UPSC CURRENT AFFAIRS – 05th July 2025

‘One Big Beautiful Bill’ (OBBB): A Landmark U.S. Legislation with Global Implications

Why in News?

- The U.S. passed the ‘One Big Beautiful Bill’ on July 4, 2025, introducing tax cuts, tightening welfare access, ending clean energy incentives, and imposing a 1% tax on remittances, including those to India.

Introduction

- On July 4, 2025, coinciding with U.S. Independence Day, President Donald Trump signed into law the ‘One Big Beautiful Bill’ (OBBB), following its passage in the U.S. House of Representatives.

- Touted by Republicans as a blueprint for fiscal discipline and economic revival, the legislation introduces sweeping tax reforms, changes to social welfare eligibility, cuts to clean energy incentives, and a 1% tax on foreign remittances, including those to India.

- The bill has triggered intense debate in the U.S. for its likely socio-economic impacts and is also of relevance to countries like India, given the high volume of U.S.-India remittance flows.

Tax Cuts and Deductions

- Extension of 2017 Trump-era tax cuts across all income brackets.

- Top marginal income tax rate reduced from 39.6% to 37%.

- Benefits largely accrue to higher-income groups, but middle- and lower-income groups receive some relief via standard deduction enhancements:

- $1,000 for individual taxpayers

- $1,500 for heads of households

- $2,000 for married couples

- Exemptions for certain incomes (until 2028):

- Up to $25,000 in tip income and $12,500 in overtime pay excluded from taxation for individuals earning less than $150,000.

Criticism: Analysts argue the bill favours the wealthiest quartile, while budget estimates indicate it could add $3.4 trillion to federal deficits by 2034. According to Yale School of Management, the lowest income quartile could see income reductions of 2.5%, while the wealthiest enjoy a 2.4% gain.

Social Security and Healthcare Changes

- Stricter eligibility for Medicaid (government health insurance for low-income individuals):

- Mandatory 80-hour work requirement

- Biannual re-enrolment, replacing annual verification

According to the Congressional Budget Office (CBO), these changes could leave 11.8 million people uninsured by 2034.

- Impact on vulnerable groups:

- Those unable to meet work requirements due to caregiving, illness, disability, or education may lose access.

- KFF (a U.S. health policy group) found that 64% of adults under 65 on Medicaid were already employed either full-time or part-time.

- Supplemental Nutrition Assistance Program (SNAP):

- Federal support is now tied to error rates in benefit distribution.

- States with error rates above 6% may be required to bear 5–15% of programme costs.

- Errors often arise from administrative lapses, raising concerns of unfair penalties on states.

Clean Energy Incentive Rollbacks

- Curtailment of clean energy tax credits:

- Biden-era 30% tax credit for solar and wind projects now limited to those operational before 2028.

- Electric vehicle (EV) subsidies of up to $7,500 per vehicle scrapped.

Industry concerns:

- Clean energy leaders warn this will halt new projects, shut down manufacturing units, and trigger layoffs, especially in rural and industrial regions.

- SEIA (Solar Energy Industries Association) labelled it a setback to U.S. energy leadership, potentially benefitting competitors like China.

White House’s defence: Claimed the bill would unleash traditional energy, refill petroleum reserves, and eliminate what it called the “Green New Scam.”

Debt Ceiling Expansion

- Increase in debt ceiling by $5 trillion, taking the U.S. borrowing limit to $41.1 trillion.

Criticism:

- Tesla CEO Elon Musk strongly opposed the bill, warning of a future debt crisis and threatened to form a new political party – the “America Party”.

President Trump accused Musk’s opposition of being rooted in the termination of EV subsidies, suggesting it would threaten Musk’s businesses.

Excise Tax on Foreign Remittances

- 1% excise tax on all outward remittances from the U.S., affecting countries like India, which received 27.7% of its global remittances from the U.S. in 2023–24.

Previous drafts:

- The bill originally proposed a 5% remittance tax, later reduced to 3.5%, and finally fixed at 1% in the final version.

Indian concerns:

- Indian diaspora in the U.S. primarily comprises white-collar professionals, contributing large remittance volumes.

- Ajay Srivastava of the Global Trade Research Initiative (GTRI) called the tax “morally questionable” as Indian-origin individuals already pay U.S. taxes.

- While 1% may not drastically deter remittances, the frequent revision in rates adds policy unpredictability.

Implications for India

1. Impact on Remittances

- The new tax could reduce net inflow of remittances to India, especially from the U.S., the second-largest remittance corridor after the UAE.

- This could affect foreign exchange reserves and household incomes in India that rely on U.S.-based relatives.

2. Lessons for India’s Fiscal Planning

- The U.S. debate highlights the dilemma between tax relief and fiscal sustainability, offering a cautionary tale for emerging economies like India as it balances:

- Welfare expenditures

- Fiscal deficits

- Investment in green growth

3. Global Climate Commitments

- Rollback of clean energy incentives by the U.S., a major emitter, could weaken global climate finance, affecting momentum on Just Energy Transitions in countries like India.

- Raises concerns ahead of international climate negotiations (e.g., COP events), where India advocates for developed nations to meet financial commitments.

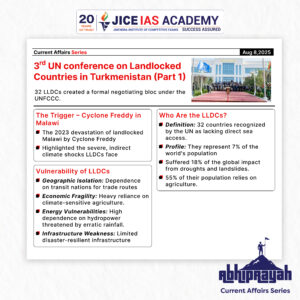

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

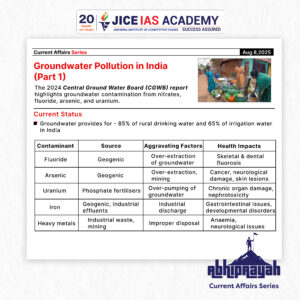

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

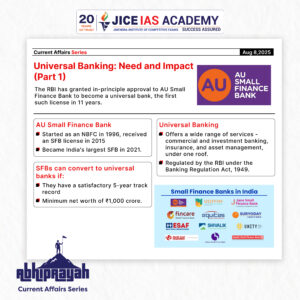

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

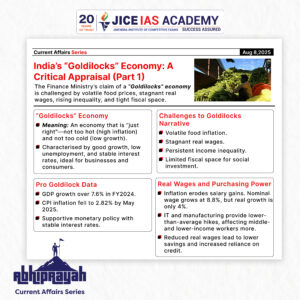

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

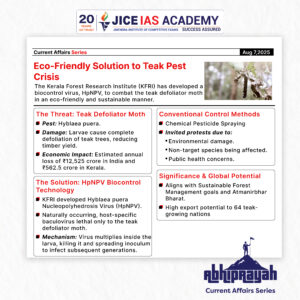

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

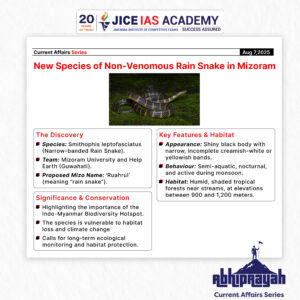

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

Economic Implications

For Indian Exporters

- These reforms reduce transaction costs and compliance hurdles

- Encourage a more competitive and efficient export environment

- Promote value addition in key sectors like leather

For Tamil Nadu

- The reforms particularly benefit the state’s leather industry, a major contributor to employment and exports

- Boost the marketability of GI-tagged E.I. leather, enhancing rural and traditional industries

For Trade Policy

- These decisions indicate a shift from regulatory controls to policy facilitation

Reinforce the goals of Make in India, Atmanirbhar Bharat, and India’s ambition to become a leading export power

Recently, BVR Subrahmanyam, CEO of NITI Aayog, claimed that India has overtaken Japan to become the fourth-largest economy in the world, citing data from the International Monetary Fund (IMF).

India’s rank as the world’s largest economy varies by measure—nominal GDP or purchasing power parity (PPP)—each with key implications for economic analysis.