UPSC CURRENT AFFAIRS – 1st June 2025

RBI changing gold loan rules

Why in News?

- Reserve Bank of India (RBI) released draft guidelines recently on gold loans to harmonise regulations across banks and NBFCs. The move comes amid concerns over rising lending irregularities, especially after a significant surge in the gold loan portfolio in FY24. The proposal has triggered political and public reactions, notably from Tamil Nadu.

Background:

Gold loans have long served as a trusted source of quick, collateralised credit in India, especially for small farmers, rural households, and informal workers. Over the years, NBFCs like Muthoot and Manappuram dominated this space, followed by aggressive expansion by banks, particularly during and after the COVID-19 period.

RBI’s regulatory journey:

- 2012: LTV cap introduced at 60% for NBFCs (raised to 75% in 2014).

- 2020: Temporary COVID relief allowed banks 90% LTV, later rolled back.

- FY24: Gold loan portfolios doubled for banks (104%) and rose over 50% for NBFCs—raising alarms over risk exposure and inadequate controls.

The April 2025 draft aims to tighten operational practices, bring parity between lenders, and safeguard borrowers.

Key Draft Proposals:

- LTV remains at 75%, but bullet loans must include accrued interest in LTV calculation.

- Proof of gold ownership is now mandatory.

- Standardised valuation based on 22-carat gold.

- Concurrent loans banned; fresh loans allowed only after full repayment of previous ones.

- Loan renewals/top-ups allowed only if the previous loan is standard and LTV-compliant.

- Delay in returning pledged gold post-repayment to incur ₹5,000/day penalty.

Finance Ministry Clarification:

In response to concerns from Tamil Nadu CM M.K. Stalin, the Ministry of Finance clarified:

- Implementation will begin from January 1, 2026.

- RBI will ensure small borrowers are not adversely impacted.

- Emphasised the importance of gold loans in rural credit and agriculture.

Impacts and Challenges:

For borrowers:

- Stricter norms may reduce access to short-term credit, particularly for small and marginal farmers.

- Documentation burdens and valuation rules may deter informal sector users.

- Likely rise in interest rates due to compliance costs.

For NBFCs and Banks:

- Reduced flexibility in loan disbursals and renewals.

- Funding constraints for NBFCs that re-pledge gold for liquidity.

- Smaller NBFCs may face survival challenges, prompting market consolidation.

Constitutional and Policy Context:

- Article 21 and 39: Emphasise access to livelihood and equitable credit.

- Priority Sector Lending norms: Gold loans to small farmers qualify.

- RBI’s move must align with financial inclusion, as envisaged under schemes like PMJDY and MUDRA.

Way Forward:

- Differentiated regulation for micro gold loans versus high-value structured loans.

- Greater use of tech-based valuation and KYC norms to ease compliance.

- Strengthen RBI-NBFC monitoring, without reducing rural credit access.

- Ongoing stakeholder consultations needed to balance control and credit flow.

Conclusion:

The RBI’s draft directions mark a critical shift toward transparent and harmonised gold loan regulation. However, since gold loans are a rural lifeline, particularly in South India, the new framework must strike a balance between regulatory discipline and financial accessibility for the vulnerable.

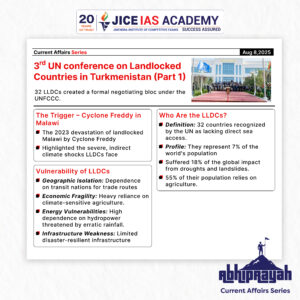

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

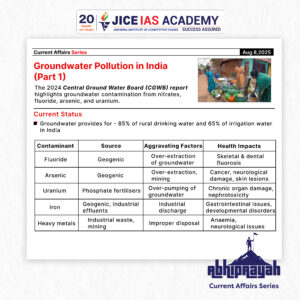

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

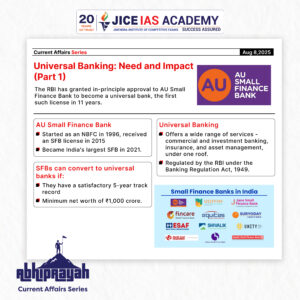

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

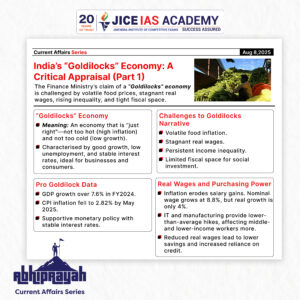

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

For Indian Exporters

- These reforms reduce transaction costs and compliance hurdles

- Encourage a more competitive and efficient export environment

- Promote value addition in key sectors like leather

For Tamil Nadu

- The reforms particularly benefit the state’s leather industry, a major contributor to employment and exports

- Boost the marketability of GI-tagged E.I. leather, enhancing rural and traditional industries

For Trade Policy

- These decisions indicate a shift from regulatory controls to policy facilitation

Reinforce the goals of Make in India, Atmanirbhar Bharat, and India’s ambition to become a leading export power

Recently, BVR Subrahmanyam, CEO of NITI Aayog, claimed that India has overtaken Japan to become the fourth-largest economy in the world, citing data from the International Monetary Fund (IMF).

India’s rank as the world’s largest economy varies by measure—nominal GDP or purchasing power parity (PPP)—each with key implications for economic analysis.