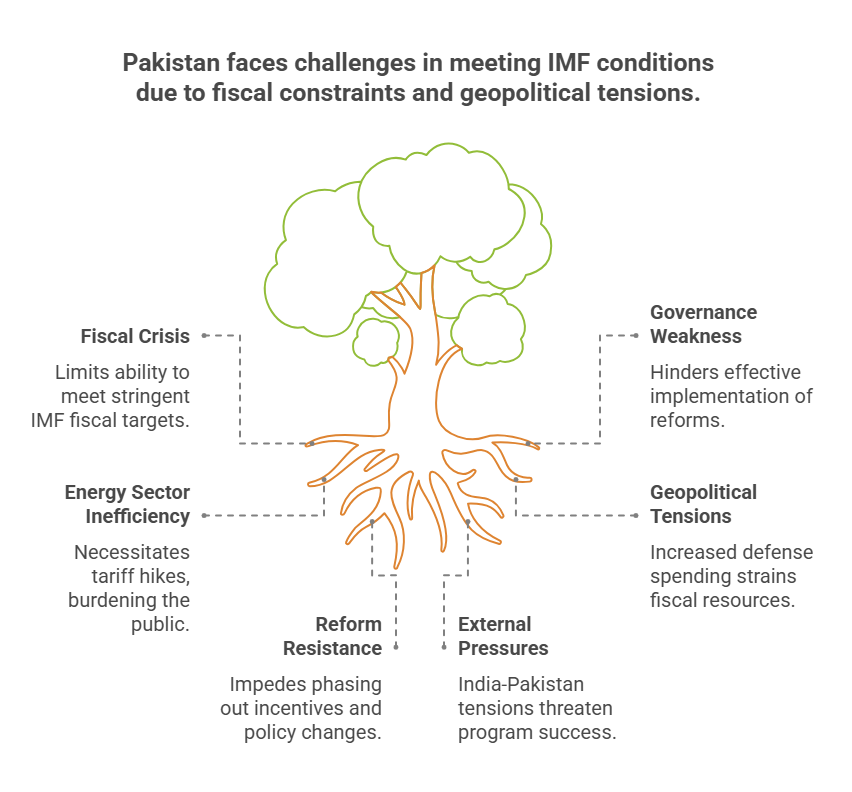

- External Risk Warning – India-Pakistan Tensions

- The IMF report notes that rising tensions with India, especially following Operation Sindoor and missile exchanges, threaten the success of the IMF programme.

- Tensions could derail fiscal targets, external stability, and reform implementation.

Defence Spending Context

- The IMF report lists Pakistan’s defence budget for the next fiscal year as ₹2.414 trillion (12% higher than previous year).

- However, government estimates show it could exceed ₹2.5 trillion (an 18% increase), especially after recent hostilities with India.

Conclusion

- The IMF is pushing Pakistan for deep structural reforms, better governance, transparency, and fiscal discipline.

- However, the rising geopolitical tensions with India and the increased defence spending pose risks to the successful implementation of these reforms.

- The conditions also place heavy socio-economic burdens on the Pakistani public, especially in the energy and taxation sectors.

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

- Decreased oxygen-carrying capacity of RBCs.

- Increased fragility and cell stiffness.

- Vascular blockage, causing pain and organ injury.

- Increased susceptibility to infections, anemia, and stroke.

В этой статье собраны факты, которые освещают целый ряд важных вопросов. Мы стремимся предложить читателям четкую, достоверную информацию, которая поможет сформировать собственное мнение и лучше понять сложные аспекты рассматриваемой темы.

Выяснить больше – https://vivod-iz-zapoya-1.ru/