UPSC CURRENT AFFAIRS – 11th July 2025

India’s Role in FATF’s latest report on terrorist financing risks

Why in News?

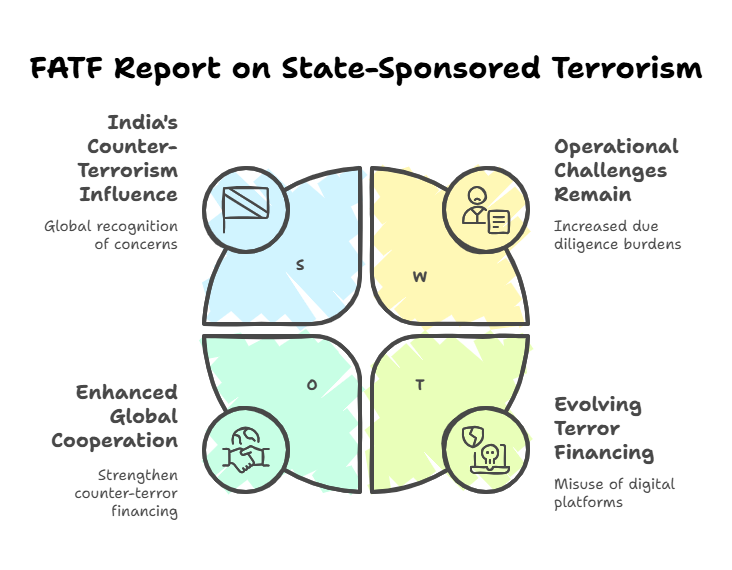

India played a key role in the FATF’s July 2025 report which, for the first time, officially recognised state sponsorship as a method of terrorist financing, aligning with India’s longstanding concerns about Pakistan.

Introduction

- The Financial Action Task Force (FATF) released its landmark report titled “Comprehensive Update on Terrorist Financing Risks”, which, for the first time, officially recognised state sponsorship as a significant method of funding terrorism. India played a key role in this global initiative.

India’s Contribution to the FATF Report:

- India was one of the key contributors to the FATF project.

- The initiative was co-led by the United Nations Security Council Counter-Terrorism Committee Executive Directorate (UNCTED) and France.

- India’s involvement helped bring attention to the long-standing issue of state-sponsored terrorism, especially emanating from Pakistan.

Key Highlights of the FATF Report:

- State Sponsorship Recognised:

- For the first time, FATF has acknowledged that states themselves can finance terrorism.

- While not developing a specific typology, FATF clearly noted that state financing of terrorism violates FATF Standards, the International Convention for the Suppression of the Financing of Terrorism, and UNSC Resolution 1373 (2001).

- Undermines International Peace and Security:

- The report recognised state-sponsored terrorism as a long-standing threat to international peace, regional stability, and financial systems.

- Impact on Financial Institutions:

- Countries are expected to incorporate this finding into their National Risk Assessments (NRAs).

- For example, the United States’ 2024 NRA had already flagged threats from Pakistan-based terrorist outfits.

- Operational Challenges:

- The cost of doing business with Pakistan is expected to rise due to increased due diligence and compliance burdens for financial institutions globally.

India’s National Risk Assessment (2022):

- India’s 2022 NRA on Money Laundering and Terror Financing flagged state-sponsored terrorism, specifically from Pakistan, as a major national security concern.

- Based on this, Indian financial institutions, including banks, have been instructed to apply enhanced due diligence on any transaction involving Pakistan.

Modus Operandi of State-Sponsored Terrorism (as per the FATF report):

- Oil Smuggling:

- Illicit oil trade from Iran to Pakistan is cited as a potential source of terror financing.

- Sham Non-Profit Organisations (NPOs):

- Pakistan-based terror outfits like Jaish-e-Mohammed (JeM) and Lashkar-e-Taiba (LeT) are exploiting fake NPOs to:

- Raise funds

- Store and move illicit money

- Disguise operations under the garb of charitable activities

- These groups have also misused humanitarian assistance programmes.

- Pakistan-based terror outfits like Jaish-e-Mohammed (JeM) and Lashkar-e-Taiba (LeT) are exploiting fake NPOs to:

- Digital Platforms:

- The report highlights the emerging misuse of online gaming platforms for:

- Propaganda

- Radicalisation

- Recruitment

- The report highlights the emerging misuse of online gaming platforms for:

- Fundraising for terror-related activities

Significance of the Report:

- Strengthens India’s long-standing diplomatic and security position against Pakistan’s state-sponsored terrorism.

- Reinforces the global framework for counter-terror financing through FATF standards and international cooperation.

- Encourages member states to improve their regulatory and enforcement measures, especially in monitoring:

- NPOs

- Digital transactions

- Cross-border financial flows

Way Forward:

- Stricter enforcement of FATF recommendations at national and international levels.

- Enhance global cooperation for intelligence sharing and tracking state-linked terror networks.

- Monitor new avenues of terror financing, especially in the digital economy.

- Countries must update their NRAs and banking risk frameworks to reflect the risks associated with state-sponsored actors.

Conclusion:

- India’s leadership and inputs in the FATF’s recent report signify its growing influence in global counter-terrorism efforts.

- By formally recognising state-sponsored terrorism as a systemic threat, the FATF has set a new global precedent that aligns with India’s long-standing concerns and provides a stronger legal and diplomatic framework for international action against countries that aid and abet terrorism.

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

Economic Implications

For Indian Exporters

- These reforms reduce transaction costs and compliance hurdles

- Encourage a more competitive and efficient export environment

- Promote value addition in key sectors like leather

For Tamil Nadu

- The reforms particularly benefit the state’s leather industry, a major contributor to employment and exports

- Boost the marketability of GI-tagged E.I. leather, enhancing rural and traditional industries

For Trade Policy

- These decisions indicate a shift from regulatory controls to policy facilitation

Reinforce the goals of Make in India, Atmanirbhar Bharat, and India’s ambition to become a leading export power

Recently, BVR Subrahmanyam, CEO of NITI Aayog, claimed that India has overtaken Japan to become the fourth-largest economy in the world, citing data from the International Monetary Fund (IMF).

India’s rank as the world’s largest economy varies by measure—nominal GDP or purchasing power parity (PPP)—each with key implications for economic analysis.