UPSC CURRENT AFFAIRS – 17th May 2025

UN Warns of Deepening Debt Crisis in Developing Nations Amid Economic Slowdown

Why in News?

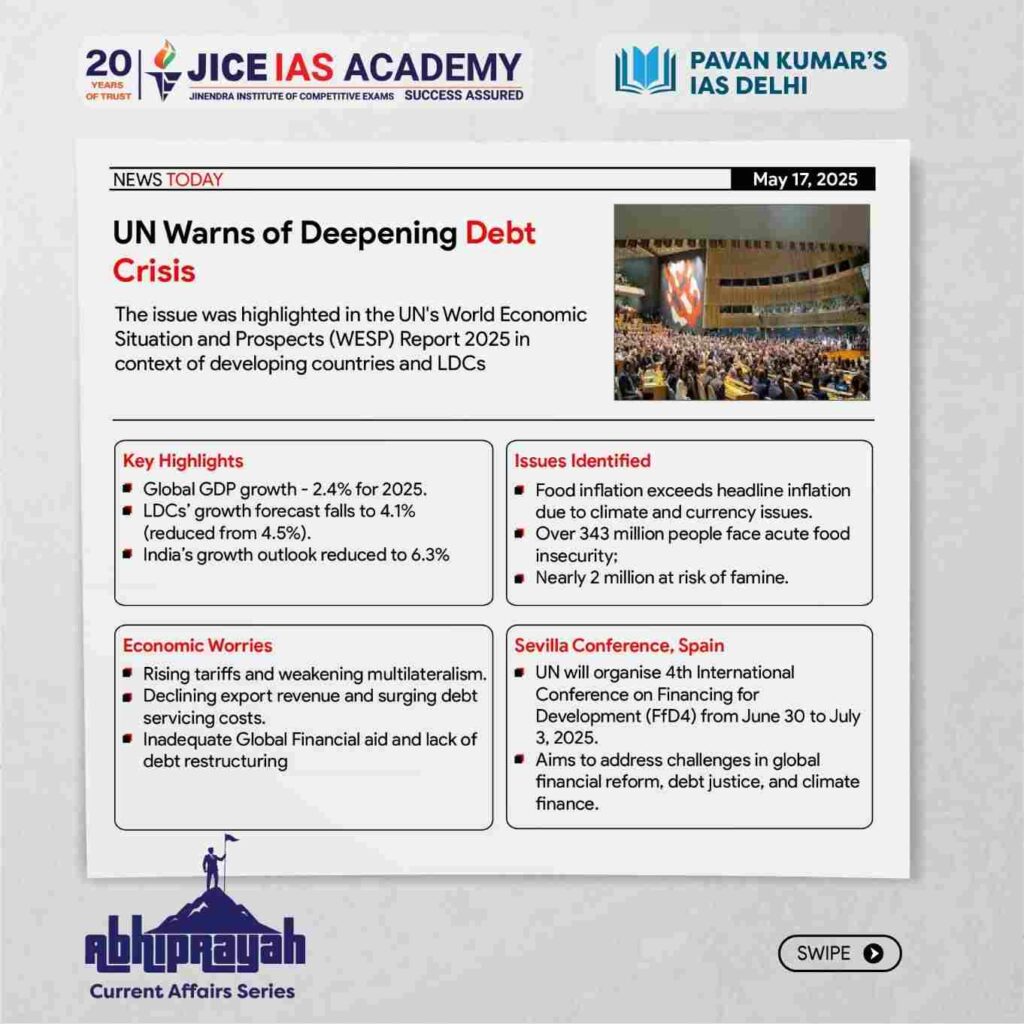

The United Nations Department of Economic and Social Affairs (UNDESA) has released its mid-2025 edition of the World Economic Situation and Prospects (WESP) report, warning that the global economic slowdown, trade tensions, and climate disruptions are pushing developing and least-developed countries (LDCs) deeper into a debt crisis, threatening to reverse hard-earned development gains.

Key Highlights from the UN Report:

- Global GDP growth forecast for 2025 is revised downward to 2.4%, from 2.9% in 2024.

- Developing countries’ inflation rose by 35% between 2020–2024, compared to 20% in developed economies.

- Growth in LDCs projected to slow to 4.1% in 2025, down from 4.5% in 2024.

- Food inflation outpacing headline inflation due to climate shocks, currency depreciation, and supply chain breakdowns.

- 343 million people globally face acute food insecurity; 1.9 million at risk of famine, especially in conflict zones like Gaza, South Sudan, Haiti, Mali.

- India’s growth revised downward to 6.3% in 2025 from 7.1%, though it remains one of the fastest-growing large economies.

Key Structural and Policy Issues Identified:

🔸 1. Trade Protectionism and Tariff Wars:

- Surge in effective U.S. tariff rates disrupting global supply chains.

- Rising trade tensions increase production costs and reduce global investor confidence.

- Undermine multilateralism and the rules-based trading system.

🔸 2. Widening Fiscal Deficits and Shrinking Fiscal Space:

- LDCs facing revenue loss from exports, tight credit conditions, and reduced foreign aid.

- Rising debt servicing costs and weaker ODA (Official Development Assistance).

🔸 3. Unequal Inflation Impact:

- Poorer countries and households hit hardest due to higher dependency on essential goods.

- Disproportionate burden of inflation on food, fuel, and housing costs.

🔸 4. Climate-related Disruptions:

- Countries already experiencing food insecurity and conflict are further destabilized by climate events.

- Lack of climate finance deepens vulnerability.

Relevant Institutional Frameworks and Events:

Institution/Event | Role |

|---|---|

UNDESA – WESP Report | Global macroeconomic trends, development challenges |

UNFCCC, SDGs (Goal 13, 17) | Links climate action and international cooperation |

IMF and World Bank | Debt relief, concessional finance, policy support for LDCs |

WTO | Critical for restoring trust in a rules-based trading system |

Fourth International Conference on Financing for Development (FfD)

- The Fourth International Conference on Financing for Development (FfD), scheduled for June 30–July 3, 2025 in Sevilla, Spain, is set to play a pivotal role in shaping the global financial architecture amid escalating debt crises, climate finance gaps, and growing inequality in developing and least-developed countries (LDCs).

Challenges:

- Developing and least-developed countries are increasingly constrained by debt stress due to reduced export earnings, tighter credit, and inflationary pressures.

- Trade protectionism and the erosion of multilateralism are fragmenting global markets and disproportionately hurting vulnerable economies.

- Rising food inflation and structural inequalities are worsening poverty and reversing gains made in the UN’s Sustainable Development Goals (SDGs).

- Climate change and extreme weather events are escalating risks for already food-insecure and conflict-affected populations.

- The current global financial architecture lacks adequate mechanisms for timely and fair sovereign debt restructuring for LDCs.

Way Ahead:

- Revive Multilateral Cooperation:

- Strengthen WTO and support rules-based trade to rebuild confidence.

- Promote debt transparency, creditor coordination, and debt service suspension under G20/Paris Club frameworks.

- Implement Targeted Fiscal Measures:

- Scale up concessional finance, SDR reallocations, and climate-related grants to reduce fiscal vulnerability in LDCs.

- Control Inflation Through Social Protection:

- Expand food subsidies, employment guarantees, and cash transfers to protect the poorest from rising costs.

- Leverage the Sevilla Conference (June 2025):

- Push for reform of global financial governance, including debt justice, green transition funding, and inclusive recovery roadmaps.

- Invest in Food Security and Climate Resilience:

- Encourage agro-climatic adaptation, crop insurance, and early warning systems in fragile states.

Conclusion:

The debt crisis looming over developing and least-developed countries is not merely a fiscal problem but a multidimensional threat encompassing inflation, inequality, conflict, and climate risk. Addressing it demands bold multilateral reforms, renewed commitment to SDG financing, and a just, equitable global economic order. The Fourth Financing for Development Conference in Sevilla presents a crucial opportunity for the global community to act decisively.

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in