UPSC CURRENT AFFAIRS – 12th June 2025

NSE Gets SEBI Nod for Launching Monthly Electricity Futures

Why in News?

SEBI has approved NSE to launch monthly electricity futures contracts, aiming to enhance risk hedging and efficiency in India’s power markets.

Introduction

- The National Stock Exchange (NSE) has received regulatory approval from the Securities and Exchange Board of India (SEBI) to introduce monthly electricity futures contracts — a major development in India’s efforts to deepen its energy markets through financial instruments.

- This move is expected to enhance the hedging ecosystem, foster market efficiency, and promote long-term investment in the country’s power sector.

Background

- Electricity is a vital commodity but lacks the kind of sophisticated financial hedging instruments available for other sectors.

- Unlike other energy markets (such as oil or natural gas), electricity is difficult to store and has traditionally relied on physical spot markets or long-term Power Purchase Agreements (PPAs).

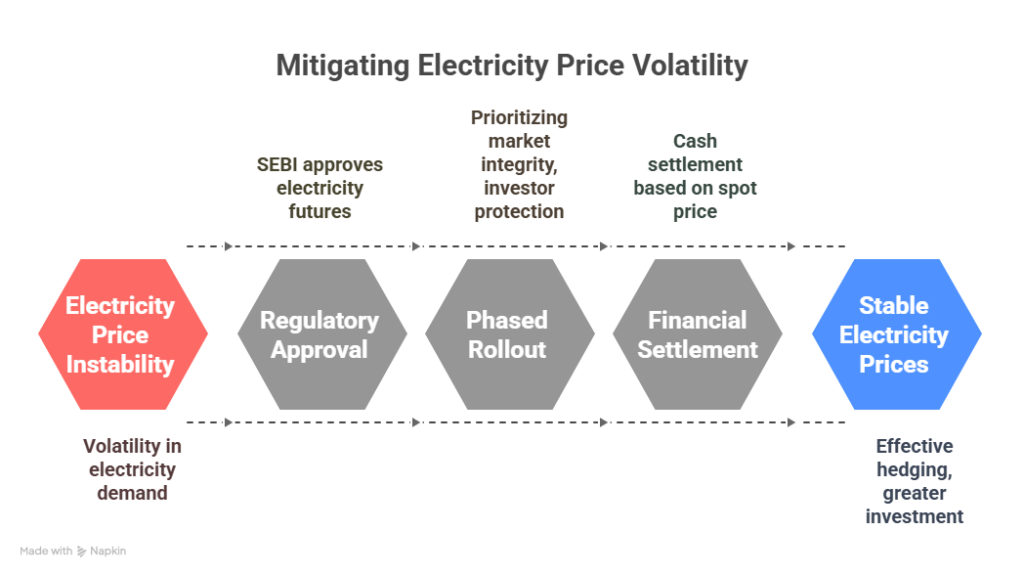

- Volatility in demand and supply due to seasonal changes, industrial usage, and renewable energy fluctuations has often led to price instability, making the need for financial derivatives in the electricity sector more pressing.

Objectives of the Electricity Futures Launch

- Price Volatility Management: The primary aim is to provide market participants — including power producers, DISCOMs, industrial consumers, and traders — with effective hedging tools to manage risks from fluctuating electricity prices.

- Improved Price Discovery: Futures contracts will complement the day-ahead spot market by offering forward-looking price signals. This dual-market structure can improve transparency and efficiency in electricity pricing.

- Encouraging Investments: With improved market visibility and risk management options, financial derivatives are expected to unlock greater capital investment across the electricity value chain — including generation, transmission, distribution, and retail supply.

- Market Development: NSE aims to gradually expand the electricity derivatives ecosystem to include contracts for difference (CFDs) and long-duration contracts such as quarterly and annual futures, subject to further regulatory approvals.

Implementation Strategy

- Calibrated & Phased Rollout: NSE has indicated that the product launch will follow a phased approach, prioritizing market integrity, investor protection, and gradual market familiarization.

- Financial Settlement: The proposed futures contracts will be financially settled, i.e., there will be no actual delivery of electricity, only cash settlement based on the reference price from the spot market.

- Spot and Futures Market Linkage: A virtuous cycle between spot and futures markets is envisioned. A robust spot market (like the Day-Ahead Market operated by Indian Energy Exchange or PXIL) ensures accurate reference prices, while an active futures market offers participants a tool to lock in future prices and reduce risk exposure.

Significance

- Strengthening the Power Market Ecosystem: This move will help create a comprehensive electricity market structure, bringing India closer to global best practices.

- Private Sector Participation: With more predictable price environments, it could increase the participation of private sector investors in power infrastructure projects, especially in the renewable sector, where intermittency challenges are high.

- Complementing Power Reforms: The initiative aligns with broader reforms in the power sector, including open access, privatization of distribution, and real-time electricity markets.

Historical Context

- NSE was the first stock exchange in India to establish an electricity exchange, having launched the Power Exchange India Limited (PXIL) in 2008 in collaboration with the National Commodity and Derivatives Exchange (NCDEX).

- Recently, the Multi Commodity Exchange (MCX) also received SEBI’s approval to launch electricity derivatives, indicating a growing regulatory and institutional push to build a mature electricity market in India.

Way Forward

- Regulatory Oversight: Continuous coordination with SEBI, CERC, and POSOCO will be essential to ensure regulatory harmony between physical and financial electricity markets.

- Market Education and Awareness: Investor education, training for utilities and market participants, and transparent contract design will be crucial.

- Technological Infrastructure: Efficient trading platforms and reliable data systems will be required to support trading volumes and price discovery.

Conclusion

- The launch of electricity futures contracts by NSE marks a transformative step in India’s power market evolution.

- It not only provides risk management solutions but also strengthens India’s commitment to creating efficient, transparent, and investment-friendly energy markets.

- As electricity becomes more central to India’s growth and decarbonization goals, financial innovation like this will play a key role in enabling a resilient and future-ready power system.

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

Economic Implications

For Indian Exporters

- These reforms reduce transaction costs and compliance hurdles

- Encourage a more competitive and efficient export environment

- Promote value addition in key sectors like leather

For Tamil Nadu

- The reforms particularly benefit the state’s leather industry, a major contributor to employment and exports

- Boost the marketability of GI-tagged E.I. leather, enhancing rural and traditional industries

For Trade Policy

- These decisions indicate a shift from regulatory controls to policy facilitation

Reinforce the goals of Make in India, Atmanirbhar Bharat, and India’s ambition to become a leading export power

Recently, BVR Subrahmanyam, CEO of NITI Aayog, claimed that India has overtaken Japan to become the fourth-largest economy in the world, citing data from the International Monetary Fund (IMF).

India’s rank as the world’s largest economy varies by measure—nominal GDP or purchasing power parity (PPP)—each with key implications for economic analysis.