UPSC CURRENT AFFAIRS – 2nd June 2025

Regulating India’s virtual digital assets revolution

Why in News?

- India has topped the Chainalysis Geography of Cryptocurrency report (2024) for the second consecutive year, highlighting its global leadership in grassroots crypto adoption amid calls for comprehensive VDA regulation.

Introduction

- India has emerged as a global leader in grassroots cryptocurrency adoption, topping the Chainalysis Geography of Crypto report for the second consecutive year (2024).

- According to NASSCOM, Indian retail investors infused USD 6.6 billion into crypto assets in 2024, and the sector could generate more than 800,000 jobs by 2030. India also hosts one of the world’s fastest-growing Web3 developer communities.

- Yet this vibrancy co-exists with an uncertain, fragmented domestic policy landscape. In May 2025, the Supreme Court pointedly asked why India still lacks a comprehensive crypto law, noting that “banning may be shutting your eyes to ground reality.”

Virtual Digital Assets (VDAs):

According to Section 2(47A) of the Income Tax Act, 1961, inserted by the Finance Act 2022:

Virtual Digital Asset (VDA) means any information or code or number or token (not being Indian currency or any foreign currency), generated through cryptographic means or otherwise, providing a digital representation of value, exchangeable with or without consideration.

VDAs include:

- Cryptocurrencies (e.g., Bitcoin, Ethereum)

- Non-Fungible Tokens (NFTs)

- Any other digital asset notified by the Central Government

Exclusions

The government may exclude any digital asset from the VDA category via notification. Fiat currencies (like INR, USD) are not considered VDAs.

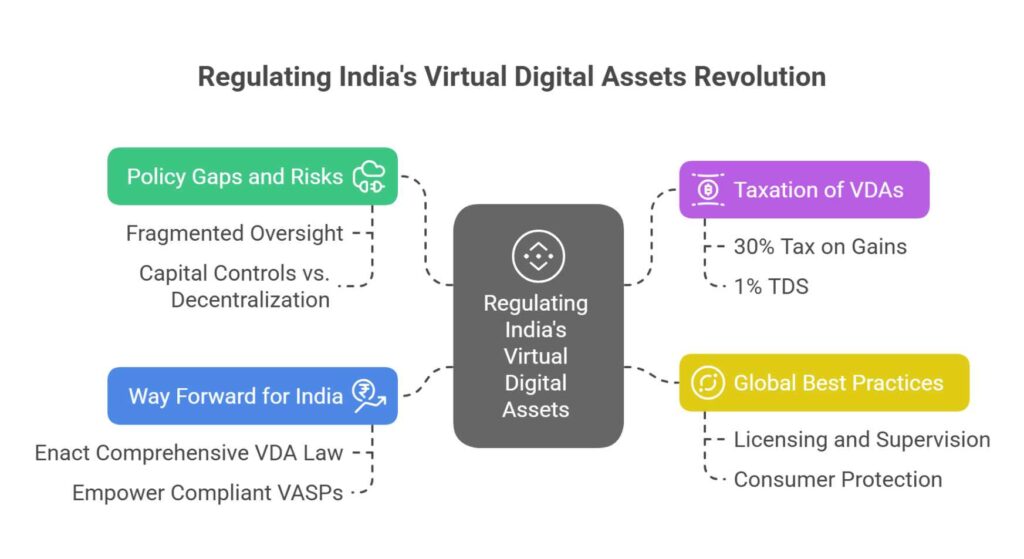

Taxation of VDAs in India

India currently does not regulate VDAs through a specific law, but taxes them under the Income Tax Act as follows:

- 30% Tax on Gains (Section 115BBH):

- Applies to profits from the transfer of VDAs.

- No set-off of losses allowed against other income.

- No carry-forward of losses.

- 1% Tax Deducted at Source (TDS) (Section 194S):

- Applicable on VDA transactions exceeding ₹10,000 in a financial year.

- The buyer is responsible for deducting TDS.

- Gift Tax:

- VDA received as a gift is taxable in the hands of the recipient (if exceeding ₹50,000 in value).

The Regulatory Vacuum: A Chronology

1. Initial Caution (2013 – 2018)

- 2013-14: The Reserve Bank of India (RBI) issues public cautions on crypto risks.

- 2018: RBI directs banks to cut ties with crypto firms.

- 2020: The Supreme Court quashes the RBI circular, calling it disproportionate.

2. Taxation Without Regulation (2022 – present)

- 1 % TDS on VDA trades above ₹10,000 (Section 194S).

- 30 % capital-gains tax with no loss set-off (Section 115BBH).

These measures expanded formal reporting but also encouraged users to shift to offshore, non-compliant exchanges, eroding tax collections (over ₹60 billion in uncollected TDS by late-2024).

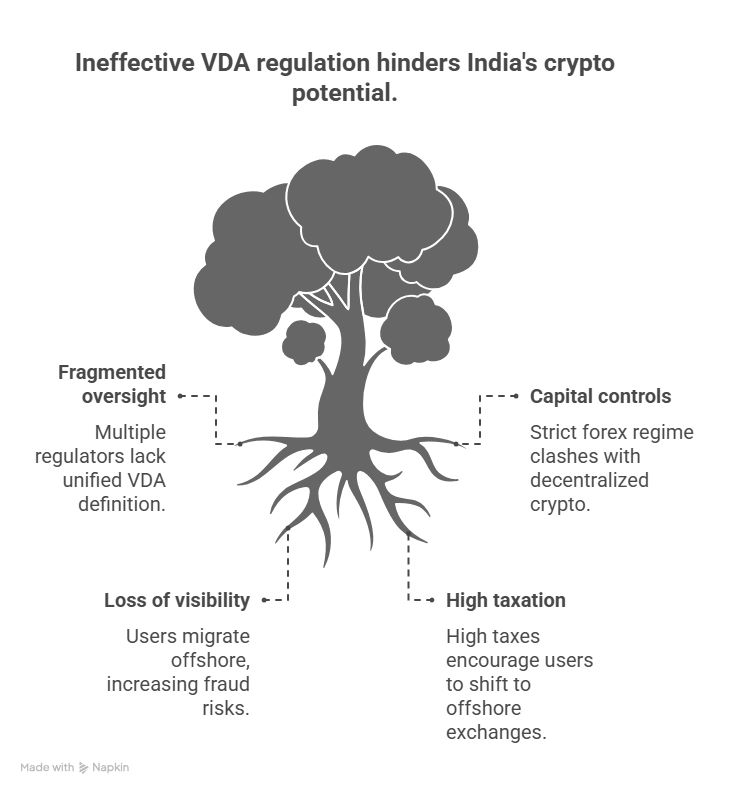

Policy Gaps and Risks

- Fragmented oversight

Multiple regulators (RBI, SEBI, FIU, Ministry of Finance) operate without a unified statute defining VDAs or assigning clear jurisdiction. - Capital controls vs. decentralisation

India’s strict foreign-exchange regime is poorly aligned with borderless crypto networks. - Loss of visibility

Users migrating to offshore platforms increase vulnerabilities to fraud, hacks, and illicit flows while depriving the exchequer of revenue.

Role of VASPs (Virtual Asset Service Providers)

- Domestic VASPs act as gateways for AML/CTF compliance, reporting suspicious transactions to FIU-India.

- After a USD 230 million hack in 2024, leading Indian exchanges voluntarily strengthened cybersecurity, set up insurance funds, and drafted industrywide standards—demonstrating their utility as cooperative partners rather than adversaries.

Global Best Practices

International bodies (IMF, Financial Stability Board, FATF) advocate risk-based, technology-neutral rules that:

- licence and supervise VASPs,

- mandate robust customer-due-diligence (“travel rule”),

- protect consumers, and

- enable cross-border information-sharing.

Several jurisdictions (EU’s MiCA, Japan’s amendments, the UK’s phased approach) show how dedicated statutes can balance innovation with systemic safeguards.

Way Forward for India

- Enact a comprehensive VDA law that defines asset classes, allocates regulatory responsibilities, and lays out consumer-protection norms.

- Empower compliant domestic VASPs through clear licensing, reporting requirements, and sandbox support, encouraging on-shore activity.

- Rationalise taxation by reconsidering the 1 % TDS trigger, permitting loss-offsetting, and aligning crypto taxes with those of securities.

- Strengthen digital infrastructure by setting minimum cybersecurity and custody standards, mandatory insurance pools, and incident-response protocols.

- Lead globally via G20 and FATF dialogues to shape interoperable rules and coordinated enforcement against illicit offshore platforms.

Conclusion

- India’s position as a top adopter of crypto assets gives it a unique opportunity—and obligation—to craft forward-looking, balanced regulation. Mere prohibition or punitive taxation cannot keep pace with technological realities.

- A coherent, risk-based framework that partners with domestic VASPs, safeguards consumers, and integrates with global norms will allow India to capture the economic benefits of Web3 while protecting its financial system and national security.

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

Economic Implications

For Indian Exporters

- These reforms reduce transaction costs and compliance hurdles

- Encourage a more competitive and efficient export environment

- Promote value addition in key sectors like leather

For Tamil Nadu

- The reforms particularly benefit the state’s leather industry, a major contributor to employment and exports

- Boost the marketability of GI-tagged E.I. leather, enhancing rural and traditional industries

For Trade Policy

- These decisions indicate a shift from regulatory controls to policy facilitation

Reinforce the goals of Make in India, Atmanirbhar Bharat, and India’s ambition to become a leading export power

Recently, BVR Subrahmanyam, CEO of NITI Aayog, claimed that India has overtaken Japan to become the fourth-largest economy in the world, citing data from the International Monetary Fund (IMF).

India’s rank as the world’s largest economy varies by measure—nominal GDP or purchasing power parity (PPP)—each with key implications for economic analysis.