UPSC CURRENT AFFAIRS – 31th May 2025

India’s Economic Growth in FY25

Why in News?

The Ministry of Statistics and Programme Implementation (MoSPI) has released two critical datasets: the Provisional Estimates (PEs) of national income for FY25 and the GDP growth estimate for Q4 (January–March 2025). These figures provide vital insights into India’s economic performance and the sectoral dynamics shaping the broader growth narrative.

Understanding National Income Estimation: GDP vs GVA

India’s economic growth is measured using two complementary approaches:

- Gross Domestic Product (GDP) reflects the demand side of the economy by summing all expenditures—by individuals, businesses, and the government.

- Gross Value Added (GVA) represents the supply side, capturing the value created by all sectors by subtracting intermediate consumption from gross output.

These two are related by the formula:

GDP = GVA + (Taxes – Subsidies)

MoSPI releases data in nominal terms (current prices) and real terms (inflation-adjusted). While nominal GDP is useful for assessing the economy’s size, real GDP offers a better measure of true growth by excluding inflationary effects.

Why Are the Estimates Called “Provisional”?

GDP estimates undergo multiple revisions:

- First Advance Estimates (FAEs) – January

- Second Advance Estimates (SAEs) – February

- Provisional Estimates (PEs) – May-end

- First Revised Estimates – Next year

- Final Estimates – Two years later

The PEs are based on more comprehensive data, including the Q4 performance, but remain subject to revision.

Key Highlights from FY25 Economic Data

1. Size and Growth of Nominal GDP

- Nominal GDP rose to ₹330.7 lakh crore in FY25, reflecting a 9.8% growth over FY24.

- In US dollar terms (using ₹85.559/USD), India’s economy stood at $3.87 trillion.

- This marks the third-slowest nominal growth since 2014 and the sixth-slowest since liberalization in 1991.

- The CAGR since 2014-15 is 10.3%, and 9.8% since 2019—indicating a slowdown in nominal growth momentum.

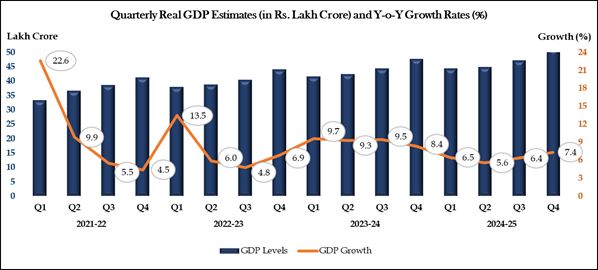

2. Real GDP Growth and Economic Momentum

- Real GDP grew by 6.5% in FY25, reaching ₹188 lakh crore.

- This is a marked decline from 9.2% growth in FY24, indicating a loss in growth momentum.

- The CAGR of real GDP since 2019 is just above 5%, down from over 6% since 2014.

- The widening gap between real and nominal GDP underscores inflation’s role in GDP expansion.

Implication: The deceleration reflects structural issues and not just cyclical fluctuations. Sustained policy efforts are needed to revive real growth.

3. Sectoral Analysis: Real GVA Insights

GVA growth in FY25 stood at 6.4%, down from 8.6% in FY24. Sector-wise breakdown:

Sector | CAGR (2019–2025) | Observation |

Agriculture & Allied | 4.72% | Stronger than expected growth |

Manufacturing | 4.04% | Weakest among sectors |

Services | Below 6% | Slowing, yet dominant contributor |

GVA, by excluding taxes and subsidies, provides a cleaner picture of sectoral health.

4. Manufacturing Sector: A Cause for Concern

- Manufacturing GVA growth lags behind even agriculture, despite the push for Make in India since 2016.

- Weak manufacturing growth explains:

- Persistent urban youth unemployment

- Labour migration back to rural areas

- Increased dependence on agriculture for livelihoods

Global Context: Manufacturing has emerged as a strategic sector worldwide, with advanced economies like the US and China safeguarding it through trade interventions. India’s underperformance in this domain weakens its global competitiveness.

Conclusion: Recalibrating India’s Growth Strategy

The provisional national income data for FY25 highlights a mixed picture:

- Macroeconomic stability has been maintained.

- But growth momentum, especially in manufacturing, remains a concern.

The slowdown in real GDP growth and the lag in GVA from core sectors signal the need for structural reforms and investment incentives, particularly in industry.

Way Forward

- Revitalize manufacturing through targeted incentives, infrastructure, and skilling programs.

- Improve rural employment opportunities to reduce disguised unemployment in agriculture.

- Enhance data reliability and timeliness to improve economic policymaking.

As India targets becoming a $5 trillion economy, ensuring balanced, inclusive, and sustainable growth across all sectors remains paramount.

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

For Indian Exporters

- These reforms reduce transaction costs and compliance hurdles

- Encourage a more competitive and efficient export environment

- Promote value addition in key sectors like leather

For Tamil Nadu

- The reforms particularly benefit the state’s leather industry, a major contributor to employment and exports

- Boost the marketability of GI-tagged E.I. leather, enhancing rural and traditional industries

For Trade Policy

- These decisions indicate a shift from regulatory controls to policy facilitation

Reinforce the goals of Make in India, Atmanirbhar Bharat, and India’s ambition to become a leading export power

Recently, BVR Subrahmanyam, CEO of NITI Aayog, claimed that India has overtaken Japan to become the fourth-largest economy in the world, citing data from the International Monetary Fund (IMF).

India’s rank as the world’s largest economy varies by measure—nominal GDP or purchasing power parity (PPP)—each with key implications for economic analysis.