UPSC CURRENT AFFAIRS – 12th July 2025

India’s Revised Proposal for Retaliatory Tariffs Against the U.S. Under WTO Norms

Why in News?

- India has revised its WTO notification to impose higher retaliatory tariffs on U.S. goods following the U.S.’s hike in duties on steel and aluminium imports to 50%.

Background

- India has submitted a revised notification to the World Trade Organisation (WTO) regarding the imposition of retaliatory tariffs against the United States.

- This revision follows the U.S. decision to further increase tariffs on steel and aluminium imports from 25 percent to 50 percent. The proposal assumes importance as both countries are in the process of negotiating a Bilateral Trade Agreement (BTA), and India’s move aims to assert its rights under international trade rules while protecting domestic interests.

Background of U.S. Tariffs and India’s Initial Response

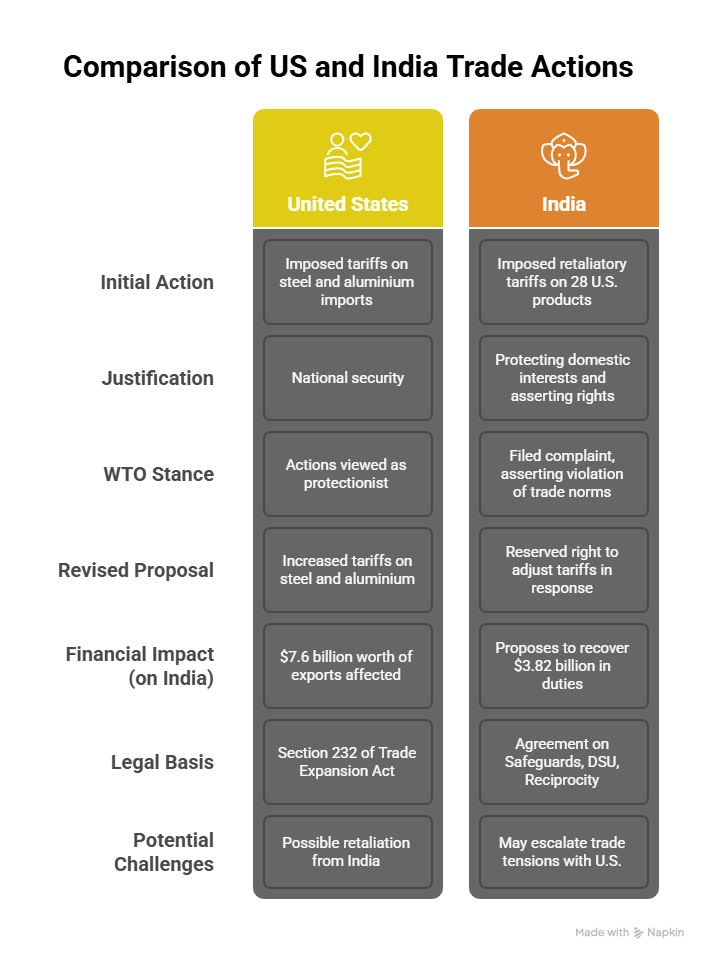

In March 2018, the United States invoked Section 232 of the Trade Expansion Act of 1962 to impose:

- A 25 percent tariff on steel imports

- A 10 percent tariff on aluminium imports

The justification offered was “national security,” which several trading partners, including India, viewed as unjustified and protectionist. These measures were later extended to include derivative products, and the tariffs were further raised in June 2025 to 50 percent on certain items.

In response, India had imposed retaliatory tariffs in June 2019 on 28 U.S. products, including almonds, walnuts, and apples. India also filed a formal complaint at the WTO, asserting that the U.S. measures violated trade norms under GATT 1994 and the WTO Agreement on Safeguards.

Details of India’s Revised Proposal (2025)

WTO Notification

India, through a communication circulated among WTO members, has stated that it reserves the right to adjust the list of products and tariff rates in response to the increase in U.S. tariffs from 25 percent to 50 percent. This step is being taken without prejudice to the earlier notification India submitted on May 12.

The revised proposal is based on the provisions of:

- Article 8 of the WTO Agreement on Safeguards, which permits suspension of concessions in case of unjustified safeguard measures

- Article 22 of the Dispute Settlement Understanding (DSU), which allows a WTO member to retaliate if the offending country fails to comply with dispute settlement recommendations

Key Financial Aspects

According to India’s communication to WTO :

- The safeguard measures by the United States impact approximately $7.6 billion worth of Indian exports

- India proposes to impose retaliatory tariffs that would recover approximately $3.82 billion in duties

- This is an increase from the earlier May 12 notification, where India had proposed to collect $1.91 billion

India’s move reflects its intent to maintain trade balance and assert legal rights under WTO rules.

Legal Justifications Under WTO Rules

India’s proposal relies on internationally accepted trade dispute mechanisms:

- Agreement on Safeguards

- Permits a country to retaliate or seek compensation if another member imposes safeguard measures that are not in accordance with WTO obligations.

- Dispute Settlement Understanding (DSU)

- Allows affected members to suspend concessions if the offending member does not bring its measures into conformity with WTO rules.

- Principle of Reciprocity and Retaliation

- Ensures that no country gains unfair advantage by breaching WTO norms, and that affected members can seek compensation or retaliatory relief.

Significance of the Proposal

Strengthening India’s Trade Negotiation Position

- India’s formal communication to the WTO strengthens its position in ongoing bilateral trade negotiations with the U.S. It sends a message that while India is open to dialogue, it will not hesitate to defend its economic interests if required.

Reinforcing Multilateral Trade Mechanisms

- By using WTO frameworks, India is also reinforcing the importance of rules-based multilateralism, which is critical in the face of rising unilateral protectionist measures by major economies.

Protecting Domestic Industries

- Steel and aluminium producers in India have been affected by the U.S. tariff hikes. By proposing equivalent tariffs, India seeks to ensure a level playing field and prevent further injury to its domestic industries.

Potential Implications

Positive Outcomes:

- Helps safeguard India’s export interests and domestic industries.

- Demonstrates India’s commitment to using international legal frameworks.

- Enhances India’s credibility in future trade disputes.

Possible Challenges:

- May escalate trade tensions with the United States.

- Could impact the progress of the proposed Bilateral Trade Agreement.

- U.S. may retaliate using non-tariff measures, including stricter regulations or restrictions on other Indian exports.

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

Economic Implications

For Indian Exporters

- These reforms reduce transaction costs and compliance hurdles

- Encourage a more competitive and efficient export environment

- Promote value addition in key sectors like leather

For Tamil Nadu

- The reforms particularly benefit the state’s leather industry, a major contributor to employment and exports

- Boost the marketability of GI-tagged E.I. leather, enhancing rural and traditional industries

For Trade Policy

- These decisions indicate a shift from regulatory controls to policy facilitation

Reinforce the goals of Make in India, Atmanirbhar Bharat, and India’s ambition to become a leading export power

Recently, BVR Subrahmanyam, CEO of NITI Aayog, claimed that India has overtaken Japan to become the fourth-largest economy in the world, citing data from the International Monetary Fund (IMF).

India’s rank as the world’s largest economy varies by measure—nominal GDP or purchasing power parity (PPP)—each with key implications for economic analysis.