UPSC CURRENT AFFAIRS – 19th May 2025

RBI ‘surplus’ transfer to the government

Why in News?

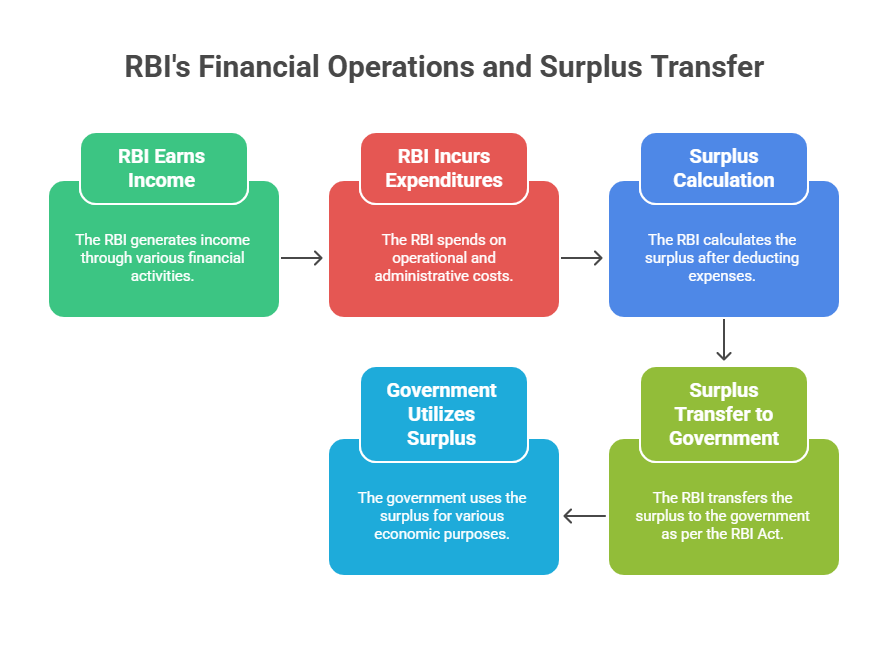

The RBI transfers its annual surplus to the central government based on the Economic Capital Framework, ensuring financial stability while supporting fiscal needs.

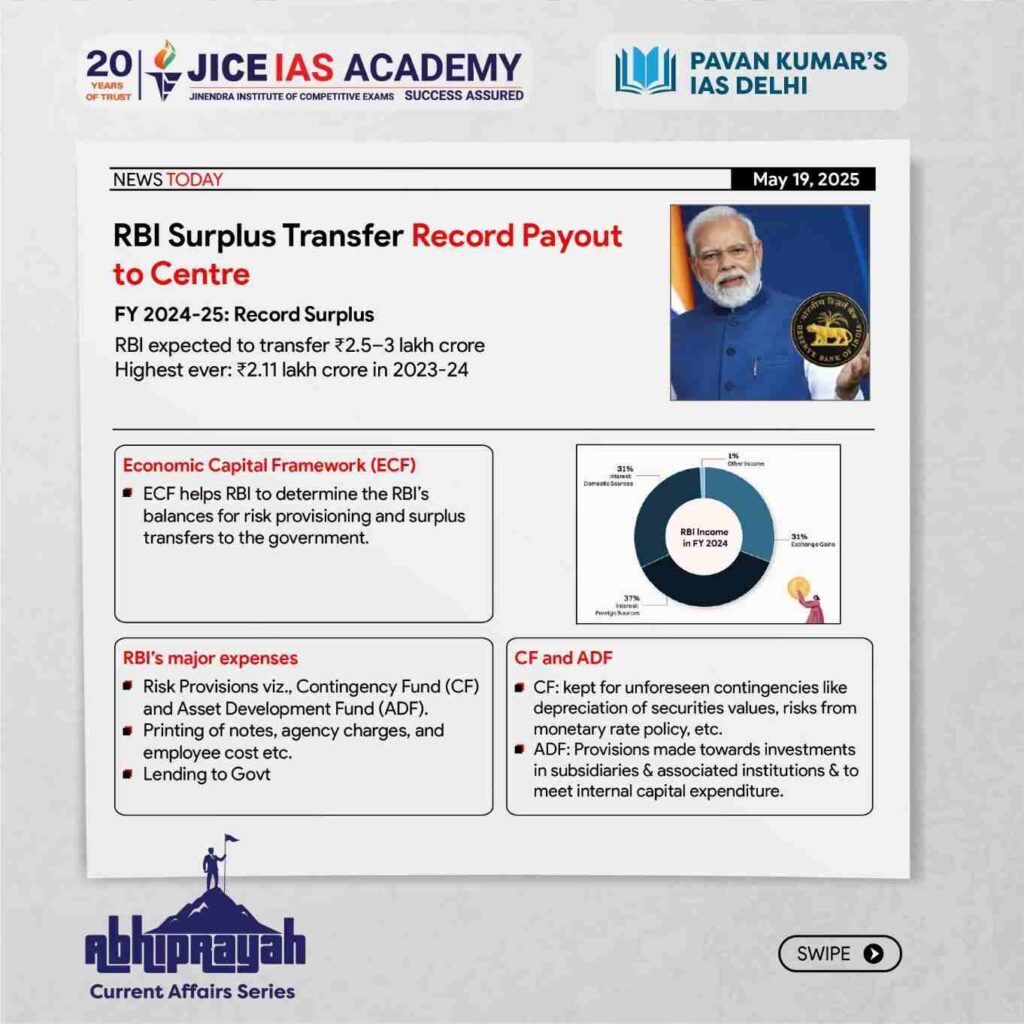

Economic Capital Framework (ECF)

- The Economic Capital Framework (ECF) is a mechanism used by the RBI to determine how much risk provisioning it needs to maintain (to safeguard against potential financial shocks) and how much surplus (profit) it can transfer to the government.

- It ensures a balance between maintaining the RBI’s financial stability and meeting the fiscal needs of the government.

Record Surplus Transfer in 2024-25

- For the financial year 2024-25, the RBI is expected to transfer a record surplus in the range of Rs 2.5 lakh crore to Rs 3 lakh crore to the central government.

- This follows the highest-ever transfer of Rs 2.11 lakh crore in 2023-24.

- Although RBI doesn’t declare a “dividend” like commercial banks, it transfers the surplus (profits) to the government annually after meeting its reserve and operational requirements.

How Does the RBI Earn Profits?

The RBI earns income through the following operations:

- Foreign Currency Assets: The RBI invests in foreign currency assets like bonds, treasury bills of other central banks, and top-rated securities. The interest or returns earned from these are part of its income.

- Domestic Government Securities: It earns interest from its holdings of rupee-denominated government bonds and securities.

- Lending to Banks: It lends money to commercial banks for short durations (such as overnight) under liquidity adjustment facilities, earning interest in the process.

- Management Fees: It charges the central and state governments a fee for managing their borrowings.

Expenditure:

RBI’s main expenditures include:

- Printing and distribution of currency.

- Staff salaries and administrative expenses.

- Commissions paid to banks for government transactions and to primary dealers for underwriting bond issues.

Legal Basis for Surplus Transfer

According to Section 47 of the RBI Act, 1934, after making provisions for:

- Bad and doubtful debts

- Depreciation of assets

- Staff-related funds

- Other customary banking provisions

…the remaining surplus is transferred to the Central Government.

Does the RBI Pay Tax on its Profits?

No. Under Section 48 of the RBI Act, 1934, the RBI is exempt from paying:

- Income tax

- Super-tax

- Wealth tax

This exemption applies to all profits, income, or gains earned by the central bank.

Is There a Fixed Policy for Surplus Distribution?

There is no explicit policy, but various committees have guided the process:

- Malegam Committee (2013): Recommended higher surplus transfers to the government.

After its recommendations, surplus transfer as a percentage of RBI’s gross income (less expenditure) rose significantly—from 53.40% in 2012-13 to 99.99% in 2013-14. - Earlier, surplus was partly retained in:

- Contingency Fund (CF): For unforeseen financial emergencies.

- Asset Development Fund (ADF): For internal capital expenditure and investments in subsidiaries.

- These reserves were meant to maintain RBI’s financial resilience and credibility in times of crisis.

Differences Between RBI and Government

- The Government of India has at times argued that the RBI holds excess reserves compared to global benchmarks and has suggested that the surplus could be used for purposes like recapitalising public sector banks.

- The RBI, on the other hand, has emphasized the need for large reserves to:

- Ensure financial stability

- Maintain market confidence

- Safeguard against macroeconomic and financial risks

RBI views higher reserves as a critical element of its institutional independence.

Despite these occasional differences, both sides usually reach a negotiated settlement, as noted by former RBI Governor Duvvuri Subbarao.

How Do Other Central Banks Handle Surplus Transfers?

- United Kingdom and United States: The central bank and the government mutually decide the quantum of surplus transfer.

- Japan: The government unilaterally decides the amount of surplus transfer.

On average, surplus transfers by central banks globally amount to around 0.5% of GDP, though this can vary by country and context.

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

- Decreased oxygen-carrying capacity of RBCs.

- Increased fragility and cell stiffness.

- Vascular blockage, causing pain and organ injury.

- Increased susceptibility to infections, anemia, and stroke.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.info/sl/register?ref=I3OM7SCZ