UPSC CURRENT AFFAIRS – 07th August 2025

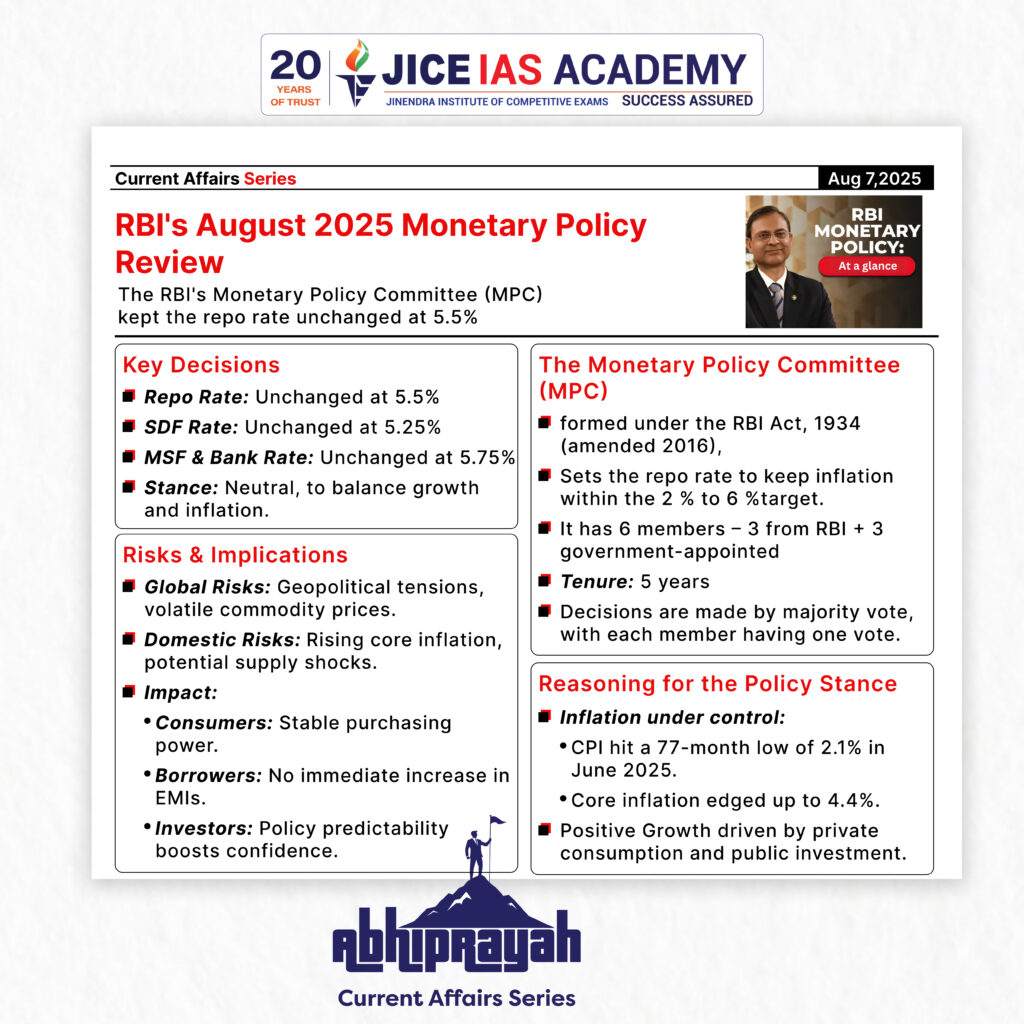

RBI's August 2025 Monetary Policy Review

Why in News?

The RBI’s Monetary Policy Committee (MPC) kept the repo rate unchanged at 5.5% while projecting GDP growth at 6.5% and CPI inflation at 3.1% for 2025-26 amid global uncertainties.

About Monetary Policy Committee (MPC)

The Monetary Policy Committee (MPC) is a statutory body formed under the RBI Act, 1934 (amended in 2016) to decide the benchmark interest rate (repo rate) required to contain inflation within a target level.

Composition:

- 6 members total

- 3 from RBI:

- RBI Governor (Chairperson)

- Deputy Governor (in charge of monetary policy)

- One RBI officer nominated by the Central Board

- 3 appointed by the Government of India

- Independent members with expertise in economics, banking, or finance

- 3 from RBI:

Set by Government of India in consultation with RBI for 5-year terms (currently till March 2026)

- Each member has one vote and Decisions taken by majority

Key Decisions of the MPC

- Recently, the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) decided to maintain the repo rate at 5.5%, while continuing its neutral policy stance, indicating a careful balancing act between supporting economic growth and ensuring price stability.

- Repo Rate: Held steady at 5.5%

- Standing Deposit Facility (SDF): Unchanged at 5.25%

- Marginal Standing Facility (MSF) & Bank Rate: Maintained at 5.75%

- Stance: Neutral, allowing flexibility to respond to evolving macroeconomic conditions

Reasoning Behind the MPC’s Decision

The decision reflects a data-driven and cautious approach by the RBI, keeping in view the evolving domestic and global economic conditions:

1. Inflation Trends

- CPI Headline Inflation dropped to a 77-month low of 2.1% (y-o-y) in June 2025, mainly due to:

- A significant drop in food inflation

- Improved agricultural output

- Effective supply-side measures

- Core inflation, however, inched up slightly to 4.4% in June due to:

- Rising gold prices

- Revised CPI Forecast for 2025-26: 3.1% (earlier 3.7%), still within RBI’s target band of 4% ± 2%

- Q2: 2.1%

- Q3: 3.1%

- Q4: 4.4%

- Q1:2026-27: 4.9%

2. Growth Outlook

- Domestic growth remains resilient, supported by:

- Private consumption

- Public infrastructure investment

- However, external headwinds continue to pose risks:

- Geopolitical tensions

- Trade barriers

- Volatile global financial markets

- GDP Growth Projection for 2025-26: 6.5% retained

- Q1: 6.5%

- Q2: 6.7%

- Q3: 6.6%

- Q4: 6.3%

- Q1:2026-27 projected at 6.6%

- Growth risks remain evenly balanced

RBI Governor’s Highlights

RBI Governor Sanjay Malhotra emphasized the MPC’s dual role:

- Supporting growth in the face of global uncertainty

- Ensuring price stability, the primary mandate of monetary policy

Monetary Policy Framework: A Balancing Act

India’s Flexible Inflation Targeting (FIT) framework mandates the RBI to:

- Maintain CPI inflation at 4%, with a band of ±2%

- Support growth while ensuring monetary and financial stability

The August 2025 decision reflects:

- Confidence in the domestic growth momentum

- Cautious optimism about continued inflation moderation

- Willingness to act proactively as global dynamics shift

Risks and Challenges

- Global risks:

- Unresolved geopolitical conflicts

- Sluggish disinflation in advanced economies

- Volatile commodity prices

- Continued trade tensions

- Domestic concerns:

- Core inflation creeping up

- Risk of supply shocks (e.g., monsoon variability, food inflation)

Implications for the Indian Economy

Area | Likely Impact |

Consumers | Lower inflation = stable purchasing power |

Borrowers | Stable repo rate = no rise in EMIs for now |

Investors | Predictability in policy = increased confidence |

Government | Encouragement for continued capital spending |

Financial Markets | Stability in interest rates = reduced volatility |

Forward Guidance

The RBI emphasized:

- Continued agility and data-dependence

- Transparent, credible communication

- Focus on medium-term price stability while nurturing growth.

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

Introduction

Economic Implications

For Indian Exporters

- These reforms reduce transaction costs and compliance hurdles

- Encourage a more competitive and efficient export environment

- Promote value addition in key sectors like leather

For Tamil Nadu

- The reforms particularly benefit the state’s leather industry, a major contributor to employment and exports

- Boost the marketability of GI-tagged E.I. leather, enhancing rural and traditional industries

For Trade Policy

- These decisions indicate a shift from regulatory controls to policy facilitation

Reinforce the goals of Make in India, Atmanirbhar Bharat, and India’s ambition to become a leading export power

Recently, BVR Subrahmanyam, CEO of NITI Aayog, claimed that India has overtaken Japan to become the fourth-largest economy in the world, citing data from the International Monetary Fund (IMF).

India’s rank as the world’s largest economy varies by measure—nominal GDP or purchasing power parity (PPP)—each with key implications for economic analysis.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.info/ES_la/register-person?ref=VDVEQ78S