UPSC CURRENT AFFAIRS – 25th March 2025

SEBI to constitute committee to decide on conflict of interest of board members

Why in News?

In response to conflict-of-interest allegations, the Securities and Exchange Board of India (SEBI), in its March 24, 2025 meeting, decided to constitute a High-Level Committee (HLC). The committee will undertake a comprehensive review of conflict-of-interest provisions, disclosure norms, and governance mechanisms for SEBI members and officials.

Securities and Exchange Board of India (SEBI)

The Securities and Exchange Board of India (SEBI) is the regulatory authority for the securities market in India, responsible for ensuring investor protection, market transparency, and the orderly functioning of stock exchanges.

Establishment and Legal Framework

- Established: April 12, 1988, as a non-statutory body.

- Given statutory status: SEBI Act, 1992, granting it autonomy and regulatory powers.

- Headquarters: Mumbai, Maharashtra.

Objectives of SEBI

- Protecting investors’ interests from fraud and malpractices.

- Regulating the securities market to ensure transparency and efficiency.

- Developing the securities market by introducing modern technology and reforms.

- Preventing insider trading and unfair trade practices.

Functions of SEBI

SEBI performs three main functions:

- Regulatory Functions

- Regulates stock exchanges, brokers, and intermediaries.

- Monitors Foreign Portfolio Investors (FPIs) and Mutual Funds.

- Imposes disclosure requirements for companies raising capital.

- Developmental Functions

- Promotes investor awareness through education and grievance redressal.

- Encourages the adoption of electronic trading and digital payment systems.

- Protective Functions

- Prohibits insider trading and fraudulent activities.

- Introduces strict norms for corporate governance.

- Implements measures to curb price manipulation in the stock market.

Structure of SEBI

- Chairman – Appointed by the Government of India.

- Board Members – Includes representatives from the Finance Ministry, RBI, and corporate sector.

Major SEBI Reforms

- SEBI (Prohibition of Insider Trading) Regulations, 2015 – Stricter insider trading rules.

- SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 – Enhanced corporate transparency.

- SEBI’s role in IPO regulations – Ensures fair pricing and investor protection in Initial Public Offerings (IPOs).

Key Decisions of SEBI Board

-

Formation of a High-Level Committee (HLC)

-

- The HLC will consist of eminent experts from constitutional, statutory, and regulatory bodies, as well as professionals from government, public sector, private sector, and academia.

- The committee’s recommendations will be submitted within three months and placed before the SEBI board for consideration.

- Objective: Enhance transparency, accountability, and ethical standards among SEBI officials.

- SEBI Chairman Tuhin Kanta Pandey emphasized the need for a structured framework to ensure disclosures and prevent ethical violations.

-

Revision in Foreign Portfolio Investor (FPI) Threshold

- SEBI has raised the disclosure threshold for FPIs from ₹25,000 crore to ₹50,000 crore in equity Assets Under Management (AUM).

- FPIs exceeding ₹50,000 crore in AUM must provide additional disclosures, per SEBI’s August 24, 2023 circular.

- Rationale: The cash equity market trading volume has more than doubled, from ₹58,000 crore in FY23 to ₹1,18,000 crore in FY25.

- No changes were made to the existing rule that FPIs holding over 50% of their AUM in a single corporate group must disclose under the additional disclosure framework.

-

Strengthening Governance of Market Infrastructure Institutions (MIIs)

- SEBI approved changes in governance norms for MIIs, particularly:

- Appointment of Public Interest Directors (PIDs) – who act as SEBI’s representatives in MIIs.

- Cooling-off period for Key Management Personnel (KMPs) and Directors to prevent conflicts of interest.

- SEBI approved changes in governance norms for MIIs, particularly:

SEBI’s Stance on Market Volatility

- SEBI denied increased market volatility, stating that fluctuations were higher last year.

- The regulator continues to monitor operators involved in market manipulation, including pump-and-dump schemes.

Conclusion

SEBI’s latest reforms reflect a proactive approach to governance, transparency, and market stability. The formation of HLC, revision of FPI norms, and strengthening of MII governance aim to bolster investor confidence and reinforce SEBI’s credibility as India’s capital market regulator.

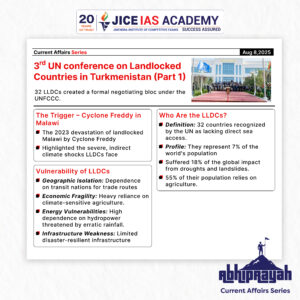

3rd UN conference on landlocked countries

UPSC CURRENT AFFAIRS – 08th August 2025 Home / 3rd UN conference on landlocked countries Why in News? At the

Issue of soapstone mining in Uttarakhand’s Bageshwar

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Issue of soapstone mining in Uttarakhand’s Bageshwar Why in News? Unregulated

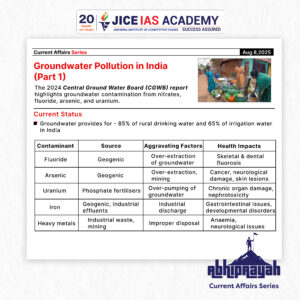

Groundwater Pollution in India – A Silent Public Health Emergency

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Groundwater Pollution in India – A Silent Public Health Emergency Why

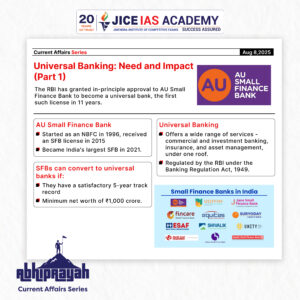

Universal banking- need and impact

UPSC CURRENT AFFAIRS – 08th August 2025 Home / Universal banking- need and impact Why in News? The Reserve Bank

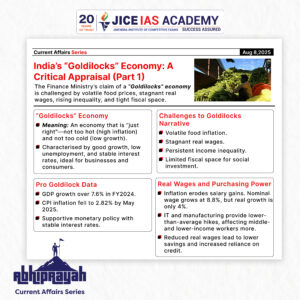

India’s “Goldilocks” Economy: A Critical Appraisal

UPSC CURRENT AFFAIRS – 08th August 2025 Home / India’s “Goldilocks” Economy: A Critical Appraisal Why in News? The Finance

U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from Russia

UPSC CURRENT AFFAIRS – 07th August 2025 Home / U.S.-India Trade Dispute: Trump’s 50% Tariffs and India’s Oil Imports from

Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology

UPSC CURRENT AFFAIRS – 07th August 2025 Home / Eco-Friendly Solution to Teak Pest Crisis: KFRI’s HpNPV Technology Why in

New Species of Non-Venomous Rain Snake Discovered in Mizoram

UPSC CURRENT AFFAIRS – 07th August 2025 Home / New Species of Non-Venomous Rain Snake Discovered in Mizoram Why in

Hi uih266h

>>> https://www.google.com/?bss44tg #Lolllukazzzur333

<<<

Good day vj1h3bp

>>> https://44z5p7jv7m.com/?wtb62dw #Lolllukazzzur333

<<<

2mqsu9

gjspya

2uvi0v

07kl8o

un7jw9

g6nujv