UPSC CURRENT AFFAIRS – 25th March 2025

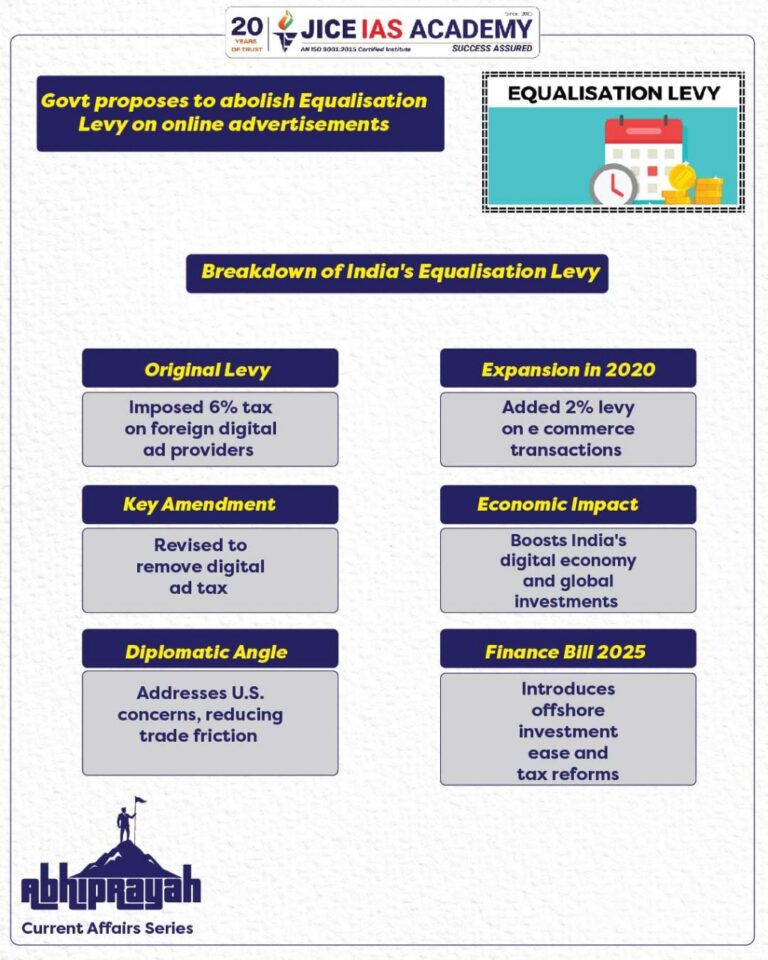

Govt proposes to abolish Equalisation Levy on online advertisements

Why in News?

Recently, the Indian government proposed the abolition of the Equalisation Levy (digital tax) on online advertisements, effective from April 1, 2025.

What is Equalisation Levy?

- The Equalisation Levy, introduced in 2016, initially imposed a 6% tax on payments exceeding Rs 1 lakh annually to non-resident service providers for online advertisements.

- This levy was introduced to address the growing digital economy and ensure that foreign digital companies contributing to India’s advertising market were appropriately taxed, despite not having a physical presence in the country.

Background

- Introduced in Finance Act 2016, the 6% Equalisation Levy taxed payments made for online advertisement services by non-resident companies.

- In 2020, the levy was extended to e-commerce services, but the 2% e-commerce levy was abolished in August 2024. The latest proposal removes the 6% tax on online ads, simplifying the digital advertising tax framework.

Expansion of Scope (2020 Amendments)

- In 2020, the Finance Act broadened the scope of the Equalisation Levy to include e-commerce companies.

- The tax, now at 2%, applies to non-resident operators involved in online sales of goods and provision of services through platforms like Amazon and Google.

- This expansion aims to target foreign e-commerce companies generating revenue from Indian customers without a tangible presence in the country.

Key Amendments and Impact

- The amendment to Section 163 of the Finance Act, 2016 will take effect on April 1, 2025, eliminating the tax on digital ads.

- This change will lower the cost for advertisers and platforms, boosting India’s digital economy.

Diplomatic Context

- The abolition comes amid tensions with the United States, which had threatened reciprocal tariffs due to India’s digital taxes.

- Experts suggest that this step is an attempt to ease diplomatic concerns and avoid trade friction, noting it as part of India’s accommodative stance.

Broader Reforms

- The Finance Bill 2025 also includes measures to ease offshore fund investments and refine search and seizure tax assessments, introducing the term Total Undisclosed Income to clarify tax proceedings.

Key Points

- The 6% Equalisation Levy applies to advertising payments exceeding Rs 1 lakh annually to non-resident service providers like Google, if their ads target Indian customers.

- The 2% levy was introduced for e-commerce transactions starting April 1, 2020, targeting global platforms like Amazon and Google that source revenue from Indian customers, but do not have a physical presence in India.

Conclusion

- By abolishing the Equalisation Levy, India is aligning its tax policies with international norms, promoting clarity for digital advertisers, and potentially improving diplomatic relations with the U.S.

- The move reflects ongoing efforts to simplify India’s tax system and encourage business growth.

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

o6gypl

Really superb information can be found on web blog.

o3qzrm

Very well written story. It will be supportive to anyone who utilizes it, as well as yours truly :). Keep doing what you are doing – can’r wait to read more posts.

I think that is one of the most significant information for me. And i am happy studying your article. However wanna statement on few common issues, The website style is perfect, the articles is in reality excellent : D. Good task, cheers

You have brought up a very superb points, appreciate it for the post.

I have recently started a website, the information you provide on this website has helped me tremendously. Thank you for all of your time & work.

I will right away grab your rss as I can’t find your email subscription link or e-newsletter service. Do you have any? Kindly let me know in order that I could subscribe. Thanks.

Hi, i believe that i saw you visited my web site so i came to “return the desire”.I am attempting to to find things to improve my site!I guess its good enough to make use of a few of your ideas!!

I discovered your blog site on google and check a few of your early posts. Continue to keep up the very good operate. I just additional up your RSS feed to my MSN News Reader. Seeking forward to reading more from you later on!…

Glad to be one of many visitors on this awing website : D.

Magnificent site. A lot of helpful information here. I’m sending it to several friends ans additionally sharing in delicious. And naturally, thanks on your effort!

What i do not understood is actually how you are no longer really much more neatly-liked than you may be right now. You’re so intelligent. You know therefore considerably relating to this matter, produced me in my view consider it from numerous numerous angles. Its like men and women aren’t fascinated unless it?¦s something to do with Lady gaga! Your personal stuffs excellent. Always maintain it up!

I like this internet site because so much utile material on here : D.

I have recently started a blog, the info you provide on this website has helped me tremendously. Thank you for all of your time & work.

Hey there! I’m at work browsing your blog from my new iphone 4! Just wanted to say I love reading through your blog and look forward to all your posts! Carry on the fantastic work!

Excellent goods from you, man. I have have in mind your stuff previous to and you’re just extremely wonderful. I actually like what you’ve bought right here, certainly like what you’re saying and the way in which during which you are saying it. You are making it entertaining and you continue to take care of to keep it smart. I can’t wait to read much more from you. That is really a wonderful site.

I’ll right away take hold of your rss as I can not find your email subscription link or e-newsletter service. Do you’ve any? Please permit me realize in order that I may subscribe. Thanks.

Great – I should certainly pronounce, impressed with your site. I had no trouble navigating through all the tabs as well as related info ended up being truly easy to do to access. I recently found what I hoped for before you know it in the least. Reasonably unusual. Is likely to appreciate it for those who add forums or anything, site theme . a tones way for your customer to communicate. Nice task.

Its fantastic as your other blog posts : D, thanks for posting. “The art of love … is largely the art of persistence.” by Albert Ellis.

I am curious to find out what blog system you are using? I’m experiencing some minor security issues with my latest blog and I’d like to find something more safeguarded. Do you have any recommendations?

Its wonderful as your other articles : D, thanks for posting. “You can’t have everything. Where would you put it” by Steven Wright.

The Pink Salt Trick is a minimalist but effective morning routine: Just drink a glass of lukewarm water mixed with a pinch of Himalayan pink salt as soon as you wake up.

I carry on listening to the news update speak about getting free online grant applications so I have been looking around for the best site to get one. Could you advise me please, where could i find some?

The Pink Salt Trick is a minimalist but effective morning routine: Just drink a glass of lukewarm water mixed with a pinch of Himalayan pink salt as soon as you wake up.

The Pink Salt Trick is a minimalist but effective morning routine: Just drink a glass of lukewarm water mixed with a pinch of Himalayan pink salt as soon as you wake up.

The Pink Salt Trick is a minimalist but effective morning routine: Just drink a glass of lukewarm water mixed with a pinch of Himalayan pink salt as soon as you wake up.

Do you mind if I quote a couple of your posts as long as I provide credit and sources back to your blog? My blog site is in the exact same niche as yours and my visitors would certainly benefit from a lot of the information you provide here. Please let me know if this ok with you. Appreciate it!

Excellent blog here! Also your website loads up very fast! What host are you using? Can I get your affiliate link to your host? I wish my website loaded up as quickly as yours lol

Really fantastic info can be found on site. “Wealth may be an ancient thing, for it means power, it means leisure, it means liberty.” by James Russell Lowell.

Woah! I’m really digging the template/theme of this blog. It’s simple, yet effective. A lot of times it’s challenging to get that “perfect balance” between superb usability and visual appeal. I must say you’ve done a excellent job with this. Also, the blog loads super fast for me on Firefox. Exceptional Blog!

you have got an ideal blog here! would you wish to make some invite posts on my blog?

Thanks so much for giving everyone an extraordinarily wonderful possiblity to check tips from this blog. It is often so cool and as well , stuffed with a good time for me personally and my office fellow workers to visit your site more than 3 times in one week to read through the latest things you will have. And definitely, I’m so actually pleased concerning the special concepts served by you. Some 3 tips on this page are basically the very best we’ve had.

Very nice post. I just stumbled upon your blog and wished to say that I have really loved surfing around your blog posts. After all I will be subscribing to your rss feed and I’m hoping you write again very soon!

Hi! Do you know if they make any plugins to safeguard against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any suggestions?

Hi, Neat post. There’s a problem with your website in internet explorer, would check this… IE still is the market leader and a good portion of people will miss your wonderful writing due to this problem.

Great write-up, I am regular visitor of one’s blog, maintain up the excellent operate, and It is going to be a regular visitor for a lengthy time.

I’m no longer positive where you are getting your information, but great topic. I must spend a while studying more or figuring out more. Thanks for great information I was looking for this info for my mission.

Thanks for all your efforts that you have put in this. very interesting info .

Hello my family member! I want to say that this post is amazing, nice written and include almost all important infos. I would like to peer extra posts like this .

I really like your writing style, wonderful information, thankyou for putting up : D.

you’re really a good webmaster. The website loading speed is incredible. It seems that you’re doing any unique trick. In addition, The contents are masterwork. you’ve done a magnificent job on this topic!

Very interesting information!Perfect just what I was looking for!

You have observed very interesting points! ps decent internet site.

You have noted very interesting details! ps nice web site.

I’ve been surfing on-line more than three hours today, yet I never discovered any attention-grabbing article like yours. It is lovely price enough for me. In my opinion, if all website owners and bloggers made just right content as you probably did, the internet shall be a lot more helpful than ever before. “We are not retreating – we are advancing in another Direction.” by Douglas MacArthur.

Thank you for the good writeup. It in fact was a amusement account it. Look advanced to more added agreeable from you! However, how could we communicate?

Its great as your other blog posts : D, thanks for putting up. “Experience is that marvelous thing that enables you to recognize a mistake when you make it again.” by Franklin P. Jones.

Hello! I’ve been following your weblog for a long time now and finally got the bravery to go ahead and give you a shout out from Kingwood Texas! Just wanted to tell you keep up the great job!

Sweet blog! I found it while browsing on Yahoo News. Do you have any tips on how to get listed in Yahoo News? I’ve been trying for a while but I never seem to get there! Thank you

Simply a smiling visitor here to share the love (:, btw outstanding pattern.

Appreciate it for this grand post, I am glad I noticed this internet site on yahoo.

What¦s Going down i am new to this, I stumbled upon this I’ve discovered It absolutely helpful and it has helped me out loads. I’m hoping to give a contribution & assist other customers like its aided me. Good job.

I genuinely enjoy looking at on this site, it has got superb posts. “The living is a species of the dead and not a very attractive one.” by Friedrich Wilhelm Nietzsche.

Hiya, I am really glad I’ve found this info. Nowadays bloggers publish only about gossips and net and this is actually annoying. A good website with interesting content, that is what I need. Thanks for keeping this website, I will be visiting it. Do you do newsletters? Can not find it.

Thank you for some other wonderful post. The place else may anyone get that kind of info in such a perfect approach of writing? I’ve a presentation subsequent week, and I’m at the look for such information.

Pretty! This was a really wonderful post. Thank you for your provided information.

I am really enjoying the theme/design of your weblog. Do you ever run into any web browser compatibility problems? A handful of my blog audience have complained about my website not working correctly in Explorer but looks great in Chrome. Do you have any ideas to help fix this issue?

Generally I don’t read article on blogs, but I wish to say that this write-up very forced me to try and do so! Your writing style has been amazed me. Thanks, quite nice post.

he blog was how do i say it… relevant, finally something that helped me. Thanks

I think you have noted some very interesting points, thankyou for the post.

I have been browsing on-line more than 3 hours these days, yet I by no means discovered any interesting article like yours. It is pretty value enough for me. In my view, if all web owners and bloggers made just right content material as you did, the web will probably be a lot more helpful than ever before.

Thank you for sharing excellent informations. Your web-site is very cool. I’m impressed by the details that you have on this web site. It reveals how nicely you understand this subject. Bookmarked this web page, will come back for extra articles. You, my pal, ROCK! I found just the information I already searched all over the place and just couldn’t come across. What a great website.

F*ckin’ amazing things here. I am very glad to see your article. Thanks a lot and i’m looking forward to contact you. Will you kindly drop me a mail?

Very well written story. It will be useful to everyone who usess it, including myself. Keep up the good work – i will definitely read more posts.

Thanks for sharing superb informations. Your site is so cool. I’m impressed by the details that you have on this web site. It reveals how nicely you perceive this subject. Bookmarked this website page, will come back for more articles. You, my pal, ROCK! I found simply the info I already searched everywhere and simply could not come across. What a perfect web site.

Glad to be one of several visitors on this awing site : D.

There is noticeably a bundle to find out about this. I assume you made sure good points in options also.

I would like to thnkx for the efforts you have put in writing this blog. I am hoping the same high-grade blog post from you in the upcoming as well. In fact your creative writing abilities has inspired me to get my own blog now. Really the blogging is spreading its wings quickly. Your write up is a good example of it.

Does your site have a contact page? I’m having a tough time locating it but, I’d like to send you an email. I’ve got some ideas for your blog you might be interested in hearing. Either way, great website and I look forward to seeing it grow over time.

I conceive this web site has got some real fantastic information for everyone :D. “Years wrinkle the skin, but to give up enthusiasm wrinkles the soul.” by Samuel Ullman.

You really make it seem really easy along with your presentation however I find this topic to be actually one thing that I feel I might never understand. It kind of feels too complex and very wide for me. I am having a look ahead in your subsequent publish, I will attempt to get the hang of it!

Thanks for this post, I am a big fan of this site would like to proceed updated.

Hey there! I know this is somewhat off topic but I was wondering if you knew where I could locate a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having problems finding one? Thanks a lot!

Have you heard about ThyraFemme Balance? This natural supplement is becoming a sensation among women worldwide because it provides a real, safe, and natural solution for those struggling with hormonal imbalance, slow metabolism, weight gain, fatigue, and lack of energy.

I’d have to examine with you here. Which is not one thing I usually do! I take pleasure in reading a post that may make folks think. Additionally, thanks for permitting me to comment!

I like this internet site because so much useful material on here : D.

Flash Burn is a revolutionary natural supplement that has been transforming the lives of thousands of people struggling with excess weight. Developed with a 100 natural and scientifically proven formula

The Pink Salt Trick is a minimalist but effective morning routine: Just drink a glass of lukewarm water mixed with a pinch of Himalayan pink salt as soon as you wake up.

I’ve been browsing online more than 3 hours today, yet I never found any interesting article like yours. It’s pretty worth enough for me. In my opinion, if all website owners and bloggers made good content as you did, the net will be a lot more useful than ever before.

Hi, i feel that i saw you visited my blog thus i got here to “go back the choose”.I am attempting to find issues to improve my website!I suppose its ok to use a few of your ideas!!

Great – I should certainly pronounce, impressed with your website. I had no trouble navigating through all tabs as well as related info ended up being truly easy to do to access. I recently found what I hoped for before you know it at all. Quite unusual. Is likely to appreciate it for those who add forums or anything, site theme . a tones way for your client to communicate. Nice task..

I have recently started a web site, the info you offer on this web site has helped me tremendously. Thank you for all of your time & work.

I am often to blogging and i really appreciate your content. The article has really peaks my interest. I am going to bookmark your site and keep checking for new information.

I enjoy your piece of work, appreciate it for all the great posts.

Hey there! I just wanted to ask if you ever have any trouble with hackers? My last blog (wordpress) was hacked and I ended up losing months of hard work due to no data backup. Do you have any methods to stop hackers?

I truly appreciate this post. I¦ve been looking everywhere for this! Thank goodness I found it on Bing. You have made my day! Thx again

Hi! I know this is kinda off topic but I was wondering if you knew where I could locate a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having difficulty finding one? Thanks a lot!

This is very attention-grabbing, You are an overly skilled blogger. I have joined your rss feed and look forward to searching for extra of your fantastic post. Also, I have shared your website in my social networks!

It is really a nice and helpful piece of information. I am happy that you simply shared this useful information with us. Please stay us up to date like this. Thanks for sharing.

Valuable info. Lucky me I found your web site by accident, and I’m shocked why this accident didn’t happened earlier! I bookmarked it.

Hello there I am so excited I found your blog page, I really found you by mistake, while I was searching on Bing for something else, Nonetheless I am here now and would just like to say many thanks for a fantastic post and a all round interesting blog (I also love the theme/design), I don’t have time to read through it all at the minute but I have saved it and also added your RSS feeds, so when I have time I will be back to read more, Please do keep up the great work.

I do accept as true with all of the ideas you’ve offered for your post. They are really convincing and can certainly work. Still, the posts are too brief for starters. May you please prolong them a little from subsequent time? Thank you for the post.

Great info and right to the point. I am not sure if this is really the best place to ask but do you folks have any ideea where to hire some professional writers? Thx 🙂

Heya i’m for the first time here. I came across this board and I find It really useful & it helped me out a lot. I hope to give something back and aid others like you helped me.

Wow! Thank you! I continually needed to write on my website something like that. Can I include a portion of your post to my website?

I’ll right away snatch your rss as I can’t to find your e-mail subscription hyperlink or newsletter service. Do you’ve any? Please permit me realize so that I may just subscribe. Thanks.

Virtually all of whatever you assert is astonishingly appropriate and it makes me ponder the reason why I hadn’t looked at this in this light previously. This particular article really did turn the light on for me as far as this specific subject goes. Nonetheless at this time there is one particular position I am not necessarily too comfy with so while I make an effort to reconcile that with the actual main theme of your issue, allow me observe exactly what the rest of the subscribers have to point out.Very well done.

Good write-up, I am normal visitor of one¦s website, maintain up the nice operate, and It is going to be a regular visitor for a lengthy time.

I’m really impressed with your writing skills and also with the layout on your blog. Is this a paid theme or did you customize it yourself? Either way keep up the nice quality writing, it’s rare to see a great blog like this one today..

Great amazing issues here. I?¦m very happy to peer your post. Thank you a lot and i am taking a look forward to contact you. Will you please drop me a mail?

After study a few of the blog posts on your website now, and I truly like your way of blogging. I bookmarked it to my bookmark website list and will be checking back soon. Pls check out my web site as well and let me know what you think.

Greetings! This is my first comment here so I just wanted to give a quick shout out and tell you I really enjoy reading through your posts. Can you recommend any other blogs/websites/forums that deal with the same subjects? Appreciate it!

My brother recommended I would possibly like this website. He used to be entirely right. This publish truly made my day. You can not consider just how much time I had spent for this information! Thanks!

Thank you for sharing with us, I think this website genuinely stands out : D.

Your place is valueble for me. Thanks!…

I as well think hence, perfectly indited post! .

I’m truly enjoying the design and layout of your site. It’s a very easy on the eyes which makes it much more pleasant for me to come here and visit more often. Did you hire out a developer to create your theme? Outstanding work!

I like what you guys are up also. Such smart work and reporting! Keep up the superb works guys I?¦ve incorporated you guys to my blogroll. I think it’ll improve the value of my web site 🙂

I like what you guys are up also. Such clever work and reporting! Keep up the excellent works guys I?¦ve incorporated you guys to my blogroll. I think it will improve the value of my web site 🙂

hi!,I really like your writing very so much! share we communicate more about your post on AOL? I require an expert in this area to unravel my problem. May be that is you! Having a look ahead to peer you.

That is the correct blog for anybody who desires to find out about this topic. You understand so much its almost laborious to argue with you (not that I really would need…HaHa). You undoubtedly put a new spin on a subject thats been written about for years. Nice stuff, just nice!

Wow, fantastic blog structure! How lengthy have you been running a blog for? you made blogging glance easy. The full look of your website is magnificent, let alone the content material!

Thank you for your own work on this web site. My mum really loves engaging in internet research and it’s really obvious why. Most of us learn all relating to the dynamic manner you provide efficient information by means of the web blog and as well improve response from others on this concept so our simple princess is now starting to learn a lot. Take advantage of the rest of the new year. You’re the one doing a really good job.

Hi , I do believe this is an excellent blog. I stumbled upon it on Yahoo , i will come back once again. Money and freedom is the best way to change, may you be rich and help other people.

Wonderful site. Plenty of helpful information here. I¦m sending it to some buddies ans also sharing in delicious. And certainly, thank you on your effort!

I loved as much as you’ll receive carried out right here. The sketch is attractive, your authored subject matter stylish. nonetheless, you command get got an impatience over that you wish be delivering the following. unwell unquestionably come further formerly again as exactly the same nearly a lot often inside case you shield this hike.

Wohh precisely what I was searching for, thanks for posting.

I?¦ve recently started a web site, the info you provide on this site has helped me tremendously. Thank you for all of your time & work.

Thank you for sharing superb informations. Your web site is very cool. I’m impressed by the details that you’ve on this blog. It reveals how nicely you perceive this subject. Bookmarked this website page, will come back for more articles. You, my pal, ROCK! I found simply the information I already searched everywhere and simply couldn’t come across. What a great site.

Regards for helping out, fantastic information. “Whoever obeys the gods, to him they particularly listen.” by Homer.

I love your blog.. very nice colors & theme. Did you create this website yourself? Plz reply back as I’m looking to create my own blog and would like to know wheere u got this from. thanks

Generally I don’t read post on blogs, but I wish to say that this write-up very forced me to try and do so! Your writing style has been surprised me. Thanks, very nice post.

good post.Ne’er knew this, thanks for letting me know.

I like this site very much, Its a really nice spot to read and receive information. “I have found that if you love life, life will love you back.” by Arthur Rubinstein.

As I web-site possessor I believe the content matter here is rattling excellent , appreciate it for your hard work. You should keep it up forever! Best of luck.

I am really enjoying the theme/design of your weblog. Do you ever run into any internet browser compatibility problems? A few of my blog readers have complained about my site not operating correctly in Explorer but looks great in Firefox. Do you have any solutions to help fix this problem?

I haven’t checked in here for a while as I thought it was getting boring, but the last few posts are great quality so I guess I will add you back to my daily bloglist. You deserve it my friend 🙂

You got a very wonderful website, Gladiola I found it through yahoo.

Very nice post. I just stumbled upon your blog and wished to say that I’ve really enjoyed browsing your blog posts. In any case I will be subscribing to your feed and I hope you write again very soon!

The very root of your writing while appearing agreeable originally, did not sit well with me personally after some time. Someplace within the sentences you were able to make me a believer unfortunately just for a while. I still have a problem with your jumps in logic and one might do well to help fill in those gaps. In the event that you actually can accomplish that, I will surely end up being amazed.

Hello, Neat post. There is an issue along with your site in web explorer, could check thisK IE nonetheless is the marketplace chief and a big section of people will omit your wonderful writing because of this problem.

Great post. I am facing a couple of these problems.

Hi there I am so thrilled I found your web site, I really found you by error, while I was browsing on Askjeeve for something else, Anyways I am here now and would just like to say many thanks for a remarkable post and a all round entertaining blog (I also love the theme/design), I don’t have time to go through it all at the minute but I have saved it and also added in your RSS feeds, so when I have time I will be back to read a great deal more, Please do keep up the excellent work.

The heart of your writing while appearing reasonable initially, did not really sit very well with me after some time. Someplace within the sentences you actually were able to make me a believer but only for a very short while. I still have a problem with your leaps in logic and you would do nicely to help fill in all those gaps. If you can accomplish that, I will definitely end up being amazed.

I very delighted to find this internet site on bing, just what I was looking for : D likewise bookmarked.

I used to be suggested this website through my cousin. I am no longer positive whether or not this post is written by means of him as no one else recognize such precise about my trouble. You’re wonderful! Thank you!

I am continuously searching online for ideas that can benefit me. Thx!

I love the efforts you have put in this, thanks for all the great posts.

I’m still learning from you, while I’m making my way to the top as well. I absolutely love reading everything that is written on your website.Keep the posts coming. I liked it!

The next time I read a blog, I hope that it doesnt disappoint me as much as this one. I mean, I know it was my choice to read, but I actually thought youd have something interesting to say. All I hear is a bunch of whining about something that you could fix if you werent too busy looking for attention.

Lovely just what I was searching for.Thanks to the author for taking his time on this one.

At this time it looks like Drupal is the top blogging platform out there right now. (from what I’ve read) Is that what you’re using on your blog?

I love your blog.. very nice colors & theme. Did you create this website yourself? Plz reply back as I’m looking to create my own blog and would like to know wheere u got this from. thanks

hello!,I like your writing so much! share we communicate more about your article on AOL? I need an expert on this area to solve my problem. Maybe that’s you! Looking forward to see you.

I’ve been absent for some time, but now I remember why I used to love this website. Thanks , I will try and check back more often. How frequently you update your web site?

Good – I should definitely pronounce, impressed with your web site. I had no trouble navigating through all the tabs as well as related info ended up being truly simple to do to access. I recently found what I hoped for before you know it at all. Reasonably unusual. Is likely to appreciate it for those who add forums or anything, site theme . a tones way for your customer to communicate. Nice task.

Hi! I’m at work surfing around your blog from my new iphone 4! Just wanted to say I love reading your blog and look forward to all your posts! Keep up the superb work!

Hello, i believe that i noticed you visited my website so i got here to “return the choose”.I’m trying to find things to enhance my website!I guess its adequate to use a few of your ideas!!

Wonderful work! This is the type of information that should be shared around the internet. Shame on Google for not positioning this post higher! Come on over and visit my website . Thanks =)

Hey! I know this is kind of off topic but I was wondering which blog platform are you using for this site? I’m getting fed up of WordPress because I’ve had issues with hackers and I’m looking at options for another platform. I would be fantastic if you could point me in the direction of a good platform.

I am continually searching online for ideas that can aid me. Thank you!

I found your weblog web site on google and verify a number of of your early posts. Continue to keep up the superb operate. I simply further up your RSS feed to my MSN News Reader. Seeking ahead to reading more from you afterward!…

You really make it seem so easy with your presentation but I find this matter to be really something which I think I would never understand. It seems too complex and very broad for me. I am looking forward for your next post, I will try to get the hang of it!

I don’t commonly comment but I gotta tell thankyou for the post on this great one : D.

I’d need to test with you here. Which is not one thing I normally do! I get pleasure from studying a submit that may make folks think. Additionally, thanks for permitting me to remark!

li3zjz

I’ve been surfing online more than three hours today, yet I never found any interesting article like yours. It is pretty worth enough for me. In my view, if all website owners and bloggers made good content as you did, the net will be a lot more useful than ever before.

Hi, Neat post. There’s a problem along with your website in internet explorer, could check thisK IE still is the market chief and a good portion of other people will miss your magnificent writing due to this problem.

I?¦ll right away seize your rss feed as I can’t in finding your e-mail subscription hyperlink or e-newsletter service. Do you’ve any? Please allow me know in order that I could subscribe. Thanks.

Good – I should certainly pronounce, impressed with your website. I had no trouble navigating through all tabs and related information ended up being truly simple to do to access. I recently found what I hoped for before you know it in the least. Quite unusual. Is likely to appreciate it for those who add forums or anything, web site theme . a tones way for your customer to communicate. Excellent task..

Excellent post. I was checking continuously this blog and I’m inspired! Very useful information particularly the closing phase 🙂 I deal with such information much. I used to be looking for this particular information for a long time. Thanks and best of luck.

I like this website because so much useful material on here : D.

Great post. I was checking continuously this blog and I am impressed! Extremely helpful information specifically the last part 🙂 I care for such info much. I was looking for this particular info for a long time. Thank you and best of luck.

Merely a smiling visitant here to share the love (:, btw outstanding style and design.

Keep up the superb piece of work, I read few articles on this website and I think that your web site is rattling interesting and contains sets of wonderful information.

You are my inhalation, I possess few blogs and infrequently run out from to brand : (.

I visited a lot of website but I conceive this one contains something special in it in it

I’ve recently started a site, the information you offer on this web site has helped me tremendously. Thanks for all of your time & work.

Hi there, i read your blog from time to time and i own a similar one and i was just curious if you get a lot of spam feedback? If so how do you protect against it, any plugin or anything you can recommend? I get so much lately it’s driving me mad so any support is very much appreciated.

Howdy! Quick question that’s completely off topic. Do you know how to make your site mobile friendly? My weblog looks weird when viewing from my iphone4. I’m trying to find a theme or plugin that might be able to resolve this problem. If you have any recommendations, please share. Many thanks!

Hi there! Quick question that’s completely off topic. Do you know how to make your site mobile friendly? My web site looks weird when browsing from my iphone 4. I’m trying to find a theme or plugin that might be able to fix this problem. If you have any suggestions, please share. Many thanks!

This blog is definitely rather handy since I’m at the moment creating an internet floral website – although I am only starting out therefore it’s really fairly small, nothing like this site. Can link to a few of the posts here as they are quite. Thanks much. Zoey Olsen

I’m very happy to read this. This is the type of manual that needs to be given and not the accidental misinformation that is at the other blogs. Appreciate your sharing this greatest doc.

I like the efforts you have put in this, appreciate it for all the great articles.

This blog is definitely rather handy since I’m at the moment creating an internet floral website – although I am only starting out therefore it’s really fairly small, nothing like this site. Can link to a few of the posts here as they are quite. Thanks much. Zoey Olsen

Very interesting points you have mentioned, appreciate it for posting. “It’s the soul’s duty to be loyal to its own desires. It must abandon itself to its master passion.” by Rebecca West.

Its great as your other posts : D, regards for putting up.

I have recently started a web site, the info you provide on this website has helped me greatly. Thanks for all of your time & work.

This is really interesting, You’re a very skilled blogger. I’ve joined your feed and look forward to seeking more of your excellent post. Also, I have shared your website in my social networks!

What i do not realize is if truth be told how you are now not actually much more smartly-preferred than you might be now. You’re so intelligent. You understand therefore considerably in terms of this subject, produced me in my view imagine it from numerous varied angles. Its like men and women are not interested except it’s something to do with Lady gaga! Your own stuffs nice. All the time take care of it up!

hey there and thank you for your info – I’ve definitely picked up something new from right here. I did however expertise some technical points using this website, since I experienced to reload the site a lot of times previous to I could get it to load properly. I had been wondering if your web hosting is OK? Not that I’m complaining, but sluggish loading instances times will sometimes affect your placement in google and could damage your high quality score if advertising and marketing with Adwords. Well I’m adding this RSS to my e-mail and can look out for a lot more of your respective exciting content. Make sure you update this again very soon..

Enjoyed looking through this, very good stuff, thanks.

Wow, amazing blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your website is magnificent, let alone the content!

You are my intake, I have few blogs and rarely run out from post :). “He who controls the past commands the future. He who commands the future conquers the past.” by George Orwell.

Hello There. I found your blog the use of msn. This is an extremely neatly written article. I will be sure to bookmark it and return to read extra of your useful information. Thank you for the post. I will certainly return.

obviously like your web-site however you need to test the spelling on several of your posts. Many of them are rife with spelling issues and I find it very troublesome to tell the reality nevertheless I’ll certainly come again again.

Really Appreciate this update, is there any way I can receive an alert email when there is a new post?

I will right away seize your rss as I can’t find your email subscription hyperlink or e-newsletter service. Do you’ve any? Kindly let me understand so that I could subscribe. Thanks.

I have recently started a blog, the information you provide on this web site has helped me greatly. Thank you for all of your time & work.

I feel this is one of the so much important information for me. And i am satisfied reading your article. But wanna statement on few basic issues, The web site taste is wonderful, the articles is truly great : D. Just right task, cheers

It’s exhausting to seek out educated people on this subject, however you sound like you already know what you’re speaking about! Thanks

hi!,I like your writing very much! share we communicate more about your article on AOL? I require an expert on this area to solve my problem. Maybe that’s you! Looking forward to see you.

I think this is among the most important information for me. And i’m glad reading your article. But should remark on some general things, The site style is perfect, the articles is really excellent : D. Good job, cheers

Hello there! Would you mind if I share your blog with my myspace group? There’s a lot of folks that I think would really appreciate your content. Please let me know. Thanks

I am not real excellent with English but I find this very leisurely to understand.

Wonderful goods from you, man. I’ve keep in mind your stuff prior to and you’re simply too wonderful. I actually like what you’ve received here, certainly like what you are saying and the way through which you say it. You are making it enjoyable and you still care for to keep it sensible. I can not wait to learn far more from you. That is actually a wonderful web site.

Wow, wonderful blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your web site is magnificent, as well as the content!

Rattling wonderful information can be found on web site. “Every obstacle yields to stern resolve.” by Leonardo DaVinci.

I have recently started a web site, the information you provide on this website has helped me tremendously. Thanks for all of your time & work.

Hello! I simply want to give an enormous thumbs up for the good data you could have right here on this post. I might be coming again to your weblog for more soon.

Hi, I think your website might be having browser compatibility issues. When I look at your blog site in Chrome, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, superb blog!

Wohh just what I was looking for, regards for posting.

Good post. I learn something more difficult on different blogs everyday. It’s going to at all times be stimulating to learn content from different writers and observe a little something from their store. I’d want to use some with the content on my blog whether or not you don’t mind. Natually I’ll offer you a hyperlink on your web blog. Thanks for sharing.

I just couldn’t leave your web site before suggesting that I extremely loved the usual info a person supply in your guests? Is going to be again frequently in order to inspect new posts

Wow! Thank you! I continually needed to write on my blog something like that. Can I take a part of your post to my site?

Hello there, You have done a great job. I will definitely digg it and personally recommend to my friends. I am sure they’ll be benefited from this web site.

An interesting discussion is worth comment. I think that you should write more on this topic, it might not be a taboo subject but generally people are not enough to speak on such topics. To the next. Cheers

Great post. I am facing a couple of these problems.

I always was concerned in this topic and stock still am, thankyou for putting up.

F*ckin’ remarkable issues here. I am very satisfied to see your post. Thank you so much and i am having a look ahead to contact you. Will you please drop me a e-mail?

Good day very cool website!! Guy .. Excellent .. Wonderful .. I will bookmark your blog and take the feeds also?KI am satisfied to seek out numerous helpful info right here in the publish, we want work out extra strategies on this regard, thank you for sharing. . . . . .

hi!,I love your writing very a lot! percentage we communicate more approximately your post on AOL? I need an expert in this space to solve my problem. Maybe that’s you! Looking forward to peer you.

I have been examinating out a few of your stories and i can state pretty clever stuff. I will definitely bookmark your blog.

Thank you for some other informative site. The place else may just I get that kind of information written in such an ideal way? I have a venture that I am just now running on, and I have been at the glance out for such info.

I am not really excellent with English but I line up this very leisurely to understand.

Amazing blog! Is your theme custom made or did you download it from somewhere? A theme like yours with a few simple tweeks would really make my blog shine. Please let me know where you got your theme. Many thanks

Only wanna remark on few general things, The website pattern is perfect, the content material is real great. “I have seen the future and it doesn’t work.” by Robert Fulford.

Attractive section of content. I just stumbled upon your blog and in accession capital to assert that I get actually enjoyed account your blog posts. Anyway I’ll be subscribing to your augment and even I achievement you access consistently quickly.

Hello! I just would like to give a huge thumbs up for the great info you have here on this post. I will be coming back to your blog for more soon.

I do not even know the way I ended up right here, however I believed this publish used to be great. I don’t know who you’re but definitely you’re going to a famous blogger in the event you are not already 😉 Cheers!

Awesome blog! Is your theme custom made or did you download it from somewhere? A design like yours with a few simple adjustements would really make my blog shine. Please let me know where you got your theme. Many thanks

As a Newbie, I am always browsing online for articles that can be of assistance to me. Thank you

I’m still learning from you, but I’m trying to reach my goals. I absolutely liked reading all that is posted on your blog.Keep the aarticles coming. I loved it!

I do accept as true with all of the ideas you have introduced to your post. They’re really convincing and will certainly work. Nonetheless, the posts are too short for starters. Could you please prolong them a bit from next time? Thank you for the post.

Fantastic website. Lots of useful info here. I?¦m sending it to several pals ans also sharing in delicious. And of course, thank you to your effort!

whoah this weblog is excellent i like reading your articles. Stay up the good paintings! You already know, lots of persons are looking around for this info, you could help them greatly.

Great post. I was checking constantly this blog and I’m impressed! Very helpful info specifically the last part 🙂 I care for such information a lot. I was seeking this particular information for a long time. Thank you and best of luck.

Simply a smiling visitant here to share the love (:, btw outstanding style.

Thank you for another wonderful post. Where else could anybody get that kind of information in such a perfect way of writing? I have a presentation next week, and I am on the look for such information.

Thanks for the sensible critique. Me and my neighbor were just preparing to do some research about this. We got a grab a book from our local library but I think I learned more from this post. I’m very glad to see such magnificent information being shared freely out there.

Wow, fantastic blog format! How long have you been running a blog for? you make running a blog look easy. The full glance of your website is wonderful, as smartly as the content!

Практичний домашній https://publish.com.ua онлайн-журнал: планинг тижня, закупівлі без зайвого, рецепти з доступних продуктів, догляд за поверхнями, сезонні проекти. Тільки у справі, без клікбейту. Зручна навігація та матеріали, до яких хочеться повертатися.

Нужен тахеометр? аренда тахеометра Sokkia по выгодной цене. Современные модели для геодезических и строительных работ. Калибровка, проверка, доставка по городу и области. Гибкие сроки — от 1 дня. Консультации инженеров и техническая поддержка.

I have not checked in here for a while as I thought it was getting boring, but the last few posts are good quality so I guess I?¦ll add you back to my daily bloglist. You deserve it my friend 🙂

You actually make it seem so easy with your presentation but I find this matter to be actually something that I think I would never understand. It seems too complicated and extremely broad for me. I’m looking forward for your next post, I will try to get the hang of it!

I’ve read several good stuff here. Definitely worth bookmarking for revisiting. I surprise how much effort you put to make such a fantastic informative website.

I like this web blog so much, saved to bookmarks.

This is really fascinating, You are an excessively skilled blogger. I have joined your feed and stay up for searching for extra of your excellent post. Additionally, I have shared your website in my social networks!

Nice blog here! Also your site loads up very fast! What web host are you using? Can I get your affiliate link to your host? I wish my website loaded up as quickly as yours lol

You have brought up a very excellent points, thankyou for the post.

This site is my inhalation, rattling good style and design and perfect written content.

Well I truly enjoyed studying it. This post provided by you is very helpful for correct planning.

As I site possessor I believe the content matter here is rattling great , appreciate it for your hard work. You should keep it up forever! Best of luck.

Woh I like your articles, saved to my bookmarks! .

Perfect work you have done, this internet site is really cool with wonderful info .

Some really interesting information, well written and generally user genial.

It’s really a great and helpful piece of information. I am satisfied that you shared this useful information with us. Please keep us up to date like this. Thank you for sharing.

We’re a bunch of volunteers and starting a new scheme in our community. Your website provided us with valuable info to work on. You’ve performed a formidable process and our whole community will probably be grateful to you.

Excellent blog here! Also your site lots up fast! What host are you the usage of? Can I am getting your associate hyperlink in your host? I want my web site loaded up as quickly as yours lol

Currently it seems like Expression Engine is the preferred blogging platform available right now. (from what I’ve read) Is that what you’re using on your blog?

I really like your writing style, excellent information, thanks for putting up :D. “Faith is a continuation of reason.” by William Adams.

I really like your writing style, superb info, regards for putting up :D. “In university they don’t tell you that the greater part of the law is learning to tolerate fools.” by Doris Lessing.

Admiring the time and effort you put into your site and detailed information you provide. It’s awesome to come across a blog every once in a while that isn’t the same out of date rehashed material. Wonderful read! I’ve bookmarked your site and I’m adding your RSS feeds to my Google account.

Hi, Neat post. There is an issue with your website in web explorer, could test this?K IE still is the marketplace leader and a good component to people will miss your great writing because of this problem.

It’s onerous to seek out knowledgeable individuals on this subject, however you sound like you recognize what you’re talking about! Thanks

Hi my friend! I wish to say that this article is awesome, great written and come with almost all significant infos. I’d like to see more posts like this.

Thanks for sharing superb informations. Your site is very cool. I am impressed by the details that you have on this site. It reveals how nicely you understand this subject. Bookmarked this website page, will come back for more articles. You, my friend, ROCK! I found simply the info I already searched everywhere and simply could not come across. What a perfect website.

I haven¦t checked in here for a while since I thought it was getting boring, but the last several posts are good quality so I guess I¦ll add you back to my daily bloglist. You deserve it my friend 🙂

Real wonderful visual appeal on this web site, I’d rate it 10 10.

I’m commenting to let you be aware of what a fantastic experience my princess found checking your web site. She picked up some details, most notably what it is like to possess an amazing coaching mood to let folks smoothly know specific multifaceted subject areas. You undoubtedly exceeded our own expectations. I appreciate you for presenting the helpful, safe, explanatory as well as fun tips about this topic to Tanya.

I am glad to be a visitor of this complete website! , thankyou for this rare information! .

Hello, you used to write great, but the last few posts have been kinda boring?K I miss your tremendous writings. Past several posts are just a little out of track! come on!

I enjoy gathering utile info, this post has got me even more info! .

I believe this website holds some rattling fantastic info for everyone :D. “We rarely think people have good sense unless they agree with us.” by Francois de La Rochefoucauld.

You are my intake, I own few web logs and occasionally run out from to post : (.

I have recently started a web site, the info you provide on this web site has helped me greatly. Thanks for all of your time & work. “Character is much easier kept than recovered.” by Thomas Paine.

I like this blog very much so much wonderful information.

Definitely, what a magnificent blog and revealing posts, I surely will bookmark your blog.Best Regards!

Your home is valueble for me. Thanks!…

Some genuinely excellent info , Gladiolus I noticed this.

Most of whatever you state happens to be supprisingly accurate and it makes me wonder the reason why I hadn’t looked at this in this light before. Your piece truly did switch the light on for me personally as far as this particular topic goes. However there is one particular issue I am not really too cozy with so while I attempt to reconcile that with the main idea of the point, let me observe what the rest of the subscribers have to point out.Nicely done.

There’s noticeably a bundle to know about this. I assume you made certain good factors in options also.

Pretty! This was a really wonderful post. Thank you for your provided information.

I’ve been exploring for a little bit for any high-quality articles or weblog posts on this kind of space . Exploring in Yahoo I finally stumbled upon this website. Studying this information So i am glad to exhibit that I have a very good uncanny feeling I found out just what I needed. I so much indubitably will make sure to don’t put out of your mind this website and provides it a glance regularly.

I don’t normally comment but I gotta say regards for the post on this great one : D.

Fantastic website. Plenty of useful information here. I’m sending it to a few buddies ans also sharing in delicious. And certainly, thank you to your sweat!

I’d have to examine with you here. Which is not one thing I usually do! I take pleasure in reading a post that may make folks think. Additionally, thanks for permitting me to comment!

I am not certain the place you are getting your info, but good topic. I must spend a while finding out much more or understanding more. Thanks for great info I used to be looking for this information for my mission.

Simply desire to say your article is as amazing. The clearness for your publish is just nice and that i could think you are knowledgeable on this subject. Well with your permission let me to snatch your feed to keep updated with impending post. Thanks a million and please keep up the rewarding work.

Excellent website. Plenty of helpful information here. I’m sending it to some buddies ans also sharing in delicious. And of course, thank you to your sweat!

Howdy would you mind sharing which blog platform you’re working with? I’m looking to start my own blog soon but I’m having a difficult time choosing between BlogEngine/Wordpress/B2evolution and Drupal. The reason I ask is because your design and style seems different then most blogs and I’m looking for something completely unique. P.S Sorry for getting off-topic but I had to ask!

I have been exploring for a little bit for any high-quality articles or blog posts in this sort of space . Exploring in Yahoo I eventually stumbled upon this site. Studying this information So i am happy to express that I’ve a very excellent uncanny feeling I came upon exactly what I needed. I so much definitely will make certain to do not disregard this site and provides it a look regularly.

Hello! I’ve been reading your site for a long time now and finally got the courage to go ahead and give you a shout out from Dallas Texas! Just wanted to tell you keep up the good work!

This is the right blog for anyone who wants to find out about this topic. You realize so much its almost hard to argue with you (not that I actually would want…HaHa). You definitely put a new spin on a topic thats been written about for years. Great stuff, just great!

Hi there! This post couldn’t be written any better! Reading through this post reminds me of my previous room mate! He always kept talking about this. I will forward this article to him. Pretty sure he will have a good read. Thank you for sharing!

I admire your work, thanks for all the informative blog posts.

Hiya, I’m really glad I have found this information. Today bloggers publish only about gossips and net and this is actually frustrating. A good site with interesting content, this is what I need. Thanks for keeping this web-site, I’ll be visiting it. Do you do newsletters? Cant find it.

Heya i am for the primary time here. I found this board and I in finding It truly useful & it helped me out much. I am hoping to offer one thing again and aid others like you aided me.

When I originally commented I clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I get four emails with the same comment. Is there any way you can remove me from that service? Thanks!

I’m not sure exactly why but this weblog is loading extremely slow for me. Is anyone else having this problem or is it a issue on my end? I’ll check back later on and see if the problem still exists.

I discovered your blog site on google and test just a few of your early posts. Proceed to keep up the very good operate. I simply extra up your RSS feed to my MSN Information Reader. Searching for forward to reading extra from you later on!…

I have been checking out some of your stories and i must say pretty good stuff. I will make sure to bookmark your site.

Can I just say what a relief to find someone who actually knows what theyre talking about on the internet. You definitely know how to bring an issue to light and make it important. More people need to read this and understand this side of the story. I cant believe youre not more popular because you definitely have the gift.

Hi, Neat post. There’s a problem with your web site in internet explorer, would check this… IE still is the market leader and a big portion of people will miss your fantastic writing due to this problem.

I have been exploring for a little bit for any high quality articles or weblog posts on this sort of space . Exploring in Yahoo I eventually stumbled upon this website. Reading this info So i am satisfied to show that I’ve a very excellent uncanny feeling I discovered exactly what I needed. I such a lot surely will make certain to don’t disregard this website and give it a look on a constant basis.

I appreciate, cause I found just what I was looking for. You’ve ended my 4 day long hunt! God Bless you man. Have a nice day. Bye

Hi, Neat post. There is a problem with your site in internet explorer, would check this… IE still is the market leader and a good portion of people will miss your wonderful writing because of this problem.

I wanted to thank you for this great read!! I definitely enjoying every little bit of it I have you bookmarked to check out new stuff you post…

Excellent post. I was checking constantly this blog and I am impressed! Very useful information particularly the last part 🙂 I care for such information much. I was looking for this certain info for a long time. Thank you and good luck.

I have been exploring for a little for any high quality articles or blog posts on this sort of area . Exploring in Yahoo I at last stumbled upon this website. Reading this information So i am happy to convey that I’ve a very good uncanny feeling I discovered just what I needed. I most certainly will make sure to do not forget this site and give it a glance on a constant basis.

Very interesting information!Perfect just what I was searching for!

I went over this site and I believe you have a lot of great info , saved to my bookmarks (:.

Wow that was strange. I just wrote an very long comment but after I clicked submit my comment didn’t appear. Grrrr… well I’m not writing all that over again. Regardless, just wanted to say great blog!

Hey very nice web site!! Man .. Excellent .. Amazing .. I’ll bookmark your site and take the feeds also…I am happy to find numerous useful information here in the post, we need develop more techniques in this regard, thanks for sharing. . . . . .

Good day! This is my 1st comment here so I just wanted to give a quick shout out and say I really enjoy reading through your posts. Can you suggest any other blogs/websites/forums that deal with the same topics? Thanks a ton!

I think you have noted some very interesting points, regards for the post.

When I originally commented I clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I get four emails with the same comment. Is there any way you can remove me from that service? Thanks!

Great ?V I should certainly pronounce, impressed with your site. I had no trouble navigating through all the tabs as well as related info ended up being truly easy to do to access. I recently found what I hoped for before you know it at all. Reasonably unusual. Is likely to appreciate it for those who add forums or something, web site theme . a tones way for your client to communicate. Nice task..

You really make it seem so easy with your presentation but I find this topic to be really something that I think I would never understand. It seems too complicated and very broad for me. I’m looking forward for your next post, I will try to get the hang of it!

Hello! I just would like to give a huge thumbs up for the great info you have here on this post. I will be coming back to your blog for more soon.

I enjoy the efforts you have put in this, thank you for all the great blog posts.

I rattling happy to find this web site on bing, just what I was looking for : D too saved to my bookmarks.

It¦s truly a great and helpful piece of info. I am satisfied that you just shared this useful information with us. Please stay us up to date like this. Thank you for sharing.

I’ll right away seize your rss feed as I can’t to find your email subscription link or newsletter service. Do you have any? Kindly permit me understand in order that I could subscribe. Thanks.

Throughout the awesome scheme of things you actually secure a B- with regard to effort and hard work. Exactly where you actually misplaced us was first on all the specifics. You know, it is said, the devil is in the details… And it could not be more correct in this article. Having said that, allow me tell you just what did work. The authoring is actually really persuasive and this is possibly the reason why I am taking the effort in order to comment. I do not make it a regular habit of doing that. 2nd, even though I can certainly see a leaps in logic you come up with, I am definitely not convinced of exactly how you appear to unite your ideas which in turn make the final result. For now I will yield to your position but trust in the near future you link your dots much better.

I like this web blog very much, Its a very nice billet to read and obtain information. “…when you have eliminated the impossible, whatever remains, however improbable, must be the truth.” by Conan Doyle.

Hi there, I found your site via Google while searching for a related topic, your site came up, it looks great. I’ve bookmarked it in my google bookmarks.

magnificent points altogether, you just gained a brand new reader. What would you recommend in regards to your post that you made some days ago? Any positive?

Some genuinely wonderful work on behalf of the owner of this web site, absolutely great subject material.

Саморазвитие: прокачайте навыки с помощью наших подборок статей https://gratiavitae.ru/

I conceive you have mentioned some very interesting details, regards for the post.

Heya just wanted to give you a quick heads up and let you know a few of the pictures aren’t loading properly. I’m not sure why but I think its a linking issue. I’ve tried it in two different web browsers and both show the same results.

I’m often to blogging and i really admire your content. The article has really peaks my interest. I am going to bookmark your web site and hold checking for brand spanking new information.

Hmm is anyone else having problems with the pictures on this blog loading? I’m trying to determine if its a problem on my end or if it’s the blog. Any responses would be greatly appreciated.

I?¦ll right away clutch your rss as I can’t find your email subscription hyperlink or e-newsletter service. Do you’ve any? Kindly let me understand in order that I could subscribe. Thanks.

so much wonderful info on here, : D.

Hello! I just would like to give a huge thumbs up for the great info you have here on this post. I will be coming back to your blog for more soon.

купить perplexity max https://uniqueartworks.ru/perplexity-kupit.html

I¦ve recently started a site, the info you offer on this site has helped me greatly. Thank you for all of your time & work.

Dead written content material, Really enjoyed reading.

Hiya, I’m really glad I have found this info. Today bloggers publish just about gossips and net and this is really frustrating. A good web site with interesting content, that’s what I need. Thanks for keeping this site, I will be visiting it. Do you do newsletters? Can’t find it.

Metabolic Freedom reveals why most diets fail and how to fix your metabolism once and for all. https://metabolicfreedom.top/ metabolic freedom book.com

Greetings! I’ve been following your website for a long time now and finally got the bravery to go ahead and give you a shout out from Porter Tx! Just wanted to tell you keep up the great job!

hi!,I really like your writing very a lot! proportion we keep up a correspondence extra about your post on AOL? I require a specialist in this space to solve my problem. Maybe that’s you! Taking a look ahead to look you.

I discovered your blog site on google and check a few of your early posts. Continue to keep up the very good operate. I just additional up your RSS feed to my MSN News Reader. Seeking forward to reading more from you later on!…

Wow, incredible blog layout! How long have you been blogging for? you made blogging look easy. The overall look of your web site is magnificent, as well as the content!

Hello just wanted to give you a quick heads up. The text in your content seem to be running off the screen in Firefox. I’m not sure if this is a formatting issue or something to do with web browser compatibility but I figured I’d post to let you know. The style and design look great though! Hope you get the problem fixed soon. Thanks

The next time I read a blog, I hope that it doesnt disappoint me as much as this one. I mean, I know it was my choice to read, but I actually thought youd have something interesting to say. All I hear is a bunch of whining about something that you could fix if you werent too busy looking for attention.

Hey There. I found your weblog using msn. This is a very smartly written article. I will make sure to bookmark it and return to read more of your useful info. Thanks for the post. I’ll definitely comeback.

wonderful post.Ne’er knew this, regards for letting me know.

Really nice design and superb subject matter, absolutely nothing else we want : D.

I am perpetually thought about this, thanks for posting.

Only wanna remark on few general things, The website style is perfect, the written content is very excellent : D.

Really wonderful info can be found on website.

https://vk.com/public211532114

Glad to be one of several visitants on this amazing internet site : D.

Howdy! Do you know if they make any plugins to protect against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any tips?

We stumbled over here coming from a different web address and thought I might check things out. I like what I see so now i am following you. Look forward to looking at your web page again.

Fantastic site. Lots of helpful information here. I’m sending it to several pals ans additionally sharing in delicious. And of course, thanks in your effort!

Your place is valueble for me. Thanks!…

The next time I read a blog, I hope that it doesnt disappoint me as much as this one. I mean, I know it was my choice to read, but I actually thought youd have something interesting to say. All I hear is a bunch of whining about something that you could fix if you werent too busy looking for attention.

Undeniably believe that which you stated. Your favorite reason appeared to be on the net the easiest thing to be aware of. I say to you, I definitely get irked while people consider worries that they plainly do not know about. You managed to hit the nail upon the top and defined out the whole thing without having side-effects , people could take a signal. Will probably be back to get more. Thanks

I’ve been surfing on-line greater than 3 hours as of late, but I by no means discovered any attention-grabbing article like yours. It¦s lovely value sufficient for me. In my opinion, if all site owners and bloggers made excellent content material as you did, the web will probably be much more helpful than ever before.

I believe other website proprietors should take this website as an model, very clean and excellent user pleasant design and style.

Very interesting subject, regards for putting up.

Good web site! I truly love how it is easy on my eyes and the data are well written. I am wondering how I might be notified whenever a new post has been made. I have subscribed to your RSS feed which must do the trick! Have a nice day!

You are my inspiration , I have few blogs and very sporadically run out from to post .

Whats Going down i am new to this, I stumbled upon this I have discovered It positively useful and it has aided me out loads. I am hoping to give a contribution & help different customers like its helped me. Great job.

Hello there, simply become alert to your weblog through Google, and located that it is really informative. I’m gonna watch out for brussels. I will be grateful when you continue this in future. Many other people will probably be benefited from your writing. Cheers!

Real clean site, regards for this post.

Super-Duper blog! I am loving it!! Will be back later to read some more. I am bookmarking your feeds also.

The root of your writing whilst sounding agreeable at first, did not really settle perfectly with me personally after some time. Somewhere throughout the sentences you were able to make me a believer unfortunately just for a very short while. I still have a problem with your jumps in logic and you would do well to help fill in those breaks. If you actually can accomplish that, I will surely be impressed.

I would like to thnkx for the efforts you have put in writing this blog. I am hoping the same high-grade blog post from you in the upcoming as well. In fact your creative writing abilities has inspired me to get my own blog now. Really the blogging is spreading its wings quickly. Your write up is a good example of it.

I have not checked in here for a while since I thought it was getting boring, but the last several posts are good quality so I guess I will add you back to my everyday bloglist. You deserve it my friend 🙂

This is the right blog for anyone who wants to find out about this topic. You realize so much its almost hard to argue with you (not that I actually would want…HaHa). You definitely put a new spin on a topic thats been written about for years. Great stuff, just great!

I got what you intend,saved to favorites, very decent site.

I’ve been absent for a while, but now I remember why I used to love this web site. Thank you, I will try and check back more often. How frequently you update your site?

Really informative and good complex body part of content, now that’s user pleasant (:.

321 adult chat room free chat

бонуси казино бонуси казіно

Spot on with this write-up, I actually think this website needs way more consideration. I’ll in all probability be once more to learn much more, thanks for that info.

Hey, you used to write excellent, but the last few posts have been kinda boring?K I miss your tremendous writings. Past few posts are just a bit out of track! come on!

I got what you mean , thanks for posting.Woh I am pleased to find this website through google. “Delay is preferable to error.” by Thomas Jefferson.

Normally I don’t learn article on blogs, however I wish to say that this write-up very pressured me to try and do it! Your writing taste has been surprised me. Thank you, very nice post.

You made some first rate factors there. I appeared on the web for the difficulty and located most individuals will associate with with your website.

I am really impressed with your writing skills and also with the layout on your weblog. Is this a paid theme or did you modify it yourself? Anyway keep up the nice quality writing, it is rare to see a great blog like this one these days..

You are my inspiration, I possess few web logs and occasionally run out from brand :). “The soul that is within me no man can degrade.” by Frederick Douglas.

Utterly composed articles, Really enjoyed reading through.

слоти онлайн онлайн слоти

Hey, you used to write excellent, but the last few posts have been kinda boring… I miss your great writings. Past few posts are just a little out of track! come on!

It is in reality a nice and helpful piece of information. I am happy that you shared this useful information with us. Please stay us up to date like this. Thanks for sharing.

You are a very bright individual!

I will immediately grab your rss feed as I can not find your email subscription hyperlink or e-newsletter service. Do you have any? Kindly permit me understand in order that I may subscribe. Thanks.

Glad to be one of many visitors on this awful internet site : D.

I would like to thank you for the efforts you have put in writing this website. I’m hoping the same high-grade web site post from you in the upcoming also. Actually your creative writing skills has encouraged me to get my own website now. Really the blogging is spreading its wings quickly. Your write up is a great example of it.

Awsome post and straight to the point. I don’t know if this is truly the best place to ask but do you people have any ideea where to get some professional writers? Thx 🙂

6s82gc

Great goods from you, man. I have understand your stuff previous to and you are just extremely wonderful. I really like what you have acquired here, certainly like what you are stating and the way in which you say it. You make it entertaining and you still take care of to keep it smart. I cant wait to read far more from you. This is actually a great web site.

Great write-up, I¦m normal visitor of one¦s blog, maintain up the nice operate, and It’s going to be a regular visitor for a lengthy time.

Dead pent articles, appreciate it for entropy. “The bravest thing you can do when you are not brave is to profess courage and act accordingly.” by Corra Harris.

he blog was how do i say it… relevant, finally something that helped me. Thanks